XrpLive Feed

Xrp breaking news and instant alerts. Crypto Feed's minimalist interface delivers verified headlines, price movements, and protocol updates the moment they happen. Fast, focused, no fluff.

- LIVE

ChatGPT’s XRP Analysis: XRP ETF Breaks $100M and Garlinghouse Eyes Trump Crypto Board

ChatGPT’s XRP Analysis: XRP ETF Breaks $100M and Garlinghouse Eyes Trump Crypto BoardChatGPT’s XRP analysis has revealed that XRP is consolidating at $2.6834 in a key decision zone, as the XRP ETF surpasses $100 million in assets under management.Meanwhile, Ripple CEO Brad Garlinghouse is reportedly being considered for President Trump’s Crypto Advisory Board, and Evernorth holdings reach 388.7M XRP at 95% of the target.ChatGPT’s XRP analysis synthesizes 26+ technical indicators at the key $2.61-$2.74 decision range.Key EMA Sandwich ZoneXRP at $2.6834 reflects +12.5% recovery from the October 16 low of $2.3843. Trading in the range between $2.6905 (high) and $2.6013 (low).Source: TradingViewRSI at 40.67 approaches oversold. Moving averages show mixed structure: Above 20-day at $2.5614 (-4.6%) 200-day at $2.6116 (-2.7%) as support But below 50-day at $2.6924 (+0.3%) 100-day at $2.7361 (+2.0%) as resistance. Key sandwich between EMAs.The MACD is weakly bullish at 0.0435, but the histogram is negative at -0.1011, indicating a loss of momentum.Source: TradingViewHigh ATR at 2.4416 confirms breakout potential. Consolidating in $2.61-$2.74 range for 2 weeks with declining volume. The historical pattern suggests a 60% breakout probability versus a 40% breakdown.ETF Milestone Meets Political IntegrationXRP ETF breaks $100 million in assets under management within weeks. Community emphasizes “institutions quietly moving, that’s not retail money, that’s institutions loading bags before headlines catch up. XRP isn’t late, just getting started.” Garlinghouse is also reportedly considered the “leading candidate for President Trump’s new Crypto Advisory Board.”Additionally, Ripple unveiled Ripple Prime after closing $1.25 billion deal. Evernorth Holdings also reaches 388.7M XRP (95% of the target) at the same time, with an average buy price of $2.44. With today’s close of Hidden Road (now Ripple Prime), Ripple has announced 5 major acquisitions in ~2 years (GTreasury last week, Rail in August, Standard Custody in 2024, Metaco in 2023). As we continue to build solutions towards enabling an Internet of Value – I’m reminding you… https://t.co/O5Uub7ulw9— Brad Garlinghouse (@bgarlinghouse) October 24, 2025 Garlinghouse also declares, “XRP central to everything Ripple does – lock in.” That statement has fueled optimism with the XRP community.Today as well, XRP rose 3% to $2.63, after influencer James Wynn invested over $25,000 and forecasted the token reaching $500 or $1,000 to overhaul global finance using Ripple’s reserves. Imagine this. $XRP teleports over $500 per coin instantly.The administration then use the premine to pay off the $35T debt Whole new financial system. Ripple at the centre of everything.Early holders are now upper class elite humanoids – Wynn— James Wynn (@JamesWynnReal) October 26, 2025 Institutional Accumulation Phase XRP maintains $161.38B market cap (+2.32%). Volume surged +41.65% to $4.97B, producing a 3.07% ratio. Market dominance 4.14% (-0.01%). Holder count 484,600. Give this week’s performance, analyst notes “XRP had one of best weekly candle closes, back above weekly Ichimoku baseline. All time highs coming” with targets between $5-$10. $XRP had one of the best weekly candle closes tonight. Back above the weekly Ichimoku baseline.All time highs are coming pic.twitter.com/C7mgiife3O— The Great Mattsby (@matthughes13) October 27, 2025 Social Sentiment: Institutional Accumulation Narrative LunarCrush shows AltRank 704 (+346). Galaxy Score 66 (+14). Engagements 7.17M (-2.45M) Mentions 24.65K (-1.81K). Social dominance 3.15% (+0.25%) Sentiment 86% positive. Mainly in the timeline, analysts are very keen on “XRP outperforming BTC today” with “XRPETH weekly RSI made bull div, first since June 2024. Very bullish XRP > ETH next 3 months.“Technical discussions center on “holding within mid-base channel hints at accumulation. So long as XRP holds, upside expected.”Traders advised to “ladder out from $5-$10 and leave moon bags depending on wider markets” with “$2.85 next sell wall” identified as critical resistance beyond EMA cluster.ChatGPT’s XRP Analysis: ETF Milestone Tests BreakoutChatGPT’s XRP analysis reveals XRP at a key juncture. Immediate resistance $2.6924 (50-day EMA) Key resistance $2.7361 (100-day EMA). Break above $2.74 with volume targets $2.80-$3.00. Support at $2.6116 (200-day EMA). Major support $2.5614 (20-day EMA). Break below $2.61 triggers a correction toward $2.56-$2.45. Three-Month XRP ForecastBullish Breakout (40%)Break above $2.74 with volume drives rally toward $2.80-$3.00 (4-12% upside), then $3.20-$3.50 (19-30% upside).Requires RSI reclaim 50 and volume above 120M.Bearish Breakdown (35%)Rejection at $2.69 with a break below $2.61 triggers a decline toward $2.56-$2.45 (2-7% downside).Extended Consolidation (25%)Continued ranging $2.61-$2.74 for 5-10 days allows institutional accumulation before a catalyst-driven break.ChatGPT’s XRP Analysis: Institutional Positioning Awaits CatalystNext Target: $2.80-$3.00 if $2.74 Breaks, $2.56-$2.45 if $2.61 FailsXRP ETF breaking $100M within weeks indicates institutional interest, while Evernorth’s 388.7M XRP accumulation at $2.44 provides support.Garlinghouse’s potential Trump Crypto Advisory Board role and Dubai appearance with Saylor, Raoul, and CZ validates integration. However, RSI at 40.67 and declining volume show consolidation fatigue. The key $2.61-$2.74 decision zone requires breakout confirmation; the best strategy is to wait for a decisive break with volume expansion.Ripple’s record 650M XRP monthly distribution and RLUSD $900M milestone support utility, but near-term clarity is needed. Historical 60% breakout probability favors bulls if $2.74 is reclaimed.The post ChatGPT’s XRP Analysis: XRP ETF Breaks $100M and Garlinghouse Eyes Trump Crypto Board appeared first on Cryptonews.

- LIVE

ETF Delays Shake Market Confidence, But XRP’s Volume Spike Supports a $2.9 Bullish Signal

ETF Delays Shake Market Confidence, But XRP’s Volume Spike Supports a $2.9 Bullish SignalXRP is staging a remarkable rebound, rising from early October lows of $1.77 to over $2.60, even as the U.S. Securities and Exchange Commission (SEC) prolongs its review of pending XRP ETF filings. The delays have sparked mixed market sentiment, yet XRP’s trading volume and technical setup indicate growing bullish momentum. Over the weekend, XRP surged to $2.68, breaking critical resistance at $2.63 on a 147% volume spike, one of the largest in recent months. This explosive move coincided with renewed optimism following Ripple’s strategic acquisitions, including the integration of Ripple Prime and GTreasury, which CEO Brad Garlinghouse said place XRP “at the center of everything Ripple does.” Technical Indicators Strengthen the Bullish Outlook From a technical perspective, XRP’s chart paints a clear bullish picture. The token has moved firmly above both its 50-day and 200-day exponential moving averages (EMAs), key indicators of trend continuation. It has also formed an inverse head-and-shoulders pattern, historically signaling potential for higher highs. The Relative Strength Index (RSI) remains near 70, showing strong demand despite slightly overbought conditions. Analysts expect a confirmed breakout above $2.70 to set the stage for XRP to reach the $2.90–$3.00 range in the near term. Momentum indicators such as the True Strength Index (TSI) and rising open interest in CME XRP futures, which recently crossed $27 billion in notional volume, reinforce this bullish outlook. However, traders are watching the $2.54–$2.58 support zone closely. A drop below this range could weaken momentum and invite short-term corrections. Institutional Flows Signal Confidence in XRP’s Future While ETF delays have briefly dented sentiment, institutional accumulation around XRP remains strong. The token’s rapid integration into U.S.-listed ETFs, expanding derivatives markets, and corporate adoption, including Evernorth’s treasury allocation, underscore growing confidence in Ripple’s long-term fundamentals. Institutional demand continues to accelerate through vehicles like the REX-Osprey XRP ETF, which recently surpassed $100 million in assets under management, placing XRP as a mainstream financial instrument rather than a speculative token. With global crypto market capitalization hovering near $3.8 trillion and the Federal Reserve’s upcoming rate decision expected to ease liquidity constraints, analysts believe XRP could outperform peers in the next leg of the bull cycle. If buying pressure holds above $2.70, the $2.90 breakout target may only mark the beginning of a broader rally, one that cements XRP’s role at the heart of institutional digital finance. Cover image from ChatGPT, XRPUSD on Tradingview

Indian court steps in over WazirX XRP distribution tied to 2024 hack

Indian court steps in over WazirX XRP distribution tied to 2024 hackJust a few weeks after a Singaporean court approved WazirX's parent company's restructuring plan, a decision out of one of India's courts could impact users.

Ethereum Sees $169M in Outflows, But Traders Aren’t Backing Down on Leverage Bets

Ethereum Sees $169M in Outflows, But Traders Aren’t Backing Down on Leverage BetsEthereum-based investment products recorded their first weekly outflows in five weeks, with $169 million, following steady withdrawals seen each day. Despite this, demand for 2x leveraged Ethereum ETPs stayed strong, which indicated continued trader interest in high-risk exposure. This comes as overall digital asset investment products attracted $921 million in inflows after several “choppy” weeks. The partial US government shutdown has clouded the macroeconomic outlook, limiting access to crucial policy data and creating uncertainty about the Federal Reserve’s next moves. However, Friday’s softer-than-expected CPI report revived optimism that more rate cuts may still come this year. Meanwhile, global ETP trading activity remained high, with $39 billion in volume for the week. This figure is far above the year-to-date average of $28 billion. Bitcoin Pulls Ahead In its latest edition of ‘Digital Asset Fund Flows Weekly Report,’ CoinShares reported Bitcoin investment products drew in $931 million in inflows this week and lifted total inflows since the US Federal Reserve’s rate cuts began to $9.4 billion. Year-to-date (YTD) inflows now stand at $30.2 billion, still trailing the $41.6 billion recorded in 2024. Short Bitcoin products also saw positive sentiment as this cohort attracted $14.4 million in new capital. Enthusiasm for Solana and XRP has tapered off ahead of their anticipated US ETF launches, with inflows of $29.4 million and $84.3 million, respectively. Multi-asset funds followed with $33.2 million in inflows, while Litecoin and Chainlink logged smaller gains of $0.3 million and $0.1 million during the same period. Among assets facing outflows, Sui followed Ethereum’s suit and registered $8.5 million, and Cardano saw $0.3 million in outflows. Regional inflows were led by the US with $843 million, while Germany delivered one of its biggest weeks to date with $502 million. Brazil and Australia recorded smaller gains of $13.2 million and $0.9 million, respectively. On the other hand, Switzerland saw outflows of $359 million, though these were largely technical and were tied to asset transfers between providers. Sweden mirrored this trend with $49 million in outflows, and both Hong Kong and Canada registered modest declines of $11.2 million and $10 million each. Markets Brace for Trump-Xi Trade Talks According to QCP Capital, crypto markets are entering a critical crossroads this week as global and domestic catalysts converge. All eyes are on the upcoming Trump-Xi meeting as any progress on a US-China trade deal is expected to boost investor confidence and risk appetite, and lift Bitcoin and other assets out of their October stagnation. However, much hinges on the Federal Reserve’s decision regarding its quantitative tightening program. Additionally, the drawn-out US government shutdown and weak equity sentiment threaten to dampen momentum. With BTC trading flat and risk reversals turning neutral, markets appear to be cautiously positioned. Until Bitcoin reclaims the $116,000 level, the digital asset trading platform expects range-bound trading as crypto awaits its next macro-driven breakout. The post Ethereum Sees $169M in Outflows, But Traders Aren’t Backing Down on Leverage Bets appeared first on CryptoPotato.

Indian court steps in over WazirX XRP distribution tied to 2024 hack

Indian court steps in over WazirX XRP distribution tied to 2024 hackJust a few weeks after a Singaporean court approved WazirX's parent company's restructuring plan, a decision out of one of India's courts could impact users.

XRP Price Ready for $3 Breakout, Legendary Trader Bollinger Sparks Debate Over Bitcoin (BTC) Chart, Shiba Inu Team Reaches Out to SHIB Community — Crypto News Digest

XRP Price Ready for $3 Breakout, Legendary Trader Bollinger Sparks Debate Over Bitcoin (BTC) Chart, Shiba Inu Team Reaches Out to SHIB Community — Crypto News DigestCrypto market today: XRP price eyes $3 breakout; John Bollinger warns Bitcoin may not be bottoming; Shiba Inu team has penned a crucial message for the SHIB community.

XRP News: BlackRock, Nasdaq, And Bloomberg Head To Ripple Swell, Here’s The Full List

XRP News: BlackRock, Nasdaq, And Bloomberg Head To Ripple Swell, Here’s The Full ListAnticipation is building ahead of Ripple Swell 2025, the company’s flagship conference scheduled for November 4 to 5 in New York, with a welcome reception on November 3. This year’s edition is set against a backdrop of growing institutional adoption of cryptocurrencies, and Ripple is bringing some of the world’s most powerful financial names to the stage. For the first time, the event will feature an extensive lineup of speakers from the White House and major traditional finance institutions, including BlackRock, Nasdaq, Bloomberg, and Citi. Major Financial Institutions Take The Stage Ripple’s 2025 edition of the Swell event is turning out to be filled with the biggest roster yet. Ripple has confirmed that the 2025 edition of Swell will host top executives from some of the largest names in both the crypto industry and in traditional finance. Among the notable names are Maxwell Stein, Director of Digital Assets at BlackRock; Adena Friedman, Chief Executive Officer at Nasdaq; Sandy Kaul, Head of Innovation at Franklin Templeton; and Hunter Horsley, CEO of Bitwise Asset Management. Other confirmed participants include senior representatives from Citi, Fidelity, JPMorgan Chase, Mastercard, CME Group, Moody’s, State Street, DBS Bank, Bloomberg, and Société Générale, among many others. This roster of names is the strongest representation of traditional finance in Swell’s eight-year history. Each of these executives brings deep institutional experience in asset management, banking, and capital markets, areas that are now embracing tokenization, digital payments, and blockchain settlement, and where Ripple is looking to become a major player. Nobody wants to be left behind in the blockchain/crypto movement. Therefore, discussions are expected to focus on how these institutions are preparing to integrate blockchain-based systems into global finance, particularly for cross-border transactions, stablecoin infrastructure, and regulated digital-asset investment products. Observers are also going to be watching for major announcements from Ripple at Swell, like new partnerships, new tokenization offerings, developments regarding Ripple’s RLUSD, institutional partnerships, and possibly some information regarding the launch of Spot XRP ETFs in the US. “From stablecoins and payments to regulation and real-world adoption, Swell brings together the conversations shaping the future of finance,” noted Ripple in a social media post. White House Representation At Swell 2025 Adding a new dimension to this year’s event is the confirmed participation of Patrick J. Witt, Executive Director of the Presidential Council of Advisors on Digital Assets (PCADA). Witt, who serves directly under the White House, will be making his first appearance at Ripple Swell, making this the first time in the event’s history that a sitting US government official has joined the speaker lineup since 2018. The inclusion of a White House voice at Swell 2025 upgrades the conference’s importance beyond the crypto community. It also shows the crypto-positive approach held by the current US administration.

How high can XRP price go in November?

How high can XRP price go in November?XRP could surge to $3 amid strong bullish signals, including Evernorth’s $1 billion accumulation and a growing supply shock at exchanges.

How high can XRP price go in November?

How high can XRP price go in November?XRP could surge to $3 amid strong bullish signals, including Evernorth’s $1 billion accumulation and a growing supply shock at exchanges.

Evernorth und XRP: Dieses Preis-Level rückt jetzt in den Fokus

Evernorth und XRP: Dieses Preis-Level rückt jetzt in den FokusEvernorth baut seine XRP-Bestände weiter aus. Ein CryptoQuant-Analyst sieht nun ein wichtiges Preis-Level, auf das Anleger jetzt achten sollten. Source: BTC-ECHO BTC-ECHO

XRP (XRP) Faces Resistance Amid Ripple USD's $900M Market Cap Milestone

XRP (XRP) Faces Resistance Amid Ripple USD's $900M Market Cap MilestoneXRP experiences significant resistance at the 50-day moving average as Ripple USD reaches a $900 million market cap, supported by solid fundamentals and ETF inflows. (Read More)

Ripple CEO Highlights Top 5 Acquisitions The Company Has Made As XRP Ledger Usage Rises

Ripple CEO Highlights Top 5 Acquisitions The Company Has Made As XRP Ledger Usage RisesRipple’s rapid expansion across the global finance space, along with the continued growth of the XRP Ledger (XRPL), has drawn significant attention from the broader market. Ripple CEO Brad Garlinghouse recently spotlighted the company’s top five strategic acquisitions, emphasizing how these deals are shaping the crypto payment firm’s future and reinforcing XRP’s central role within the evolving ecosystem. Ripple and XRP Ledger Solidify Global Position Through Acquisitions In an X social media post on Friday, Garlinghouse confirmed that with the complete acquisition of Hidden Road, now rebranded as Ripple Prime, the crypto payments company has finalized five key takeovers in roughly two years. These include GTreasury, Rail, Standard Custody, Metaco, and now Ripple Prime. Each acquisition strengthens the company’s position in the global finance ecosystem and aligns with its vision to create what Garlinghouse calls an “internet of value,” where one moves as easily as information does online. Garlinghouse emphasized in his post that XRP sits “at the center of everything Ripple does,” underscoring its vital role in the company’s growing range of financial products. Every acquisition, whether focused on liquidity management, custody, or settlement, aims to enhance how institutions leverage Ripple’s payment technology and, ultimately, the XRP Ledger to transfer value globally with greater efficiency and security. Following Garlinghouse’s post, crypto market expert Crypto Sensei raised an important question about how the company’s new integration would handle settlement. He also asked whether the company’s stablecoin, RLUSD, which already lives on Ethereum, would also operate on the XRP Ledger. While the Ripple CEO has not confirmed the specifics, the community chimed in, suggesting that the payments firm plans to roll out RLUSD on XRPL soon. This would allow the recently acquired brokerage platform, Ripple Prime, to handle both liquidity and settlement natively on the ledger. If this happens, the company could soon control everything from trade execution to settlement, with XRP acting as the core bridge asset. It’s a move that could help the company achieve its clear goals of integrating traditional financial infrastructure with blockchain-based liquidity. The Firm Uses XRP In Landmark Equity Deal In another major development, crypto enthusiast Diana announced that Ripple has confirmed through a US Securities and Exchange Commission (SEC) filing that it paid for a corporate acquisition using XRP as the payment currency. The filing by Armada Acquisition Corp II revealed that Ripple contributed 126,791,458 XRP, approximately $305 million, in exchange for equity units that would convert into PubCo Class A shares upon closing. The transaction marks one of the first instances where XRP has been used directly as a financial instrument in a regulated equity deal. This move signifies a milestone for Ripple, especially since it officially concluded a 7-year lawsuit with the SEC earlier this year, which had alleged that XRP was a security. According to Diana, the purchase will effectively transform XRP from a utility token into a form of institutional capital. The payment firm’s use of XRP as payment also comes on the heels of its GTreasury acquisition and its inclusion in the Federal Reserve’s Faster Payments Task Force Steering Committee, further embedding XRP into mainstream financial operations.

Price predictions 10/27: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE

Price predictions 10/27: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPEBitcoin and several major altcoins have started a strong recovery, but the relief rally is expected to face significant headwinds near major overhead resistance levels.

Yellow Network boosts RWA trading with XRPL EVM Sidechain integration

Yellow Network boosts RWA trading with XRPL EVM Sidechain integrationYellow Network, a blockchain network backed by Ripple co-founder Chris Larsen, has integrated with XRPL EVM Sidechain to advance its real-world assets trading system. Yellow Network’s proprietary layer-3 clearing network will leverage the XRPL EVM Sidechain to ramp up its…

Price predictions 10/27: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE

Price predictions 10/27: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPEBitcoin and several major altcoins have started a strong recovery, but the relief rally is expected to face significant headwinds near major overhead resistance levels.

Spot XRP, Solana, and Litecoin ETFs may launch in next two weeks, expert speculates

Spot XRP, Solana, and Litecoin ETFs may launch in next two weeks, expert speculatesThe potential launch of these crypto ETFs could significantly enhance institutional access to digital assets, driving broader market adoption. The post Spot XRP, Solana, and Litecoin ETFs may launch in next two weeks, expert speculates appeared first on Crypto Briefing.

XRP Price Needs Just A 7% Push To Rally — Two Metrics Hint It’s Close

XRP Price Needs Just A 7% Push To Rally — Two Metrics Hint It’s CloseXRP price is inching closer to a potential breakout, needing just a 7% push to unlock its next rally zone. Fresh whale accumulation and improving short-term signals suggest that move could come sooner than many expect. The post XRP...

What XRP promised, this new token delivers: A deep dive into XRP 2.0

What XRP promised, this new token delivers: A deep dive into XRP 2.0As XRP loses steam despite a $1b boost, Digitap is gaining traction as the “XRP 2.0,” targeting the global payments market with faster growth and broader access. #partnercontent

XRP Gains Traction Among Businesses Despite Challenges in Wider Adoption

XRP Gains Traction Among Businesses Despite Challenges in Wider AdoptionXRP, initially designed for broad institutional use, is gaining business traction. However, stablecoins and regulatory hurdles pose challenges to its wider adoption. (Read More)

- XRP Price Needs Just A 7% Push To Rally — Two Metrics Hint It’s Close

XRP has gained nearly 6% in the past week, trimming some of last month’s weakness. It’s still down in the three-month band, but the token remains up over 400% year-on-year — showing that the larger uptrend hasn’t been broken. Now, a small 7% move could be all it takes to unlock the next rally zone. The latest on-chain and chart signals suggest it might happen sooner than many expect. Whales And The Short-Term Chart Hint At A Push Coming Big XRP holders are adding again. Since yesterday, wallets holding over 1 billion XRP have increased their stash from 25.07 billion to 25.12 billion, a 50 million addition. Additionally, wallets holding 10 million–100 million XRP have added around 70 million coins, taking their total from 8.15 billion to 8.22 billion. In total, these wallets have added tokens worth $314 million. XRP Whales Are Active: Santiment That accumulation often happens when large players expect near-term momentum to pick up. The 4-hour chart supports this, showing improving short-term structure. Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. The 20-period Exponential Moving Average (EMA), which tracks recent price momentum, has already crossed above the 50-period EMA and is now approaching the 100-period EMA. That would form another golden crossover. XRP’s 4-Hour Price Chart: TradingView If the faster EMA moves above the longer one, it typically means buying strength is growing and traders are starting to position for a breakout. Together, the steady whale inflows and strengthening short-term chart set the stage for a test of XRP price’s most important resistance. We will reveal that in the next sections. Cost-Basis Heatmap Shows Where The Price Battle Lies Before looking at the price chart, the cost-basis heatmap helps us understand where most holders are sitting on potential profits or losses, and where they might sell. Data from Glassnode shows that the heaviest supply cluster is between $2.78 and $2.80. This zone is where roughly 135 million XRP were last acquired. XRP Price Supply Zone: Glassnode This is the zone where traders who bought earlier may try to sell and lock in profits. Breaking above it means absorbing that supply, which often triggers follow-up buying. That $2.78–$2.80 zone aligns almost perfectly with the next chart-based breakout level we’ll look at next. What the XRP Price Chart Shows On the daily chart, XRP continues to trade inside a falling wedge. This pattern usually signals a bullish reversal once the upper boundary is breached. That boundary lies near $2.81, the same level marked by the heatmap’s dense supply band. A daily close above $2.81 would confirm the breakout and validate the technical and on-chain signals. Once broken, price targets appear at $3.37 and $3.66. XRP Price Analysis: TradingView If XRP fails to break above $2.81 and instead slips below $2.59, it could delay the next move higher. Losing $2.43 could even bring $2.27 back into the mix, invalidating the near-term bullishness. But for now, the combination of whale buildup, positive short-term EMA signals, and a concentrated resistance zone just 7% (6.98% to be exact) away makes the setup hard to ignore. The post XRP Price Needs Just A 7% Push To Rally — Two Metrics Hint It’s Close appeared first on BeInCrypto.

Pundit Says XRP Price Risks Crash Below $1, Here’s Why

Pundit Says XRP Price Risks Crash Below $1, Here’s WhyCrypto analyst Bobby A is warning that the XRP price may face trouble soon. He says the large monthly chart is showing weak signs, and this could mean the market is turning bearish again. The analyst thinks the price...

Pundit Says XRP Price Risks Crash Below $1, Here’s Why

Pundit Says XRP Price Risks Crash Below $1, Here’s WhyCrypto analyst Bobby A is warning that the XRP price may face trouble soon. He says the large monthly chart is showing weak signs, and this could mean the market is turning bearish again. The analyst thinks the price might need to drop further before it can move higher. Bearish Signals Showing On The XRP Price Monthly Chart Bobby A says the big XRP chart does not look healthy right now. He explains that many important monthly indicators are crossing bearishly. He says XRP is trading below the 1.618 level, and the price action there looks like a rejection rather than a breakout. He thinks this rejection is happening at a terrible time for XRP, noting that the monthly candle is closing near the BMSB line, another dangerous sign for the price. Bobby A reminds traders that when the Bressert indicator crosses bearish on the monthly chart, history shows it has never been good for XRP. He believes that history could repeat itself, and these bearish signals are evident on the chart right now, suggesting the mid-term trend may not be strong. His analysis says that in six days, XRP will be facing the monthly candle close again, and facing it while price action is weak is usually not a good sign. He is worried because the chart’s overall structure shows more weakness than strength at this time. He explains that when a chart shows this kind of technical damage, the smart move is to stay alert. He says traders must focus on risk control during times when the big charts start to flash warning signs. He shares this because he has trusted his chart study before when XRP was under $0.30, and now he needs to trust what he sees again with XRP above $2. He says the market can change very fast, and traders must be ready for those changes. XRP May Drop To Lower Support Before Moving Up Again Right now, XRP is already making a small move downward. Bobby A says this retracement is happening in real time. He warns that XRP could roll over again and retest lower price support levels. If this happens, the token price could fall under $1 to find more substantial support before it tries to recover. He believes there is a real and present risk that the price will crash below $1 if sellers keep pushing it down. He advises traders to protect their money and manage their trades carefully. He says capital safety must come first in times like these. Even though he still believes in XRP’s long-term future and remains a strong supporter of the project, he feels the odds right now point to lower prices in the mid-term. He says this is because the latest market signs are not strong enough to support a big bullish move yet.

Q3 2025: Bitcoin Surged to ATH But With ‘Notable Laggard’ as Ethereum Led the Quarter

Q3 2025: Bitcoin Surged to ATH But With ‘Notable Laggard’ as Ethereum Led the QuarterThe third quarter of 2025 was a significant one, posting substantial achievements, according to the latest crypto industry report by crypto data aggregator CoinGecko. Yet, despite Bitcoin (BTC)’s surge to a fresh ATH, major altcoins – particularly Ethereum (ETH) – strongly outperformed.The crypto market recorded its third consecutive rallying quarter in Q3 this year. This is also the second consecutive quarter of “significant capital appreciation,” the report noted.Moreover, it was the market’s second leg of recovery, powered by liquidity, a sharp recovery of trading activity, and renewed institutional inflows.The total market capitalization increased by 16.4% with $563.6 billion, hitting the $4 trillion mark. Notably, this is the highest level since late 2021.Source: CoinGeckoMoreover, the average daily trading volume saw “a decisive reversal” in Q3, suggesting higher market participation. It went up nearly 44% from Q2 to $155 billion, following two consecutive quarters (Q1 and Q2) of diminishing spot activity.At the same time, Bitcoin dominance noted a significant shift, dropping to 56.9%. This signaled “a material rotation into ETH and other large-cap altcoins” and “a material shift from the ‘flight to quality’ trend seen earlier in the year,” CoinGecko noted.The main beneficiary was Ethereum, as will be discussed below. Its market share rose to 12.5%, showing a renewed interest and capital inflows into ETH.Other major altcoins benefited as well, including XRP (+0.5 percentage points), BNB (+0.7 p.p.), and SOL (+0.4 p.p.). You may also like: Q1 2025: Bitcoin Boosts Dominance as Market Cap and Investor Activity Plunge A newly discovered domain linked to MetaMask has reignited speculation that the long-rumored MASK token airdrop could be imminent. The emergence of a password-protected claim portal at claim(.)metamask(.)io has fueled widespread belief that Consensys’ popular Ethereum wallet is preparing to roll out its long-awaited token distribution. How Soon Is the MetaMask Airdrop? The Countdown to MASK Begins The domain, first spotted earlier this week, features a login page that requests... Altcoins In Focus, Bitcoin LaggingAltcoins strongly outperformed in Q3 this year, CoinGecko highlighted. BTC was “the notable laggard” in the top 5 coins category, with a 6.4% appreciation.At the same time, ETH led the list with a 66.6% rise, outperforming major altcoins and even hitting a new all-time high of nearly $5,000.Source: CoinGeckoNotably, there was a clear renewed interest in ETH, fueled by strong net inflows into US Spot ETH exchange-traded funds (ETFs) and institutional buy pressure from treasury companies such as Tom Lee’s Bitmine Immersion and Joe Lubin’s SharpLink.At the same time, BNB went up 53.6%, SOL 34.7%, and XRP 27%. BNB exploded in Q3, also hitting an ATH, powered by closer integration with Binance via Binance Alpha and the perp DEX Aster success, says the report.Also, SOL reached a quarterly high of $248 with an influx of treasury companies. However, it lost momentum amidst a late-September market pullback and ETF approval delay. You may also like: Sharplink Gaming Adds $80M in Ethereum to Strategic Reserve After Month-Long Lull Sharplink Gaming added 19,271 Ether worth about $80.37m to its strategic reserve on Monday, ending a month of quiet accumulation and signaling renewed conviction in the asset. The purchase lifts the company’s holdings to 859,400 Ether valued at roughly $3.6b, placing it second among disclosed corporate treasuries behind BitMine, which holds about 3.24m Ether worth $13.5b. ACY Securities said that the fresh buy fits Sharplink’s prior accumulation pattern and looks like positioning ahead... Speaking of ETFs…CoinGecko highlighted that BTC’s early surge followed continuous retail and institutional accumulation, particularly through Bitcoin ETFs.However, analysts also noted a reversal of the inflow trend at the end of September. US spot BTC ETFs recorded outflows amidst a general market decline.US Spot BTC ETFs net inflows decreased from $12.8 billion in Q2 to $8.8 billion in Q3. Total AUM grew by 16% from $143.4 billion to $166.3 billion.At the same time, US spot ETH ETFs noted $9.6 billion in net inflows. This was “by far the largest quarter and the first time it has surpassed BTC ETFs,” the report says. Total AUM reached $28.6 billion, marking a 177.4% jump quarter-on-quarter.Moreover, crypto digital asset treasury companies (DATCos) spent at least $22.6 billion in new crypto acquisitions in Q3. This was “by far the largest quarterly amount thus far.” Of this, altcoin DATCos accounted for $10.8 billion (47.8%).Overall, DATCos held some $138.2 billion worth of crypto by the end of Q3.Strategy dominated with >50% share, while two ETH DATCos made the top 5 list (Bitmine Immersion and Sharplink).Stablecoin Market Cap Hits New ATHIn the previous quarter, the top 20 stablecoin market cap surged by over 18%, with $44.5 billion, reaching a new ATH of $287.6 billion.Top gainers are: Ethena’s USDe: jumped by 177.8% or $9.4 billion in market cap, with the market share growing from 2% to 5%, overtaking USDS as the third-largest stablecoin. Tether’s USDT: saw the largest absolute increase, adding $17 billion to its market cap, while its market share fell from 65% to 61% due to the accelerated growth of other stablecoins. The market cap has continued to climb in early Q4, surpassing $300 billion. At the time of writing in late October, it stands at $312 billion, per CoinGecko. You may also like: Japan Breaks New Ground with Launch of First Yen-Denominated Stablecoin Japan will debut the world’s first stablecoin pegged to the yen on Monday, a small but significant step in a market still dominated by cash and card payments. The move aims to pull blockchain into everyday finance and test demand for a digital yen proxy. JPYC, a Tokyo startup, said it will issue a fully convertible yen stablecoin backed by domestic bank deposits and Japanese government bonds (JGBs). The company plans to waive transaction fees at launch to spur usage, and instead earn... DeFi SurgesDeFi Total Value Locked (TVL) was up 40.2% from $115 billion at the start of July to $161 billion at the end of September. ETH’s “outsized appreciation and the ongoing stablecoin narrative” fueled this surge, CoinGecko says.Moreover, the DeFi sector’s market cap climbed to $133 billion shortly after ETH hit $3,000 in mid-July. In late September, it hit the Q3 peak of $181 billion following a price jump of newly launched tokens from perpetual DEXes such as Avantis (AVNT) and Aster (ASTER).DeFi’s market share increased from 3.3% in Q2 to 4% in Q3 2025.CEX and DEXIn Q3, the top centralized exchanges (CEXes) recorded $5.1 trillion in spot trading volume. This is a nearly 32% increase from Q2’s $3.9 trillion. Upbit was the largest gainer, rising +40.5%, climbing to #9. Bybit rose by 38.4%, moving from #6 to #3. Its monthly average volume moved above $120 billion, the level last seen in February before the hack. Binance’s trading volume grew 40 QoQ for a cumulative $2.06 billion. Its market share increased slightly to 40%. Coinbase ranked #10 globally. Its volume rose by 23.4% but was still “outpaced by its rivals.” Meanwhile, the trading volume of the top 10 perpetual decentralized exchanges grew by +87% from $964.5 billion in Q2 to $1.81 trillion in Q3.Aster, Lighter, and edgeX are challenging Hyperliquid for the position of the largest Perp DEX. The latter had a 54.6% market share in Q3.“From an OI perspective, Hyperliquid still retains a sizeable lead amongst perp DEXes, with 75% share of OI as at October 1. No other competitor had You may also like: Upbit Corners 72% of S Korean Crypto Market as Smaller Exchanges ‘Face Extinction’ South Korean industry officials are once again voicing concerns that the crypto exchange Upbit may be a de facto monopoly, with smaller competitors’ market presence becoming “insignificant.” The South Korean newspaper Seoul Kyungjae reported that, per data from the regulatory Financial Supervisory Service (FSS), Upbit’s share of total domestic crypto trading volumes was 71.6% in the first six months of 2025. The platform’s operator, Dunamu, is on the verge of a merger with Naver, the... The post Q3 2025: Bitcoin Surged to ATH But With ‘Notable Laggard’ as Ethereum Led the Quarter appeared first on Cryptonews.

Alibaba’s Qwen AI Predicts The Price of XRP, DOGE, and SOL for November 2025

Alibaba’s Qwen AI Predicts The Price of XRP, DOGE, and SOL for November 2025Qwen AI, Alibaba’s flagship model, has released price predictions that XRP, Cardano, and Ethereum could generate rapid, explosive gains in the coming month. An ongoing real-market cryptocurrency trading competition has found that Chinese AI models generate more profitable trades, beating out Western powerhouses like ChatGPT. DeepSeek is the new king now.It’s gaining 125% in just 9 days, making more than GPT-5 and Gemini 2.5 Pro lost combined.DeepSeek is just a side project of a hedge fund, confirmed. pic.twitter.com/YhJ2GLo2gk— Yuchen Jin (@Yuchenj_UW) October 27, 2025 Qwen stands second in the tables, growing its initial capital of $10,000 to $20,776 in just 9 days—a 107% gain, while Western leader Claude notches just 22%.While the altcoins have missed out on “Uptober” tailwinds with renewed US-China trade war tensions weighing on market sentiment, November could mark a turnaround. This week’s FOMC meeting stands to set the tone, with signs of potential U.S. monetary easing expected to revive risk appetite and fuel deeper capital rotation into altcoins.XRP Price Prediction: Qwen AI Sees Institution-Driven RallyQwen AI presents an optimistic outlook that XRP could surge past $6.50 in November, marking a 150% increase from its current $2.63 level.XRP Price Predictions for November. Source: Qwen3-Max.The forecast centers on institutional-grade adoption, positioning XRP as a bridge asset for high-volume payment corridors, potentially tied to central bank or SWIFT-level integrations.It also prices in regulated exposure in U.S. TradFi markets through spot ETFs, opening up a new touch point for institutional demand and boosting XRP’s role in global liquidity networks.Technicals support the bullish setup. A triple-bottom reversal formed through October serves as a launchpad for November gains, fueling a potential year-long ascending triangle breakout.DOGE / USD 1-day chart, ascending triangle. Source: TradingView.More so as momentum indicators flash bullish. The MACD histogram has its widest lead on the signal line since the July bull run, while the RSI has broken above neutral, suggesting the new uptrend has real staying power. If catalysts align, XRP could approach $6.50 this month and extend toward $8 into 2026.Dogecoin Price Prediction: Qwen AI Predicts Potential $1.20 MoveQuen maintains that, despite growing mainstream exposure through a U.S. spot ETF, DOGE remains heavily tied to social sentiment. An optimistic case eyes, $1.20, but not without influence. It cites proactive endorsements from key opinion leaders like Elon Musk as fundamental to significant gains this cycle, eying front-line integration into payment services. While Musk has humored Dogecoin as a payment option on X and Tesla in the past, some real follow-through could translate into massive social momentum and demand for Dogecoin. Looking at the charts, a $1 setup could be in play. A similar October triple bottom reversal structure could be the setup for a breakout from a symmetrical triangle in November. Still, momentum indicators suggest hesitation. The MACD maintains only a narrow lead above the signal line, while the RSI has again been rejected at the neutral zone—signs of weak buy pressure.For now, broader macro tailwinds could provide support in November, but a $1 move still looks premature without renewed hype or major utility news.Solana Price Prediction: Real World Utility Lays Grounds For SurgeQwen AI eyes a 133% move to $700 for Solana, citing its growing status as the leading Ethereum alternative and its expanding role in real-world asset (RWA) tokenization.The model highlights Solana’s growing competitiveness in tokenized stocks, payments, and identity solutions, positioning it as a go-to blockchain for scalable, real-world applications.Solana is also emerging as the second-fastest-growing developer ecosystem behind Ethereum, with exponential monthly onboarding of new builders. Consumer crypto apps, with a total value locked already exceeding $40 billion, could drive real-world use through major gaming or social platform launches.Technically, the 7-month ascending channel offers a clear $500 setup, supported by a triple-bottom reversal structure forming along its lower boundary.Momentum indicators suggest renewed buyer strength. The MACD is widening its lead above the signal line while the RSI breaks above the neutral line, creating a strong foundation for a surge.If near-term catalysts like spot ETFs deliver, SOL could approach $700 next month and extend toward $1000 into 2026.Snorter: How to Make The Most of Your TradesWith November expected to deliver the breakout Uptober couldn’t, traders are honing in their entries and exit strategies. Snorter ($SNORT) is quickly becoming the go-to tool for investors who want to make the most of every move in this volatile market. Snorter Bot has the full competitive trading toolset: limit-order sniping for precision entries, MEV-resistant swaps that block frontrunners, copy trading that follows proven winners, and rug-pull protection to filter out scams before you commit.Just as crucially, it helps traders exit right, locking in profits before momentum fades instead.This isn’t your average trading bot. It’s built for the speed, chaos, and opportunity of a bull market.With the presale now over, the untapped demand of exchanges is knocking. Early adopters of $SNORT are getting ready to ride the next Solana rally — with sharper entries, cleaner exits, and smarter trades.Visit the Offical Snorter Website HereThe post Alibaba’s Qwen AI Predicts The Price of XRP, DOGE, and SOL for November 2025 appeared first on Cryptonews.

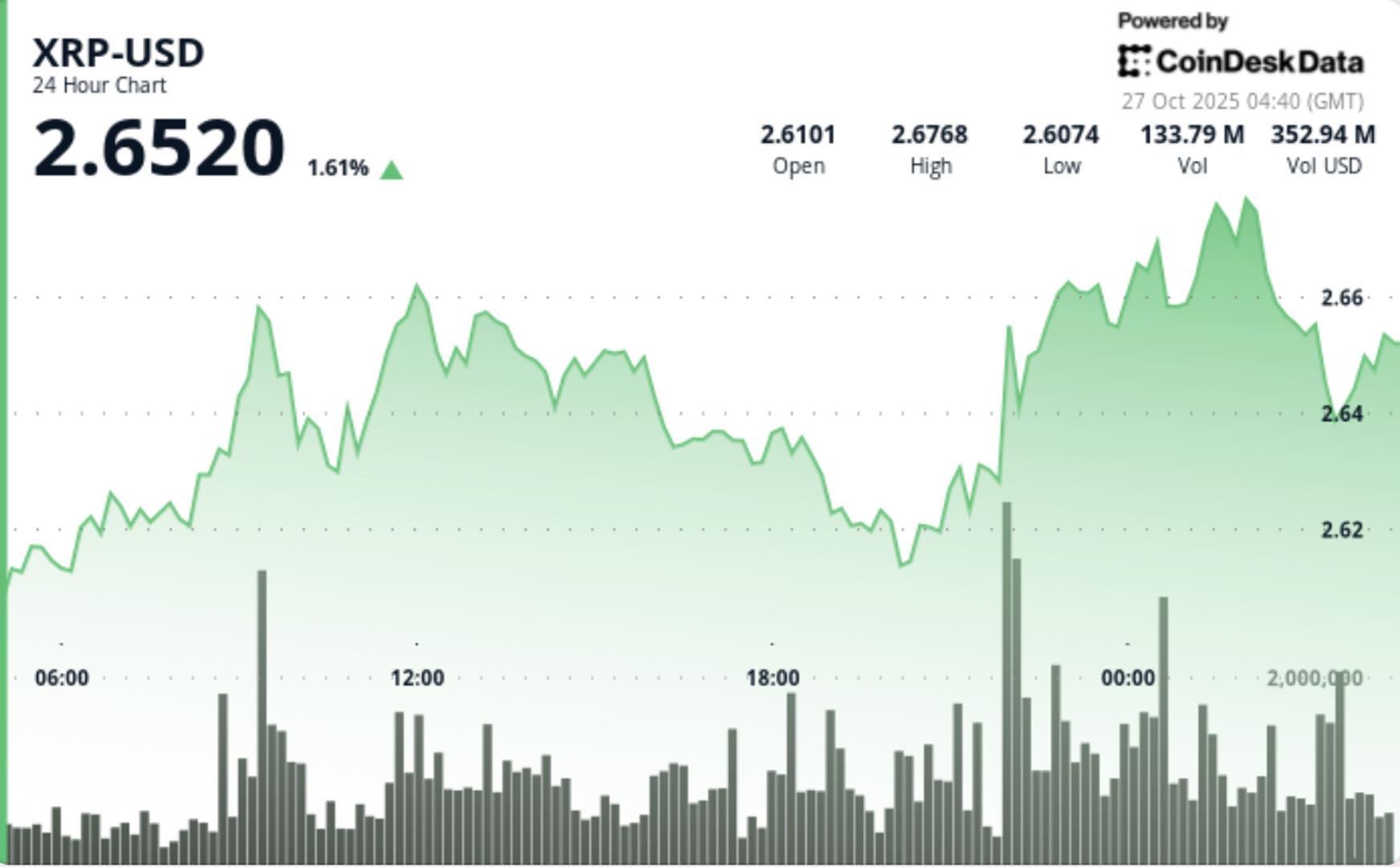

XRP Price Prediction for October 27

XRP Price Prediction for October 27Can the rise of XRP lead to a test of the $2.70 mark?

XRP Takes 286% Bigger Bite Than Solana in $921 Million Weekly Crypto Fund Surge

XRP Takes 286% Bigger Bite Than Solana in $921 Million Weekly Crypto Fund SurgeXRP pulled in $84.3 million last week, which is about 11% of all crypto inflows, beating Solana by 286% as XRP ETF buzz keeps money circling the token.

Despite anticipated new SHIB and XRP highs, investors flock to this low-cap coin: How high can it go in 2025?

Despite anticipated new SHIB and XRP highs, investors flock to this low-cap coin: How high can it go in 2025?The Shiba Inu coin and XRP price reaching new highs is great, but finding a […]

Crypto Wins Legal Status In India — High Court Calls It ‘Property’

Crypto Wins Legal Status In India — High Court Calls It ‘Property’Madras High Court has ruled that cryptocurrencies can be treated as property, a decision that could reshape how exchanges handle user assets after hacks. The court found that certain crypto holdings are identifiable and controllable, and therefore eligible for legal protection similar to other movable property. Cryptocurrency Treated As Property Under Law According to the Madras High Court, crypto-assets meet the basic tests of property because they can be owned, transferred and controlled by private keys. Justice N. Anand Venkatesh said they can be held “in trust,” and that they are neither physical goods nor traditional currency but are property nonetheless. Based on reports, the decision relied in part on the Income Tax Act’s definition of “virtual digital asset” under Section 2(47A). WazirX Hack And The Disputed Holdings Reports have disclosed that WazirX suffered a major security breach on July 18, 2024, when its cold wallet was compromised and about $230 million in Ethereum and ERC-20 tokens were taken. A WazirX user who held 3,532 XRP — valued at roughly ₹1.98 lakh in January 2024 — asked the court to protect her coins from being swept into any pooled compensation arrangement for the stolen funds. The court agreed that her XRP was separate from the tokens stolen in that hack. Court Rejects Arbitration Barrier WazirX argued that disputes should go to arbitration in Singapore under its agreements. The court rejected that view for this case because the transactions had clear links to India — funds came from Indian bank accounts and the exchange is registered in India. Jurisdiction was thus left with the Madras High Court, and ad-interim relief was ordered to stop the user’s XRP from being reallocated as part of the hack losses. What This Means For Users And Exchanges The judgment gives a stronger legal basis to individual users to challenge exchanges legally in Indian courts if they feel their funds are misrepresented or exploited. Exchanges could be required to have a more robust record-keeping regime, clearer segregation of client funds, and direct audit trails. According to reports, judges pointed to technical characteristics of cryptocurrencies — transferability, identifiability and exclusive control — that support the conclusion that legal ownership can be recognized. Potential Tax And Legal Implications Ahead Tax experts are monitoring this closely. Treating crypto as property matches the way some tax rules currently describe virtual assets in tax codes, and may influence the taxation of gains and transfers in the future. This is an important decision of a High Court, which has authority, but can be appealed and reviewed by other courts of higher authority. The judgment protects the specific XRP holdings in this petition. Further legal fights over other users and different tokens may follow. Featured image from JSA, chart from TradingView

Shiba Inu Looks Weak—But Hides A 2,000% End-Cycle Breakout: Analyst

Shiba Inu Looks Weak—But Hides A 2,000% End-Cycle Breakout: AnalystPopular technician Charting Guy (@ChartingGuy) calls Shiba Inu “weak and choppy” and suggests the token may not break out until late in the current crypto cycle. Sharing a weekly Shiba Inu chart, he wrote on Oct. 26, 2025: “SHIB has been weak and choppy all cycle. Won’t do anything until the end imo.” How High Can Shiba Inu Price Go? The below TradingView chart is a weekly SHIB/USD study anchored to a Fibonacci ladder. The price marker on the right rail reads $0.000010205, placing SHIB fractionally below the 0.236 retracement band annotated at $0.000011043. Above that, the chart maps successive overhead levels at 0.382 near $0.000016434, 0.5 around $0.000022661, 0.618 near $0.000031247 and 0.786 at about $0.000049369. The red 1 line flags $0.000088410, with higher extension markers plotted at 1.272 ≈ $0.000185406, 1.414 ≈ $0.000272917 and a terminal 1.618 ≈ $0.000475605. A stylized projection trace on the chart depicts a late-cycle, near-vertical advance that only materializes after a prolonged base and then stalls inside the 1.0–1.272 cluster before breaking above the 1.272 Fib extension and topping below the 1.414 Fib extension roughly at $0.000022; the path visually reinforces the author’s contention that SHIB underperforms until the “end.” In a separate post on Oct. 24, Charting Guy ranked market structures across majors and large-cap altcoins, explicitly placing SHIB in his “Bad Looking Charts” bucket while labeling Bitcoin, Ether, XRP, Solana, BNB and Stellar as “Good Looking Charts.” His list read, in part: “Good Looking Charts: BTC, ETH, XRP, SOL, BNB, XLM … Decent Looking Charts: XDC, DOGE, PENGU, ADA, ONDO, SUI, AAVE, LTC … Eh Looking Charts: PEPE, FLOKI, FLR, LINK, BCH … Bad Looking Charts: SHIB, WIF, ETC, AVAX, FET, RENDER, INJ, CRV, ALGO, SOLO, COREUM, NEAR, VET, COMP, DOT, IOTA, FIL, ATOM, And many more.” What To Expect The technical message is unambiguous: on a weekly timeframe, SHIB remains capped beneath early Fibonacci thresholds that many chartists treat as momentum gates. Remaining below 0.236 typically signals that price has yet to reclaim even the shallowest retracement of the prior cycle; clearing it often opens room to test the 0.382–0.5 midpoint zone where trends either accelerate or fail. In Charting Guy’s map, structurally meaningful inflection areas stack tightly from roughly $0.000016 to $0.000031, with the 0.618 level near $0.000031 attributed the role of a trend-confirmation threshold. The cycle-top roadmap he drew concentrates risk and reward into the higher cluster around $0.000088 to $0.000185, a range often watched by Fibonacci practitioners for exhaustion and distribution in late-stage moves. However, a rise to $0.00022 could still mean an incredible upside for SHIB of around 2,055.81%—a roughly 20.56-fold increase. Contextually, his relative-strength table is just as important as the levels. By grouping SHIB with other “bad looking” structures while upgrading Bitcoin, Ether, XRP, Solana and BNB, he is signaling an expectation that market breadth will remain narrow and quality-led before any speculative rotation into meme-beta like SHIB. That framework aligns with his succinct call that SHIB “won’t do anything until the end,” implying a sequencing view rather than a categorical dismissal. At press time, SHIB traded at $0.00001046.

- Standard Chartered Says This Could Be the Week Everything Changes for Bitcoin | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead. Grab a coffee because this week could quietly redefine the tone of the entire market. Between shifting US-China trade winds, a looming Fed decision, and Bitcoin’s tightening grip above six figures, the mood feels different — almost expectant. Crypto News of the Day: Standard Chartered Says the Week That Decides If Bitcoin Ever Falls Below $100,000 Again Has Begun This could be one of those weeks where the market quietly shifts from uncertainty to conviction. According to Standard Chartered’s Head of Digital Assets Research, Geoff Kendrick, a wave of surprisingly positive US-China developments has turned market sentiment “from fear into hope.” Kendrick highlighted that US Treasury Secretary Bessent signaled an imminent breakthrough over the weekend. He indicated that China is expected to suspend rare earth export controls for a year and increase soybean purchases from the US in exchange for Washington dropping its threatened 100% tariffs. Details of this potential deal will be finalized after the Trump-Xi meeting in Korea later this week. The news has already rippled through the markets, with Bitcoin benefiting from the positive sentiment. In the same tone, the USD-CNH pair has fallen to near year-to-date lows, signaling a stronger yuan and renewed confidence in global trade stability. This easing tension has, in turn, fueled a rebound in Bitcoin’s correlation to risk appetite, as investors rotate away from defensive positions. “The Bitcoin-gold ratio, highlighted last week, continues to push higher,” Kendrick wrote, noting that it now sits just above levels seen before the tariff scare earlier this month. “I’ll watch for this ratio to break back above 30 to signal an end to such fear.” The Week That Could Redefine Bitcoin’s Future For Kendrick, the coming days may mark a critical turning point for Bitcoin and how investors interpret its long-term cycle. He pointed out that over $2 billion exited US gold ETFs last week, suggesting an appetite shift that could soon favor Bitcoin. “It would confirm a more positive backdrop if even half of that re-entered Bitcoin ETFs early this week,” he noted. The broader setup looks equally intriguing. Wednesday’s FOMC meeting is expected to deliver a 25 basis-point rate cut, despite the Fed operating in what Kendrick described as a “data blackout.” It's FOMC week!There's a 96.7% chance the Fed will cut interest rates by 25bps. What’s your prediction? pic.twitter.com/SRVPczDYcL— Lark Davis (@TheCryptoLark) October 27, 2025 He also hinted that growing speculation over the next Fed Chair could prove “Bitcoin positive” if it raises concerns about central bank independence. Add to that, the looming earnings releases from five of the ‘Magnificent Seven’ — Microsoft, Meta, Google, Apple, and Amazon — and the macro calendar looks loaded with catalysts. “This week is about to be pure chaos…the government shutdown is about to hit day 30. The Fed decides rates on Wednesday. Powell speaks right after, during a data blackout. Then, we’ve got Microsoft, Apple, Google, Meta, and Amazon, all reporting earnings. That’s $15.2 trillion in market cap dropping numbers in the same week. And just when you think it’s over… Trump meets President Xi on Thursday, 48 hours before his 100% tariff deadline. Buckle up. This week could move everything,” Mario Nawfal corroborated. Kendrick argues that a fresh Bitcoin all-time high would serve as the “death knell” for those still clinging to the halving cycle as the primary driver of BTC’s value. “ETF flows matter more now…If this week goes well, Bitcoin may never go below $100,000 again,” he said. This statement echoes remarks highlighted in a recent US Crypto News publication. Whether or not that prediction holds, this week’s mix of diplomacy, data, and digital gold could prove decisive for the next phase of Bitcoin’s story. Chart of the Day Bitcoin to Gold Ratio. Source: Long-term Trends Byte-Sized Alpha Here’s a summary of more US crypto news to follow today: Another year, another delay: Mt. Gox keeps $4 billion in Bitcoin off the market. Crypto inflows near $1 billion as rate cut hopes fuel market momentum. XRP price needs a 7% push to rally — Two metrics hint it’s close. Top crypto news this week: BlackRock ETH ETF, MegaETH ICO, Trump-Xi meeting, and more. The crypto market is exploding — and one man is betting on its collapse. Three altcoins are facing major liquidation risks in the last week of October. Ocean Protocol denies token theft allegations as ASI Alliance rift deepens. Argentina’s Javier Milei celebrates 2025 midterm triumph as LIBRA scandal deepens. Inside the x402 token boom: The new payment standard powering AI agents. Crypto Equities Pre-Market Overview CompanyAt the Close of October 24Pre-Market OverviewStrategy (MSTR)$289.08$300.01 (+3.78%)Coinbase (COIN)$354.46$364.65 (+2.87%)Galaxy Digital Holdings (GLXY)$39.82$41.29 (+3.69%)MARA Holdings (MARA)$19.54$20.38 (+4.29%)Riot Platforms (RIOT)$21.42$22.36 (+4.39%)Core Scientific (CORZ)$19.34$19.71 (+1.91%)Crypto equities market open race: Google Finance The post Standard Chartered Says This Could Be the Week Everything Changes for Bitcoin | US Crypto News appeared first on BeInCrypto.

XRP price on edge as Ripple USD hits $900m milestone

XRP price on edge as Ripple USD hits $900m milestoneXRP price rally found substantial resistance at the 50-day moving average despite its strong fundamentals, including the growing Ripple USD market cap and ETF inflows. Ripple (XRP) token jumped to a high of $2.6340, its highest point since October 11.…

Here’s XRP Price If the Crypto Market Hits $10T, $50T, or $100T and XRP Keeps Its Share

Here’s XRP Price If the Crypto Market Hits $10T, $50T, or $100T and XRP Keeps Its ShareXRP has the potential to reach higher price levels if it maintains its market dominance when the total crypto market cap hits $10 trillion, $50 trillion, or $100 trillion. The global crypto market now stands at about $3.8 trillion,...

WazirX news: Indian court freezes XRP redistribution after $230 million hack

WazirX news: Indian court freezes XRP redistribution after $230 million hackThe Madras High Court has ruled against WazirX redistributing user’s XRP holdings following its 2024 hack, declaring that cryptocurrencies qualify as property under Indian constitutional law. WazirX barred from redistributing user’s XRP under its “socialisation of losses” plan The Madras…

Here’s Why XRP Has a Better Chance to 100x from Here Than Bitcoin

Here’s Why XRP Has a Better Chance to 100x from Here Than BitcoinDom Kwok, the co-founder of EasyA, has insisted that XRP has a much stronger chance to surge a hundredfold compared to Bitcoin. Kwok made this assertion in a recent discussion within the XRP community after he countered claims from...

Businesses warm up to XRP, but wider adoption remains elusive: Here’s why

Businesses warm up to XRP, but wider adoption remains elusive: Here’s whyXRP is one of the first cryptocurrencies created with broad adoption and partnerships with banks and other institutions in mind. Over 10 years later, it is possible to pay for various goods and services with XRP, but today’s stablecoins pose…

XRP Open Interest Just Reset Again: Here’s What Happened the Last Time This Occurred

XRP Open Interest Just Reset Again: Here’s What Happened the Last Time This OccurredXRP open interest on Binance has again reset to yearly lows, giving the XRP market more room to breathe. This is largely due to the Oct.Visit Website

XRP (XRP) Faces Volatility Amid Government Shutdown and ETF Delays

XRP (XRP) Faces Volatility Amid Government Shutdown and ETF DelaysThe U.S. government shutdown impacts XRP ETF decisions, while Osprey fund amasses significant assets, influencing XRP's price trajectory. (Read More)

Ripple Model Is To Spend Money In a Way To Maximize XRP Value: Ripple CTO Once Said

Ripple Model Is To Spend Money In a Way To Maximize XRP Value: Ripple CTO Once SaidThe XRP community has unearthed a past statement in which Ripple CTO David Schwartz said the company pursues business models that benefit XRP’s price. Specifically, Schwartz made the comment exactly eight years ago, on October 27, 2017.Visit Website

Here’s What The XRP Open Interest Reset Means For The Price

Here’s What The XRP Open Interest Reset Means For The PriceCrypto analyst CryptosRus has drawn attention to the open interest reset for XRP. The analyst also explained why this development could spark a major price surge for the altcoin. XRP’s Open Interest Drops To New Lows In an X post, CryptosRus revealed that XRP’s open interest on Binance has dropped back to the same lows that were seen in May 2025. The analyst noted that back then, the liquidation flush sparked a massive rally for the altcoin, which pushed it to $3.50. He added that this time around, the open interest is at the floor again, but the price is holding around $2.6. CryptosRus stated that this means that leverage is gone while the strong hands are still holding XRP. The analyst predicted that if new liquidity enters, this setup could signal the next leg up for the altcoin. He added that rallies usually start when leverage is low, spot demand is strong, and shorts are trapped. Notably, XRP has witnessed new demand with the launch of the largest XRP treasury company, Evernorth. The company has already accumulated up to $1 billion in XRP with Ripple’s backing and has revealed plans to continue accumulating more, using gains from its DeFi activities. Notably, the company stated that it will purchase XRP on the open market, which is expected to impact the altcoin’s price. Meanwhile, the SEC is expected to approve the spot XRP ETFs once the U.S. government shutdown ends. This could drive new liquidity into the altcoin, boosting its price. Moreover, experts such as Canary Capital’s CEO Steven McClurg have predicted that the XRP ETFs could see more inflows in their first month than the Ethereum ETFs did. XRP Is Gearing Up For A ‘Face Melting’ Rally Crypto analyst Ether stated that XRP is quietly gearing up to melt faces and that most aren’t even aware or ready for what is coming. This came as the analyst alluded to an earlier analysis, in which he revealed that a similar scenario from a previous cycle was playing out for the altcoin. Ethere stated that XRP’s cyclical structure is showing a striking similarity again. After the altcoin’s rally in 2017, its price was rejected from the 2013 all-time high (ATH) level and then retested the 2014 ATH level, which had previously acted as resistance. XRP then began its parabolic run after it accumulated strength in that range. Now, this same XRP price action is playing out again, according to Ether. He noted that after the strong surge in 2024, the altcoin’s price was rejected at the 2017 ATH level and retested the 2021 ATH level, which had previously acted as resistance. The analyst added that the power accumulation phase is now underway in this region and that once it is complete, the next parabolic run will be inevitable. At the time of writing, the XRP price is trading at around $2.63, up in the last 24 hours, according to data from CoinMarketCap.

XRP Ready to Break Out? Key Resistance Level Under Watch

XRP Ready to Break Out? Key Resistance Level Under WatchXRP nears key $2.70 level after bullish weekly candle, with long-term chart setup echoing its 2017 breakout structure.

XRP Ready to Break Out? Key Resistance Level Under Watch

XRP Ready to Break Out? Key Resistance Level Under WatchXRP is back in focus after printing a bullish weekly candle. At the time of writing, the token trades at $2.62 with a 24-hour volume of $4 billion. It is down slightly on the day but has gained over 5% in the past week. Meanwhile, the market is watching the $2.70 level, which has acted as a major resistance area. Weekly Candle Shows Bullish Reversal Pattern The weekly chart has formed a bullish engulfing candle. This pattern tends to appear after downtrends and suggests that buyers are stepping in. The candle covers the body of the previous red candle entirely, signaling a momentum shift. Notably, the focus now is $2.70. A clean break and hold above that level may confirm bullish strength. ChartNerd said, $XRP has printed a weekly bullish close with an engulfing candle Breaking above $2.70 and staying above such level is the main objective. A higher low could form if met as resistance Reversal signals are printing. Great signs for continuation macro. Be prepared https://t.co/EdcY9UUsaw pic.twitter.com/FJGlGWLaRn — ChartNerd (@ChartNerdTA) October 27, 2025 Analysts have drawn comparisons to XRP’s price action in 2017. At that time, the token broke above a long-term resistance block after months of consolidation. A similar structure is forming now, according to a multi-year chart. The price has broken above the same type of resistance block and is holding support from previous accumulation zones. Fibonacci extension levels show long-range targets at $8, $13–$15, and $27. These are based on XRP’s past expansion moves. Long-Term Accumulation Still in Play XRP has been trading within a rising channel since January. According to ChartNerd, it recently tested the lower boundary and bounced. That bounce occurred near key trendline support, which has held for over 10 months. This adds weight to the idea of continued accumulation. Cryptoinsightuk noted, “XRP has no downside liquidity… at some point price will be pushed higher into the deep areas of liquidity.” The quote reflects how thin order books below can act as a springboard if demand returns. Institutional Focus and Broader Sentiment The market narrative remains mixed. Some traders questioned the strength of the current move due to recent whale activity. Still, data from Santiment shows buying interest picked up after a round of negative social media sentiment, as we reported. Separately, Ripple also confirmed it has completed its $1.25 billion acquisition of Hidden Road, now rebranded as Ripple Prime. The deal, first announced in April, was finalized last week. It gives the company an entry into the institutional brokerage space. Moreover, for more on Ripple’s recent strategic actions, read here. The post XRP Ready to Break Out? Key Resistance Level Under Watch appeared first on CryptoPotato.

Wealth Manager Suggests New Launch Date for XRP ETFs

Wealth Manager Suggests New Launch Date for XRP ETFsPresident of NovaDius Wealth Management, Nate Geraci, has suggested that spot XRP ETFs could potentially debut as early as next month. Geraci shared this optimistic outlook via a viral meme that illustrates the current state of spot crypto ETFs.Visit...

BNB Jumps Over 3% After $1.69B Token Burn, Overtakes XRP's Market Cap

BNB Jumps Over 3% After $1.69B Token Burn, Overtakes XRP's Market CapXRP now has a market cap of $157.6 billion, slightly behind of BNB's $161 billion.

XRP Never Designed to Be Cheap: BlackSwan Capitalist Founder

XRP Never Designed to Be Cheap: BlackSwan Capitalist FounderBlackSwan Capitalist founder makes a bullish case for XRP's price breakout.

Crypto Investment Products See $921M Inflows as Rate-Cut Hopes Rise

Crypto Investment Products See $921M Inflows as Rate-Cut Hopes RiseDigital asset investment products attracted $921 million in inflows over the past week, rebounding after several volatile sessions. Key Takeaways: Digital asset funds saw $921 million in inflows last week as softer U.S. inflation data renewed hopes for rate cuts. Bitcoin led the rebound with $931 million in inflows, while Ethereum products recorded their first outflows in five weeks. Global ETP trading volumes surged to $39 billion, far above the yearly average, driven mainly by US and German investors. The rise comes amid renewed optimism that US interest rates could fall later this year following softer-than-expected inflation data, according to a Monday report by CoinShares.Lower CPI Data Lifts Investor Sentiment as ETP Volumes Surge to $39BThe lower CPI print released Friday boosted investor confidence despite uncertainty caused by the ongoing US government shutdown, which has delayed key economic indicators.Global trading activity also stayed strong, with ETP volumes hitting $39 billion—well above the year-to-date weekly average of $28 billion.The U.S. dominated regional inflows with $843 million, while Germany saw one of its largest weekly totals ever at $502 million.Switzerland, meanwhile, posted $359 million in outflows, though these were attributed to asset transfers between providers rather than active selling.Bitcoin continued to lead investor demand, recording $931 million in inflows for the week. According to CoinShares, digital asset investment products saw $921 million in net inflows last week. Bitcoin led with $931 million in inflows, while Ethereum recorded its first outflows in five weeks, totaling $169 million. Solana and XRP saw cooling flows, with $29.4 million…— Wu Blockchain (@WuBlockchain) October 27, 2025 Since the Federal Reserve began cutting rates, Bitcoin products have seen $9.4 billion in cumulative inflows, bringing total year-to-date inflows to $30.2 billion, still shy of last year’s $41.6 billion record.Ethereum products, however, saw $169 million in outflows, their first in five weeks. Despite this, demand for 2x leveraged Ethereum ETPs remains strong.Solana and XRP also saw reduced inflows at $29.4 million and $84.3 million, respectively, as investors await the anticipated U.S. spot ETF launches.Ethereum ETFs Face $244M Outflows as Bitcoin Products Regain MomentumSpot Ethereum exchange-traded funds (ETFs) recorded their second consecutive week of outflows, signaling cooling investor sentiment after months of strong inflows.According to SoSoValue data, Ether products saw $243.9 million in redemptions for the week ending Friday, following $311 million in the previous week.Cumulative inflows across all Ether ETFs now total $14.35 billion, with assets under management at $26.39 billion, or 5.55% of Ethereum’s market capitalization.Outflows on Friday alone reached $93.6 million, led by BlackRock’s ETHA ETF, which posted $100.99 million in withdrawals.Meanwhile, Grayscale’s ETHE and Bitwise’s ETHW reported minor inflows, suggesting selective investor rotation rather than a broad retreat from Ethereum exposure.In contrast, spot Bitcoin ETFs saw renewed demand, drawing $446 million in inflows over the same period. BlackRock’s IBIT and Fidelity’s FBTC led the recovery, adding $32.68 million and $57.92 million, respectively.Total cumulative inflows into Bitcoin ETFs now stand at $61.98 billion, with $149.96 billion in total assets, representing 6.78% of Bitcoin’s market cap.The post Crypto Investment Products See $921M Inflows as Rate-Cut Hopes Rise appeared first on Cryptonews.

Ripple-Backed Evernorth Nears $1B XRP Treasury: Major Supply Shock Incoming?

Ripple-Backed Evernorth Nears $1B XRP Treasury: Major Supply Shock Incoming?The post Ripple-Backed Evernorth Nears $1B XRP Treasury: Major Supply Shock Incoming? appeared first on Coinpedia Fintech News Evernorth Holdings is quickly becoming a major player in the XRP space, moving closer to its $1 billion goal. Backed by...

Morning Crypto Report: XRP Scores Legal Win in India, Mt. Gox Delays Bitcoin Payouts, China Warns of Crypto Risks

Morning Crypto Report: XRP Scores Legal Win in India, Mt. Gox Delays Bitcoin Payouts, China Warns of Crypto RisksCrypto heads into a critical week after $470 million in liquidations, with XRP gaining legal ground in India, Mt. Gox repayments pushed to 2026 and the Central Bank of China slamming stablecoins.

XRP Breaks Most Important Resistance of 2025

XRP Breaks Most Important Resistance of 2025XRP is reclaiming one of the biggest resistances of 2025, with the possibility of a rally acceleration.

XRP's Potential Rebound as Retail Capitulation Intensifies

XRP's Potential Rebound as Retail Capitulation IntensifiesXRP's price faces pressure from retail fear and whale sell-offs, but historical patterns suggest a potential rebound as market conditions evolve. (Read More)

- [LIVE] Crypto News Today, October 27 – BTC Price USD Reclaims $115K Ahead of FOMC Meeting, BNB Flips Again XRP: Best Crypto Presale to Buy?