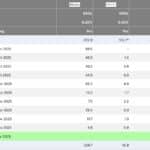

Japan Exchange Group (JPX) is considering stricter regulations for DAT companies amid sharp stock declines, including Metaplanet’s 75% plunge from June highs, despite early-year gains of 420%, highlighting persistent market volatility. The possible regulatory overhaul reflects JPX’s response to investor losses and extreme swings in the digital asset treasury sector. As uncertainty rises, Japan could move toward restrictions similar to those in Hong Kong to protect market stability better. JPX Weighs Tighter Regulatory Approach Japan Exchange Group, operator of the Tokyo Stock Exchange, is evaluating new rules to slow the rapid growth of digital asset treasury (DAT) firms. JPX is reportedly considering stricter merger regulations to deter backdoor listings and is enforcing mandatory audits in some cases. Japan remains Asia’s leader in listed companies holding Bitcoin, hosting 14 such firms. However, recent losses in this group have prompted a regulatory rethink. Since September, JPX has asked at least three companies to pause digital asset purchases due to capital-raising concerns. While no blanket bans are in effect, JPX is assessing risks surrounding governance, risk management, and investor protection. This mirrors shifts across the Asia-Pacific, with exchanges in Hong Kong, Australia, and India ramping up scrutiny of digital asset treasury business models. The move comes amid mounting Bitcoin volatility. Crypto markets have faced significant stress in recent weeks, with Bitcoin temporarily dipping below $100,000 before rebounding. Volatility Hits Metaplanet and Sector Rivals Metaplanet, a leading digital asset treasury firm in Japan, demonstrates the sector’s instability. Shares for the Tokyo-listed company slid over 75% from June highs after climbing about 420% earlier in the year. Nevertheless, Metaplanet secured a $100 million loan using its Bitcoin reserves as collateral, and plans to make further crypto purchases, conduct share buybacks, and enter into options trades. The company now holds 30,823 BTC valued at approximately $3.51 billion. This new loan is just 3% of Metaplanet’s total Bitcoin reserves—an indication that management is confident in long-term growth despite ongoing turmoil. Other Japanese crypto treasury firms have also faced steep losses. For example, Convano’s stock has dropped 60% since August. Data shows 23 of 43 global DAT firms lost over half their market value in 2025 amid similar volatility. Part of this volatility stems from PIPE financing, which intensifies market swings by deferring liquidation pressures. Industry analysis indicates that about $15 billion was raised through private placements between April and November 2025. After lock-up periods expire, discounted shares often flood the market, triggering 50% stock drops. Exchanges Across Asia-Pacific Clamp Down on DAT Firms Japan’s moves reflect a regional crackdown on digital asset treasury companies. Hong Kong’s exchange has blocked at least five DAT listings, requiring strict business viability tests. Australia’s ASX caps cash and equivalents at 50% of total assets, while India’s Bombay Stock Exchange rejects similar models. The Hong Kong Securities and Futures Commission continues to impose strict oversight on virtual asset trading platforms, emphasizing risk controls and transparency for product expansions. This approach targets risks of market manipulation, investor protection gaps, and the viability of companies that primarily hold volatile crypto assets. Additionally, global index provider MSCI is considering barring crypto-heavy DAT firms from its indices, which could further limit these companies’ access to institutional investment. DAT firms collectively control over $100 billion in Bitcoin, Ethereum, and Solana globally. MicroStrategy, now known as Strategy, leads with 640,418 BTC—nearly 3% of global Bitcoin supply. This concentration poses systemic risks, with crypto liquidations quickly eroding equity value and amplifying volatility both ways. As regulatory pressure grows, digital asset treasury companies must prove they generate operational revenue beyond token price appreciation. The next few months will reveal whether these firms can meet more demanding governance standards while upholding their Bitcoin-centric strategies or if further consolidation will reshape the sector. The post Japan Cracks Down on Crypto Treasury Stocks — Is the DAT Boom About to Collapse? appeared first on BeInCrypto.

More Headlines

[LIVE] Crypto News Today, November 13 – Bitcoin Retests $101K, XRP Price Surges +4% as Hyperliquid Hit by New Attack – Best Crypto to Buy Now?

99bitcoins

Trump Ends Shutdown; Crypto Rebounds As Bitcoin Hyper’s Best Presale Gains Traction

BitCoinist

TradFi Solana ETF Frenzy Continues: What Does Wall Street Know That You Don’t

99bitcoins

With Nearly $27M Raised, Bitcoin Hyper is Now One of 2025’s Crypto Presales

BitCoinist

Next Crypto to Explode? Bitcoin Hyper Could Change Bitcoin with L2 Tech

NewsBTC

Best Altcoins to Watch as Solana Whales Start Buying

NewsBTC