TreasuryLive Feed

Treasury breaking news and instant alerts. Crypto Feed's minimalist interface delivers verified headlines, price movements, and protocol updates the moment they happen. Fast, focused, no fluff.

Ripple Prime: How The Company Just Set A Major Record That Boosts The XRP Ledger

Ripple Prime: How The Company Just Set A Major Record That Boosts The XRP LedgerRipple has announced the completion of its acquisition of Hidden Road, officially rebranding the global non-bank prime broker as Ripple Prime. This is a historic moment for the company, as it makes the payment firm the first crypto-based company to own and operate a global, multi-asset prime brokerage platform. The acquisition is also a major record that significantly expands Ripple’s institutional presence and further improves the XRP Ledger’s ecosystem through new integrations and utility for the company’s stablecoin, RLUSD. Ripple Prime Acquisition To Boost The XRP Ledger In a recent post on the social media platform X, Ripple announced that it has completed the acquisition of Hidden Road. The company’s acquisition of Hidden Road positions it as a pioneer in combining traditional finance with digital assets at scale. Hidden Road is one of the fastest-growing prime brokers in the world. The company offers a range of institutional services such as clearing, financing, and brokerage across foreign exchange, digital assets, derivatives, swaps, and fixed income. Now that the rebranding to Ripple Prime is complete, the new name embodies the payment firm’s strategy to build the foundation for institutional digital asset adoption. One of the most significant outcomes of Ripple Prime’s launch is its impact on the adoption and utility of Ripple’s stablecoin, RLUSD. According to the company’s announcement post on its website, RLUSD is now being actively used as collateral for several prime brokerage products. Derivatives clients have begun holding their balances in RLUSD, and this is expected to keep growing with institutional confidence. Ripple emphasized that RLUSD’s regulatory compliance and governance framework have made it one of the most trusted stablecoins in the market. Earlier this year, Bluechip rated RLUSD as the number one stablecoin for stability, governance, and asset backing, assigning it an A grade. The firm further reinforced its institutional credibility by appointing The Bank of New York Mellon (BNY Mellon) as RLUSD’s primary reserve custodian. At the time of writing, RLUSD is the 12th biggest stablecoin in market cap, with a $902 million market cap, now inching towards the billion-dollar mark. The Firm’s Expanding Institutional Footprint And Future Outlook Ripple Prime is part of the company’s expansion strategy to capture a notable share of the global financial market. The company’s acquisition of Hidden Road makes it its fifth acquisition in two years. The acquisition trend started with the purchase of Metaco in May 2023, and then the purchase of Standard Custody in June 2024. Since then, the payment firm has continued to strengthen its institutional offerings with acquisitions like Rail in August 2025 and GTreasury just last week. Each acquisition has been strategically done in order to upgrade Ripple and XRP’s position as the leading provider of enterprise-grade blockchain solutions. “As we continue to build solutions towards enabling an Internet of Value – I’m reminding you all that XRP sits at the center of everything Ripple does.” CEO Brad Garlinghouse said in a post on X.

- MicroStrategy Stock Rises Despite S&P’s Dismal Credit Rating

S&P Global Ratings assigned a credit rating to Strategy, giving it a B-. The firm claimed that its weak liquidity and narrow focus could make it fragile to future collapse. Nonetheless, Strategy’s stock rose today, as Saylor noted that his is the first digital asset treasury (DAT) to attract the S&P’s notice. This marketing technique epitomizes Strategy’s ongoing history of success. S&P Rates Strategy’s Credit Strategy recently slowed down its BTC purchases after a complete pause, but the firm remains determined to keep buying Bitcoin. Michael Saylor even announced a $43.4 million acquisition today, but the company has experienced a setback, as the S&P gave Strategy a B- credit rating, representing low confidence: “We view Strategy’s high bitcoin concentration, narrow business focus, weak risk-adjusted capitalization, and low US dollar liquidity as weaknesses. These are only partially offset by the company’s strong access to capital markets and prudent management of its capital structure,” the S&P claimed in a press release. The S&P highlighted a lot of structural factors, both specific to Strategy and applicable to the whole DAT industry, to assign this credit score. For one thing, the company is under acute pressure from shareholders thanks to stock dilution concerns, and Strategy is juggling diminishing mNAV concerns. Moreover, other DAT companies are turning away from Strategy’s pioneering tactics. More of these firms are pursuing diversified methods to build crypto stockpiles, even mining the tokens themselves, putting this early leader on the back foot. Even these tactics, however, are showing their own warning signs. These reasons led the S&P to assign such a low credit rating to Strategy, claiming it’s “unlikely” that this score will rise in the next year. The Show Must Go On Despite this sign of no confidence from the S&P, however, Strategy’s stock actually rose today. Saylor, an outsized personality in the crypto industry with a keen eye for marketing, cast this credit rating as a positive development. Sure, the agency took a dim view of his company, but Strategy is the first DAT to warrant an official rating from this institution. That special attention already serves as a milestone for the crypto industry: S&P Global Ratings has assigned Strategy Inc a 'B-' Issuer Credit Rating (Outlook Stable) — the first-ever rating of a Bitcoin Treasury Company by a major credit rating agency. https://t.co/WLMkFqkkCb— Michael Saylor (@saylor) October 27, 2025 Crypto economics live and die on community hype, and Strategy’s branding could be an “X factor” that the S&P can’t necessarily incorporate into a credit rating. Even now, new DAT firms are referred to as “MicroStrategies,” showing the original company’s outsized reputation. In other words, genuine enthusiasm could help paper over these contradictions. Ultimately, though, that doesn’t seem like enough. TradFi is becoming integrated with the broader crypto industry, but the S&P specifically spurned Strategy. Saylor needs to do more than weather momentary setbacks; he needs to regularly keep competing trends from crashing together. Eventually, one of these weaknesses could blow up in his face. The post MicroStrategy Stock Rises Despite S&P’s Dismal Credit Rating appeared first on BeInCrypto.

This Ethereum Treasury Stock Is Rising Following Beyond Meat Investor’s Backing

This Ethereum Treasury Stock Is Rising Following Beyond Meat Investor’s BackingETHZilla continued climbing Monday, with the Ethereum treasury firm selling ETH to buy back shares—just like a prominent investor asked.

ETF Delays Shake Market Confidence, But XRP’s Volume Spike Supports a $2.9 Bullish Signal

ETF Delays Shake Market Confidence, But XRP’s Volume Spike Supports a $2.9 Bullish SignalXRP is staging a remarkable rebound, rising from early October lows of $1.77 to over $2.60, even as the U.S. Securities and Exchange Commission (SEC) prolongs its review of pending XRP ETF filings. The delays have sparked mixed market sentiment, yet XRP’s trading volume and technical setup indicate growing bullish momentum. Over the weekend, XRP surged to $2.68, breaking critical resistance at $2.63 on a 147% volume spike, one of the largest in recent months. This explosive move coincided with renewed optimism following Ripple’s strategic acquisitions, including the integration of Ripple Prime and GTreasury, which CEO Brad Garlinghouse said place XRP “at the center of everything Ripple does.” Technical Indicators Strengthen the Bullish Outlook From a technical perspective, XRP’s chart paints a clear bullish picture. The token has moved firmly above both its 50-day and 200-day exponential moving averages (EMAs), key indicators of trend continuation. It has also formed an inverse head-and-shoulders pattern, historically signaling potential for higher highs. The Relative Strength Index (RSI) remains near 70, showing strong demand despite slightly overbought conditions. Analysts expect a confirmed breakout above $2.70 to set the stage for XRP to reach the $2.90–$3.00 range in the near term. Momentum indicators such as the True Strength Index (TSI) and rising open interest in CME XRP futures, which recently crossed $27 billion in notional volume, reinforce this bullish outlook. However, traders are watching the $2.54–$2.58 support zone closely. A drop below this range could weaken momentum and invite short-term corrections. Institutional Flows Signal Confidence in XRP’s Future While ETF delays have briefly dented sentiment, institutional accumulation around XRP remains strong. The token’s rapid integration into U.S.-listed ETFs, expanding derivatives markets, and corporate adoption, including Evernorth’s treasury allocation, underscore growing confidence in Ripple’s long-term fundamentals. Institutional demand continues to accelerate through vehicles like the REX-Osprey XRP ETF, which recently surpassed $100 million in assets under management, placing XRP as a mainstream financial instrument rather than a speculative token. With global crypto market capitalization hovering near $3.8 trillion and the Federal Reserve’s upcoming rate decision expected to ease liquidity constraints, analysts believe XRP could outperform peers in the next leg of the bull cycle. If buying pressure holds above $2.70, the $2.90 breakout target may only mark the beginning of a broader rally, one that cements XRP’s role at the heart of institutional digital finance. Cover image from ChatGPT, XRPUSD on Tradingview

- Huione Laundered Millions Through South Korean Exchanges

The US recently sanctioned Cambodia-based Huione Group, calling it a transnational crime organization. Authorities have now confirmed that the group laundered criminal funds through South Korean cryptocurrency exchanges. Data from South Korea’s Financial Supervisory Service (FSS) shows significant capital movements. Bithumb Processed Most of the Suspicious Transactions Huione’s subsidiary, Huione Guarantee, conducted extensive transactions with Korean won-market exchanges over the past three years. In total, deposits and withdrawals in Tether (USDT) reached about 15.9 billion KRW ($12 million). The office of ruling People Power Party lawmaker Lee Yang-soo disclosed the FSS data on Monday. The records reveal that Huione Guarantee was deeply involved in financial activity with Korean exchanges. Further, officials suspect the funds are linked to kidnapping, human trafficking, and voice phishing operations currently under investigation in Cambodia. 5/ Huione has directly facilitated laundering billions in illicit funds over the past couple years from pig butchering scams, investment scams, human trafficking and hacks/exploits in Southeast Asia. Last week the US applied additional restrictions against Huione in relation to… pic.twitter.com/L2ZIoMx6By— ZachXBT (@zachxbt) October 19, 2025 Bithumb processed the majority of transactions, handling about 14.6 billion KRW, while Upbit and Korbit accounted for 889 million KRW and 454 million KRW, respectively. Meanwhile, the timing of these transfers has raised an alarm. They coincide with a spike in fraud, kidnapping, and human trafficking cases in Cambodia. On October 18, the South Korean government repatriated 64 Korean nationals arrested in Cambodia for participating in online fraud schemes. Many were reportedly held captive by Chinese crime syndicates. Possible Links to Kidnapping and Sanctions Recent high-profile cases involving Korean victims of kidnapping, confinement, and murder have prompted a broader probe. South Korean authorities are investigating whether these incidents are tied to Huione Group’s operations. Investigators noted that transactions between Bithumb and Huione surged in 2024, around the same time reports increased of Koreans being lured to Cambodia under false job offers and then detained. Right after the U.S. cut Huione Group off from the global financial system, One Property in Phnom Penh suddenly told residents they can no longer pay through ABA, only Prince Bank or Huione. That shift looks less like a business adjustment and more like a strategy to keep… pic.twitter.com/KjAfzfA30y— Jacob in Cambodia (@jacobincambodia) October 17, 2025 Who Is the Huione Group? Huione Group presents itself as a legitimate Cambodian conglomerate. Yet, its subsidiary Huione Guarantee has been accused of facilitating online fraud and money laundering under the guise of offering payment and surety services. The group first drew international attention in July 2024, when blockchain analytics firm Elliptic reported that Huione Guarantee was a key platform for cryptocurrency laundering. Initially launched in 2021 as a peer-to-peer marketplace for cars and real estate, the platform evolved into a major exchange hub for Chinese yuan and USDT among criminal networks across Southeast Asia. Elliptic estimated that it processed about $11 billion in illicit funds. Today, OFAC and FinCEN, with UK's FCDO, designated the Prince Group TCO and 146 associates, while Huione Group was named under Section 311 of the USA PATRIOT Act. DOJ also seized a record $15B in bitcoin linked to these Southeast Asian crypto scam operations. Read more here:… pic.twitter.com/MgjkMFmCbl— Chainalysis (@chainalysis) October 14, 2025 Crackdown and US Sanctions On October 14, 2025, the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) imposed sanctions on Huione Group. The action effectively cut the conglomerate off from the US financial system. The Treasury cited confirmed links between Huione Group and North Korean cybercrime operations as well as large-scale virtual asset scams across Southeast Asia. Authorities continue to trace the network’s financial ties as investigations expand across multiple jurisdictions. The post Huione Laundered Millions Through South Korean Exchanges appeared first on BeInCrypto.

- Trump Family’s American Bitcoin Gains 10% With Fresh BTC Purchases

American Bitcoin, a BTC miner/treasury firm launched by the Trump family, holds a little under $4.5 million in Bitcoin. The firm’s stock price has climbed in recent days. The company hopes to use its mining operations and “Trump Bump” to remain at the cutting edge. Still, it’s hard to make any long-term predictions in today’s uncertain environment. A Trump Family Bitcoin Treasury President Trump has been introducing a lot of chaos to crypto markets, but many of his family’s business ventures are far less provocative. The President’s family has been receiving substantial incomes from its industry connections, and Trump venture American Bitcoin is making huge acquisitions: And we are just getting warmed up! Incredibly excited about $ABTC and what we are building. https://t.co/hjv8KCbCNx— Eric Trump (@EricTrump) October 27, 2025 According to a new press release, American Bitcoin has acquired 1,414 BTC since September, bringing its total holdings to 3,865. At current market rates, this represents a little under $4.5 billion in total, a major stockpile. Eric Trump repeatedly claimed that the firm plans to keep buying Bitcoin. Past Gains and Future Concerns American Bitcoin has only existed for a few months, but the Trump family’s support has already brought the firm a ton of success. The company’s stock value has been climbing since before the purchase announcement, growing roughly 20% in the last five days. Still, this new publicity caused an additional spike today alone: American Bitcoin Price Performance. Source: Yahoo Finance Much of the firm’s BTC stockpile comes from these purchases, but its mining operations have also helped buoy its mNAV. While most digital asset treasury (DAT) firms are struggling under this limitation, mining and the “Trump Bump” could help American Bitcoin remain competitive. Still, the whole DAT sector is facing a ton of challenges, both in terms of finance and possible legal issues. Although the latter concern likely won’t matter for a Trump family venture, American Bitcoin is still in a very chaotic sector. The post Trump Family’s American Bitcoin Gains 10% With Fresh BTC Purchases appeared first on BeInCrypto.

Ripple CEO Highlights Top 5 Acquisitions The Company Has Made As XRP Ledger Usage Rises

Ripple CEO Highlights Top 5 Acquisitions The Company Has Made As XRP Ledger Usage RisesRipple’s rapid expansion across the global finance space, along with the continued growth of the XRP Ledger (XRPL), has drawn significant attention from the broader market. Ripple CEO Brad Garlinghouse recently spotlighted the company’s top five strategic acquisitions, emphasizing how these deals are shaping the crypto payment firm’s future and reinforcing XRP’s central role within the evolving ecosystem. Ripple and XRP Ledger Solidify Global Position Through Acquisitions In an X social media post on Friday, Garlinghouse confirmed that with the complete acquisition of Hidden Road, now rebranded as Ripple Prime, the crypto payments company has finalized five key takeovers in roughly two years. These include GTreasury, Rail, Standard Custody, Metaco, and now Ripple Prime. Each acquisition strengthens the company’s position in the global finance ecosystem and aligns with its vision to create what Garlinghouse calls an “internet of value,” where one moves as easily as information does online. Garlinghouse emphasized in his post that XRP sits “at the center of everything Ripple does,” underscoring its vital role in the company’s growing range of financial products. Every acquisition, whether focused on liquidity management, custody, or settlement, aims to enhance how institutions leverage Ripple’s payment technology and, ultimately, the XRP Ledger to transfer value globally with greater efficiency and security. Following Garlinghouse’s post, crypto market expert Crypto Sensei raised an important question about how the company’s new integration would handle settlement. He also asked whether the company’s stablecoin, RLUSD, which already lives on Ethereum, would also operate on the XRP Ledger. While the Ripple CEO has not confirmed the specifics, the community chimed in, suggesting that the payments firm plans to roll out RLUSD on XRPL soon. This would allow the recently acquired brokerage platform, Ripple Prime, to handle both liquidity and settlement natively on the ledger. If this happens, the company could soon control everything from trade execution to settlement, with XRP acting as the core bridge asset. It’s a move that could help the company achieve its clear goals of integrating traditional financial infrastructure with blockchain-based liquidity. The Firm Uses XRP In Landmark Equity Deal In another major development, crypto enthusiast Diana announced that Ripple has confirmed through a US Securities and Exchange Commission (SEC) filing that it paid for a corporate acquisition using XRP as the payment currency. The filing by Armada Acquisition Corp II revealed that Ripple contributed 126,791,458 XRP, approximately $305 million, in exchange for equity units that would convert into PubCo Class A shares upon closing. The transaction marks one of the first instances where XRP has been used directly as a financial instrument in a regulated equity deal. This move signifies a milestone for Ripple, especially since it officially concluded a 7-year lawsuit with the SEC earlier this year, which had alleged that XRP was a security. According to Diana, the purchase will effectively transform XRP from a utility token into a form of institutional capital. The payment firm’s use of XRP as payment also comes on the heels of its GTreasury acquisition and its inclusion in the Federal Reserve’s Faster Payments Task Force Steering Committee, further embedding XRP into mainstream financial operations.

What Do Industry Leaders Think Of Michael Saylor’s Bitcoin Strategy? Adam Back, Paolo Ardoino Weigh In

What Do Industry Leaders Think Of Michael Saylor’s Bitcoin Strategy? Adam Back, Paolo Ardoino Weigh InOn 27 October 2025, Strategy CEO Michael Saylor acquired additional 390 Bitcoin worth nearly $44 million, bringing the company’s total to 640,808 BTC. Blockstream CEO Adam Back, Tether CEO Paolo Ardoino, and Twenty One Capital CEO and Strike CEO Jack Mallers, voiced their opinions on Saylor’s Bitcoin accumulating strategy during the Plan B conference held in Lugano. “Saylor has been very communicative about his learning through the process,” said Blockstream CEO Adam Back. “They started with the bonds, moved on to the convertibles, at the market share selling, and now the preferred.” “I think he’s been vocal that he thinks the preferred is a better strategy, and he appears to be trying to repay the converts or get them converted to move across to preferred. So that’s his view,” said Back. “I think one way to look at those high interest rates, though, is – let’s say it’s 10% when Bitcoin is $100,000, but it’s 1% when it’s $1 million.” “I think he has an eye on the far future and is just trying to buy as much Bitcoin as possible,” said Adam Back Meanwhile, Tether CEO Paolo Ardoino said, “What Michael is doing is elegant, but it is financial engineering. Instead, I think we need a public company, a public Bitcoin company, that carries forward the ethos and philosophy of Bitcoin. And basically, it is almost like a Trojan horse within Wall Street itself.” “In the last quarter, we bought 8,888 Bitcoin and we also used part of that capacity to contribute to Twenty One Capital,” revealed Ardoino. So, Tether is in a very unique position.” Strategy has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/1d4Pmv8ub2 — Michael Saylor (@saylor) October 27, 2025 DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now “Michael Saylor Does Great Service To Humanity By Going Out, Taking Risk, And Being Brave,” Said Jack Mallers “What I will say about MicroStrategy and Michael, and we’re friends and he knows this, Michael does a great service to humanity by going out, taking risk, and being brave, and allowing guys like me to learn,” said Mallers. The young CEO continued, “He’s never ever charged me a dime to learn from him, right? That’s the way I think about. He’s a pioneer in that way. He’s never invoiced me for the things I’ve learned watching him over the last four years.” Meanwhile, Mallers said that, from founding, Twenty One Capital has never considered itself a Bitcoin Treasury company. “I think it’s a really loose term. And this industry does that sometimes where Satoshi created Bitcoin and it’s a decentralized cryptocurrency. And then Vitalik Buterin prints a bunch of tokens in his basement and goes, I’m also a decentralized cryptocurrency. It’s like, well, you know, that’s not technically the definition of decentralized. But now decentralized and crypto has become something that’s impossible to define. It depends the circle you’re in and what you’re talking about. I feel similarly about Bitcoin treasury companies.” “Do we have a Bitcoin treasury business? Absolutely,” Mallers added. “I love shorting the dollar and buying Bitcoin. It’s incredibly profitable! That’s historically a tremendous business,” said Jack Mallers “And to have the capital partners like a Tether and a SoftBank and to be able to do that at scale and access to the capital markets, that’s 100% part of our company,” Mallers added. DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025 “Eventually All Companies Will Be Bitcoin Treasury Companies,” Said Adam Back “If you’re a fund manager and you can’t outperform Bitcoin, and it’s a long-term investment plan, you should probably stop and buy Bitcoin. Or tell your clients to buy Bitcoin,” said Back, talking about fund managers. “If you turn around and apply that to an operating company, how do you keep up with Bitcoin? Well, I think you have to use Bitcoin as your cash reserves. Of course, some volatility and cash reserves are required apart from Bitcoin. And reinvest in your business to grow your cash flow. Use some of that to buy Bitcoin. And then if you’re a public format. Use the capital markets too – amplify that affect. But I think there’s been a mixture in the market of pure plays – like MicroStrategy has basically become a pure play because their core business revenues become de minimis but there are also a great number of pure plays. I think we’ll probably see a kind of return to more operating business revenue and Bitcoin standard treasury.” “Tether itself has a huge balance sheet that is providing a lot of cash flow and allows us to buy Bitcoin,” said Tether CEO DISCOVER: Best Meme Coin ICOs to Invest in 2025 Key Takeaways “Saylor has an eye on the far future, and he’s just trying to buy as much Bitcoin as he can,” said Adam Back. “Look at Tether’s correlation – USDT’s correlation to the Bitcoin market cap, like Bitcoin doubles, USDT’s probably going to double,” said Jack Mallers. The post What Do Industry Leaders Think Of Michael Saylor’s Bitcoin Strategy? Adam Back, Paolo Ardoino Weigh In appeared first on 99Bitcoins.

Trump Sons' American Bitcoin Stock Jumps After Adding $163 Million to BTC Treasury

Trump Sons' American Bitcoin Stock Jumps After Adding $163 Million to BTC TreasuryThe company holds approximately 3,865 Bitcoin acquired through mining and strategic purchases.

White House GameStop Tweet Causes WLFI Frenzy as Volume Spikes to $222M: Maxi Doge to Soar Next?

White House GameStop Tweet Causes WLFI Frenzy as Volume Spikes to $222M: Maxi Doge to Soar Next?What to Know: 1️⃣ A surprise White House post featuring Donald Trump as Halo’s Master Chief sent social media — and GameStop traders — into overdrive, fueling speculation of deeper ties between Trump’s circle and retail-favorite stocks. 2️⃣ Binance founder CZ’s presidential pardon restores a key link between Trump-aligned World Liberty Financial (WLFI) and global crypto liquidity, with WLFI’s trading volume spiking to $222 million. 3️⃣ GameStop’s parody “end of the console wars” post cleverly revived nostalgic gaming culture while amplifying retail investor attention — just as WLFI and meme-coin markets caught fire. 4️⃣ Meme coin Maxi Doge ($MAXI) has surged past $3.7 million in presale funding, with whales and retail traders alike viewing it as the next high-momentum play alongside $WLFI and $GME. First, US President Donald Trump pardons Binance founder Changpeng Zhao, also known as CZ. Next, Gamestop drops a mocking, press-release-style announcement declaring the end of the console wars. Then, the White House (yes, that one) pushes a pic of Donald Trump as Halo’s Master Chief. All fun and games, or is there something brewing underneath it all? In the wake of the tweets, $WLFI’s trading volume briefly spiked to $220M before falling back below $200M. Will CZ’s restoration push $WLFI even higher on the back of Trump’s support? Time for a closer look at what’s going on, and why meme coin upstart Maxi Doge ($MAXI) could take off. CZ + Binance + MGX = WLFI It’s no secret that CZ had lobbied for the pardon for years. It’s also no secret that Binance has been a key player in negotiations between MGX – the Abu Dhabi-based investment company that sank $2B into USD1, World Liberty Financial’s stablecoin – and WLFI. That deal probably generates significant amounts (around $50M per year) of income for World Liberty Financial based on yield from treasury notes. Regardless of the gory details of the deal between MGX and WLFI, Binance’s role is clear. And now, with CZ cleared and a potential return to Binance possible, Trump’s World Liberty Financial has (re)gained an important ally. But what about GameStop? GameStop + Halo = Memes, Evolved The original title for Halo – back in the halcyon days of 2004 – was ‘Halo: Combat Evolved.’ GameStop remembers those days and decided to remind everyone of them in a probably unserious press release on X. Fair play on GameStop, which knows its memes and popular culture. The ‘PR’ jokingly refers to the end of the console wars, the decades-long competition over which company and console would launch the biggest games (and draw the most players). Halo, released initially on Xbox, is finally arriving on PlayStation in 2026. Two decades+ later, but finally full circle. Enter Donald Trump’s social media team at the White House, who saw an opportunity and took it: Why the shout-out? That’s where the details end and the speculation begins: Could Barron Trump, whose stake in the World Liberty fortune probably amounts to nearly $150M, be looking for a new place to invest? Would GameStop work? Could GameStop seek further support from Trump’s White House? Is the move merely a distraction, taking away from the ongoing shutdown? There’s no way to tell. Regardless, GameStop is honoring Halo, and then the White House’s response. However, as it sets up for the biggest crypto presales of 2025 to achieve immediate success, Max Doge. Maxi Doge ($MAXI) – Lift, Pump, Repeat for Maximum Doge Gains Barron Trump is 6’8” tall. He stands out in a crowd, just like Maxi Doge ($MAXI) intends to do in the $40B dog-themed meme coin market. What is Maxi Doge? It’s a pure meme coin. No utility, no real-world application, no problem; it’s all about relentless marketing and the meme coin momentum shared with Maxi’s better-known sibling, Dogecoin ($DOGE). Why would anyone look twice at $MAXI? Because while it’s a simple project, there’s a real vibe there. Over $3.7M has poured into the $MAXI presale, headlined by two major whale buys of $314K each. The project supports the presale with a tokenomics structure that allocates a full 40% of available tokens to marketing opportunities. During the presale, investors can stake their purchases for an additional 80% APY. If that sounds like a win, you can learn how to buy and stake $MAXI with our guide. Our price prediction for Maxi Doge suggests the token could potentially climb from $0.000265 to $0.0058, generating 2088% returns for investors who get in now. To avoid missing out, check out the $MAXI presale page for the latest information. What will CZ do now that he’s been pardoned? And where will WLFI go from here? The token is already up 10% for the week, with a 24-hour trading volume of around $176M; will it make further moves in the future? Watch $MAXI, $GME, and $WLFI for more crypto craziness and potentially game-changing moves. As always, do your own research – this isn’t financial advice. Authored by Bogdan Patru for Bitcoinist — https://bitcoinist.com/white-house-gamestop-tweet-causes-wlfi-frenzy

Reliance Global Group expands digital asset portfolio with Solana

Reliance Global Group expands digital asset portfolio with SolanaReliance Global Group has added Solana to its digital asset portfolio, a move that sees the Nasdaq-listed company now boast treasury holdings with five of the top ten cryptocurrencies today. Reliance is the latest public company to tap into the…

Tom Lee’s BitMine Rises as Ethereum Rebounds, Firm Adds $321 Million in ETH

Tom Lee’s BitMine Rises as Ethereum Rebounds, Firm Adds $321 Million in ETHBitMine Immersion Technologies now holds over $13.8 billion worth of Ethereum, widening its ETH treasury lead over SharpLink Gaming.

Trump-linked American Bitcoin adds $163M in BTC, boosting treasury above $445M

Trump-linked American Bitcoin adds $163M in BTC, boosting treasury above $445MTrump-linked Bitcoin miner and treasury company American Bitcoin added 1,414 BTC to its holdings, bringing its total stash to 3,865 BTC.

American Bitcoin nears 4k BTC in treasury milestone

American Bitcoin nears 4k BTC in treasury milestoneAmerican Bitcoin is rapidly approaching a 4,000 BTC treasury, with its holdings now at 3,865 BTC following a disciplined period of accumulation and mining. According to a press release dated Oct. 27, American Bitcoin Corp. executed a significant accumulation play,…

Here’s What The XRP Open Interest Reset Means For The Price

Here’s What The XRP Open Interest Reset Means For The PriceCrypto analyst CryptosRus has drawn attention to the open interest reset for XRP. The analyst also explained why this development could spark a major price surge for the altcoin. XRP’s Open Interest Drops To New Lows In an X post, CryptosRus revealed that XRP’s open interest on Binance has dropped back to the same lows that were seen in May 2025. The analyst noted that back then, the liquidation flush sparked a massive rally for the altcoin, which pushed it to $3.50. He added that this time around, the open interest is at the floor again, but the price is holding around $2.6. CryptosRus stated that this means that leverage is gone while the strong hands are still holding XRP. The analyst predicted that if new liquidity enters, this setup could signal the next leg up for the altcoin. He added that rallies usually start when leverage is low, spot demand is strong, and shorts are trapped. Notably, XRP has witnessed new demand with the launch of the largest XRP treasury company, Evernorth. The company has already accumulated up to $1 billion in XRP with Ripple’s backing and has revealed plans to continue accumulating more, using gains from its DeFi activities. Notably, the company stated that it will purchase XRP on the open market, which is expected to impact the altcoin’s price. Meanwhile, the SEC is expected to approve the spot XRP ETFs once the U.S. government shutdown ends. This could drive new liquidity into the altcoin, boosting its price. Moreover, experts such as Canary Capital’s CEO Steven McClurg have predicted that the XRP ETFs could see more inflows in their first month than the Ethereum ETFs did. XRP Is Gearing Up For A ‘Face Melting’ Rally Crypto analyst Ether stated that XRP is quietly gearing up to melt faces and that most aren’t even aware or ready for what is coming. This came as the analyst alluded to an earlier analysis, in which he revealed that a similar scenario from a previous cycle was playing out for the altcoin. Ethere stated that XRP’s cyclical structure is showing a striking similarity again. After the altcoin’s rally in 2017, its price was rejected from the 2013 all-time high (ATH) level and then retested the 2014 ATH level, which had previously acted as resistance. XRP then began its parabolic run after it accumulated strength in that range. Now, this same XRP price action is playing out again, according to Ether. He noted that after the strong surge in 2024, the altcoin’s price was rejected at the 2017 ATH level and retested the 2021 ATH level, which had previously acted as resistance. The analyst added that the power accumulation phase is now underway in this region and that once it is complete, the next parabolic run will be inevitable. At the time of writing, the XRP price is trading at around $2.63, up in the last 24 hours, according to data from CoinMarketCap.

Bo Hines Says, “US Bitcoiners Are Becoming Engaged At Local Level Because Financial System Failed So Many For So Long”

Bo Hines Says, “US Bitcoiners Are Becoming Engaged At Local Level Because Financial System Failed So Many For So Long”While Bitcoin was designed to be apolitical, it is now deeply entwined with political institutions. On 25 October 2025, Bo Hines, who is the former head of US President Donald Trump’s Council of Advisers on Digital Assets, acknowledged that previously governments viewed cryptocurrency and Bitcoin as almost a criminal asset that was used for nefarious activity. “They’ve realized that that’s not the case. People want freedom, and they want the freedom to move money how they please. And so the demand that people have created for this commodity has changed the course of history, and governments are forced to address it,” said Hines, while talking at the PlanB Forum in Lugano, Switzerland. I think that you’re going to start seeing Bitcoiners in the US become more engaged at a local level as well. And this, honestly, is a result of the fact that the financial system has failed so many people for so long. Hines, who is now the Strategic Advisor for Digital Assets and US Strategy at Tether, said, “So in the US, obviously, we’ve created the Strategic Bitcoin Reserve in which the Treasury is responsible for being a custodian over. But that’s a direct result of the power and persistence that the people created, and I think that’s an incredible thing to recognize. And I think that it will change the really change the course of history forever. “We say in the US now that Bitcoin is digital gold” “We say in the US now that bitcoin is digital gold,” Hines added. “It is a commodity that should be recognized. I think that’s something that will happen across the rest of the globe.” Bitcoin is the grandfather for us in a sense of welcoming in a new age that completely revolutionizes the financial system. “David likes to describe it as having the immaculate conception,” said Hines, talking about the Crypto Czar David Sacks. “Obviously, we understand it’s finite. We understand that governments have a strong desire to obtain it and hold on to it. And so I think as we look at this long term, we have to recognize that, one, this is a commodity that’s here to stay and probably, in my opinion, becomes the most valuable asset in the world.” DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now “Most Importantly, Bo Is A Bitcoiner,” Said Tether CEO Paolo Ardoino “But from a broader perspective, think about how many things from this ecosystem will be applied to the financial system more generally,” said Hines. You think about Tether. You think about the way that stablecoins work now. We’re going to have 24-7 markets. We’re going to have tokenized public securities. “We’re going to have a brave new world in the financial system that creates really connectivity that we’ve never seen before across the entire globe. And that is a direct result of Bitcoin in this ecosystem. And so the US government fully recognizes that. And I’m proud to say I worked for an administration that embraced it,” said Hines. Talking about Ardoino and Tether, Hines said, “For a long time, they told Paolo that he was servicing a niche. Now, the niche happens to be one third of the global population – folks that are underbanked, debanked, underserved. Bitcoin is truly the representative of the entire digital assets ecosystem, obviously. As being the grandfather. But again, I would just say that in terms of financial freedom – it’s worth protecting and worth fighting for and also worth educating. So I’d encourage Bitcoiners to educate folks around you about what it means to you.” Bo Hines, formal executive director of the White House Crypto Council, transitioned from public service to the private sector to take the helm at Tether for its new stablecoin USAT under the fresh GENIUS Act regulatory framework.https://t.co/VlNOcMHXo4 — Akriti Seth (@AkritiSethN) October 8, 2025 DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025 “Gary Gensler’s Firing Received Loudest Applause,” Reveals Bo Hines “The loudest applause line was when Gary Gensler was fired,” said Hines. “He was the former SEC chairman under the Biden administration. The reason I bring him up is because the standard that was set prior to the Trump administration was basically policymaking through prosecution and persecution.” Talking about the changes the Trump administration brought in, Hines said, “So, we came in and our mindset was that this has to be a complete sea change. We have to completely reverse what has been set in the standard that has been in place and actually educate folks on really what Bitcoin is and what digital assets are. And so Bitcoin sets the standard for what it means to be decentralized, what it means to be a true digital commodity. And we’ve used that standard and applied it across basically the entire digital assets ecosystem.” I think that Bitcoin now is the beacon of what it means to have financial freedom. “So for this ecosystem, it’s really not a choice to be politically engaged or not,” he said. “It’s something that we have to be in the fight for. And obviously, the US has now set the standard for what it means. And what this commodity means more generally for the world. But I think that’s worth protecting. And worth fighting for across the entire globe. So, I’d encourage everyone to get involved. We want more folks that are looking at those contracts, right?” DISCOVER: Best Meme Coin ICOs to Invest in 2025 Key Takeaways Former White House Crypto Council Executive Director Bo Hines said, “Bitcoin is the grandfather for us in a sense of welcoming in a new age that completely revolutionizes the financial system.” “We’re going to have a brave new world in the financial system that creates really connectivity that we’ve never seen before across the entire globe,” added Hines, who now works for Tether. The post Bo Hines Says, “US Bitcoiners Are Becoming Engaged At Local Level Because Financial System Failed So Many For So Long” appeared first on 99Bitcoins.

Strategy acquires 390 Bitcoin valued at $43M

Strategy acquires 390 Bitcoin valued at $43MStrategy's Bitcoin acquisition strategy may influence corporate treasury practices, promoting Bitcoin as a key asset amid economic uncertainty. The post Strategy acquires 390 Bitcoin valued at $43M appeared first on Crypto Briefing.

Strategy Slows Bitcoin Purchases to 2021 Levels: What’s Going on Behind the Scenes?

Strategy Slows Bitcoin Purchases to 2021 Levels: What’s Going on Behind the Scenes?The company’s once-aggressive Bitcoin accumulation strategy appears to be losing momentum. After making headlines with massive weekly purchases, sometimes exceeding 10,000 BTC and even peaking at 55,500 BTC in late 2024, Strategy’s buying pace has now slowed drastically to around 200 BTC per week. The largest corporate Bitcoin holder’s deceleration is reflected in its spending as well. Slower Buys, Same Conviction In his latest analysis, Crypto analyst ‘Maartunn’ estimated that spending fell from billion-dollar allocations to just $22.1 million spent for 196 BTC last week. Despite the slowdown, 2025 still ranks as Strategy’s second-largest BTC investment year, with $19.53 billion deployed so far, trailing only 2024’s $21.76 billion. The firm now holds roughly 3.2% of all Bitcoin in circulation. However, tighter capital conditions have started to bite as equity issuance premiums have plummeted from 208% to just 4%, which has made fresh fundraising more challenging. Meanwhile, MSTR stock is down nearly 50% from its all-time high, while Bitcoin itself trades only 16% below its peak, which has further widened the performance gap between the two assets. Despite this, the company’s share price remains closely correlated with Bitcoin, and Maartunn noted that it often mirrors its moves. Interestingly, Strategy continues to buy near local price highs, most recently acquiring 196 BTC at an average price of $113,000. Even as the accumulation pace has slowed down, the firm’s unrealized Bitcoin profit still stands at a staggering $23.7 billion. As such, the analyst stated, “Strategy is no longer buying big – but they’re still buying. Long-term conviction remains, even as funding pressure grows.” Trillion-Dollar Bitcoin Dream Though purchases have eased, Strategy co-founder Michael Saylor remains adamant that Bitcoin is at the heart of the firm’s long-term corporate treasury strategy. Speaking at a conference in Prague, the former chief exec said that there is only one way to lose – and that’s not to play the (Bitcoin) game. In a separate interview last month, Saylor revealed an ambitious “endgame” to build a trillion-dollar Bitcoin balance sheet and use it to reinvent the global credit system. He said the goal is to accumulate $1 trillion in Bitcoin and grow it by 20-30% annually. The post Strategy Slows Bitcoin Purchases to 2021 Levels: What’s Going on Behind the Scenes? appeared first on CryptoPotato.

- How Much Did a Presidential Pardon Cost CZ? $700K if Binance Offers Any Clues

Over the weekend, Binance founder Changpeng “CZ” Zhao secured a Presidential pardon from Donald Trump following months of speculation and an extensive lobbying effort in Washington. The Binance-affiliated token, BNB, which is most commonly associated with CZ, has risen around 10% since the pardon was confirmed on October 23, increasing from $1,060 to $1,150 as it continues to solidify its position as the fourth-largest cryptocurrency by market capitalization, according to CoinGecko. This time last year, CZ had just finished serving a four-month prison sentence for violating US anti-money laundering laws and was supported by a campaign aimed at appealing to prominent figures within the Trump administration. Market Cap 24h 7d 30d 1y All Time Politico Report Finds that CZ and Binance Have Paid Out Millions in Lawyer Fees and Lobbying Efforts A Politico report alleges that Binance has been lobbying the White House and the Treasury Department for several months, seeking what they call “executive relief.” In September of this year, Binance reportedly hired Ches McDowell, a political operative with close ties to Donald Trump Jr. and his firm, Checkmate Government Relations, which billed them $450,000 for just one month of work, according to Politico. Binance and CZ also hired Teresa Goody Guillén, a lawyer with alleged close ties to the Trump administration, paying $290,000 to Guillén’s firm this year alone. It isn’t the first time Binance has gone on a spending spree in Washington, having previously spent over $1 million in the Capital in 2022, but paused its efforts after a plea deal with the US Department of Justice in 2023. Now, under the pro-crypto Trump administration, Binance has renewed lobbying efforts, reportedly spending $860,000 this year and expanding influence by partnering its USD1 stablecoin with ventures linked to Trump’s network, including World Liberty Financial. The lesson of CZ's pardon is clear: Justice is only as strong as your lobbying budget.$860,000 flowed to Trump-linked lobbyists to erase a guilty plea for money laundering. This was an expensive influence campaign, not an act of mercy. When money can buy executive relief after a… pic.twitter.com/C1KfZxSvFR — Winghaven (@WinghavenCrypto) October 26, 2025 Trump Doubles Down on CZ Pardon Decision Following Backlash from Democrats President Trump has gone on the defensive regarding his decision to pardon CZ, claiming that the Binance founder was “persecuted by the Biden administration” and that “what he did is not even a crime.” This statement was made during a White House press conference in response to the criticism he has received, mainly from Democratic Party politicians. Democratic Representative Maxine Waters condemned the pardon as “a massive favor for crypto criminals.” She argued that CZ’s guilty plea for anti-money laundering violations disqualified him from clemency and accused the administration of “selling justice to the highest bidder.” Waters also alleged that the pardon was influenced by months of lobbying and financial support to Trump’s personal crypto company, World Liberty Financial, though this claim lacks documentation. During the same press conference, Trump also highlighted cryptocurrency innovation as “the future of American finance”, further solidifying the US’s stance since the U-turn by Trump and his administration after Biden left office in January. BREAKING: President Trump speaks about the pardon for CZ. "They said, what he did is not even a crime, wasn't a crime… I gave him a pardon at the request of a lot of good people." pic.twitter.com/abvBTaxkxl — CoinDesk (@CoinDesk) October 23, 2025 DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now BNB Price Analysis: New All-Time High Following CZ Pardon and Binance’s Strengthening Ties to Washington? BNB remains one of the strongest-performing major-cap digital assets this year. Its fundamentals are rock-solid, as the native token of the BNB Smart Chain (BSC), which now holds over $8.8Bn in TVL (Total Value Locked), according to DeFiLlama. Within the BSC ecosystem is a vast array of protocols, including meme coins, DeFi platforms, and more recently, its Perp DEX, Aster. The recent Maxwell upgrade for BSC has made navigating the blockchain even quicker, halving block times to 0.75 seconds. It’s also worth noting that the BNB listing announcements by Robinhood and Coinbase both dropped last week, just days after BNB hit its all-time high of $1,375 on October 13. The listings came following BNB’s incredible rebound following October 10’s historic Black Swan market crash. On a short-term timeframe, BNB has two significant sell walls to overcome, at $1,190 and $1,210. However, if these two levels can be breached, it will be a relatively straightforward run to a new all-time high above $1,370. Looking at a higher timeframe, BNB could be set to break $2,000 by the end of 2025 if Bitcoin .cwp-coin-chart svg path { stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) { stroke: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) { stroke: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; } Bitcoin BTC $114,850.33 1.26% Bitcoin BTC Price $114,850.33 1.26% /24h Volume in 24h $66.90B ? --> Price 7d // Make SVG responsive jQuery(document).ready(function($) { var svg = $('.cwp-graph-container svg').last(); if (svg.length) { var originalWidth = svg.attr('width') || '160'; var originalHeight = svg.attr('height') || '40'; if (!svg.attr('viewBox')) { svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight); } svg.removeAttr('width').removeAttr('height'); svg.css({'width': '100%', 'height': '100%'}); svg.attr('preserveAspectRatio', 'xMidYMid meet'); } }); Learn more continues to hold above $105,000. Positive news surrounding China-US trade tensions offers a bullish platform for crypto to springboard into its next leg up. (SOURCE: TradingView) EXPLORE: Best Meme Coin ICOs to Invest in 2025 Join The 99Bitcoins News Discord Here For The Latest Market Updates The post How Much Did a Presidential Pardon Cost CZ? $700K if Binance Offers Any Clues appeared first on 99Bitcoins.

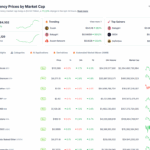

- [LIVE] Crypto News Today, October 27 – BTC Price USD Reclaims $115K Ahead of FOMC Meeting, BNB Flips Again XRP: Best Crypto Presale to Buy?

Global crypto markets are in the green today, with total capitalization back above $3.9 trillion, up 3.3% in the past 24 hours. .cwp-coin-chart svg path { stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) { stroke: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) { stroke: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; } Bitcoin BTC $114,850.33 1.26% Bitcoin BTC Price $114,850.33 1.26% /24h Volume in 24h $66.90B ? --> Price 7d // Make SVG responsive jQuery(document).ready(function($) { var svg = $('.cwp-graph-container svg').last(); if (svg.length) { var originalWidth = svg.attr('width') || '160'; var originalHeight = svg.attr('height') || '40'; if (!svg.attr('viewBox')) { svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight); } svg.removeAttr('width').removeAttr('height'); svg.css({'width': '100%', 'height': '100%'}); svg.attr('preserveAspectRatio', 'xMidYMid meet'); } }); Learn more reclaimed the $115,000 level, while .cwp-coin-chart svg path { stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) { stroke: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) { stroke: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; } Ethereum ETH $4,171.41 2.13% Ethereum ETH Price $4,171.41 2.13% /24h Volume in 24h $28.05B ? --> Price 7d // Make SVG responsive jQuery(document).ready(function($) { var svg = $('.cwp-graph-container svg').last(); if (svg.length) { var originalWidth = svg.attr('width') || '160'; var originalHeight = svg.attr('height') || '40'; if (!svg.attr('viewBox')) { svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight); } svg.removeAttr('width').removeAttr('height'); svg.css({'width': '100%', 'height': '100%'}); svg.attr('preserveAspectRatio', 'xMidYMid meet'); } }); Learn more surged over 5.6% to cross $4,170. The rebound follows stronger risk sentiment across global markets, fueled by a U.S.–China trade framework that pauses tariff escalations and rare-earth export restrictions. The market’s strength has investors searching for the best crypto presale opportunities as macro and political developments align in crypto’s favor. Market Cap 24h 7d 30d 1y All Time Investors are also anticipating a Federal Reserve rate cut following softer inflation data, a move that could compress Treasury yields and improve the outlook for risk assets. The FOMC meeting on October 29 and U.S. GDP data on October 30 will likely confirm whether the Fed is adopting a softer stance. Meanwhile, FTX’s $1.6 billion creditor repayment and Bitcoin’s breakout above its 50-day EMA ($114,176) further boosted sentiment. Analysts are watching the $117,600 resistance level as a key short-term trigger. DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now BNB Flips XRP After Trump Pardons CZ One of today’s most notable developments is .cwp-coin-chart svg path { stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) { stroke: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) { stroke: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; } BNB BNB $1,145.25 1.73% BNB BNB Price $1,145.25 1.73% /24h Volume in 24h $5.22B ? --> Price 7d // Make SVG responsive jQuery(document).ready(function($) { var svg = $('.cwp-graph-container svg').last(); if (svg.length) { var originalWidth = svg.attr('width') || '160'; var originalHeight = svg.attr('height') || '40'; if (!svg.attr('viewBox')) { svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight); } svg.removeAttr('width').removeAttr('height'); svg.css({'width': '100%', 'height': '100%'}); svg.attr('preserveAspectRatio', 'xMidYMid meet'); } }); Learn more overtaking .cwp-coin-chart svg path { stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) { stroke: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) { stroke: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; } XRP XRP $2.65 0.44% XRP XRP Price $2.65 0.44% /24h Volume in 24h $4.67B ? --> Price 7d // Make SVG responsive jQuery(document).ready(function($) { var svg = $('.cwp-graph-container svg').last(); if (svg.length) { var originalWidth = svg.attr('width') || '160'; var originalHeight = svg.attr('height') || '40'; if (!svg.attr('viewBox')) { svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight); } svg.removeAttr('width').removeAttr('height'); svg.css({'width': '100%', 'height': '100%'}); svg.attr('preserveAspectRatio', 'xMidYMid meet'); } }); Learn more once again in market cap after a presidential pardon for Binance founder Changpeng “CZ” Zhao. The decision clears Zhao’s previous conviction, opening the door for him to return to a leadership role at Binance: the exchange he built into the world’s largest. BNB is currently consolidating above $1,100, and a decisive move above $1,195 could push the price toward $1,300 and beyond. XRP, on the other hand, continues to struggle to gain positive momentum, with the $3 level still appearing distant. (Source: Coingecko) The move could mark a new chapter for Binance’s U.S. operations, where Binance.US has struggled under regulatory pressure. With sentiment in Washington shifting more favorably toward digital assets, Zhao’s reinstatement is seen as a catalyst for Binance’s re-expansion. In a statement on X, Zhao thanked Trump and vowed to “make America the Capital of Crypto.” Legal experts confirm the pardon restores his full corporate rights, potentially allowing Binance to rebuild its presence in the U.S. market. EXPLORE: As Miners Flee to AI, Crypto Faces a Structural Test: Can Bitcoin Survive Its Own Golden Geese Leaving? Best Crypto Presale to Buy Now? Only 3 Days Left Before Snorter (SNORT) Launches One of the most notable new crypto launches this month is Snorter Bot (SNORT), a Solana-based trading sniper bot designed to give users faster, safer access to new tokens. The Telegram-native bot allows traders to buy and sell directly within the app, automatically scanning Solana transaction queues and liquidity pools to identify breakout tokens while filtering out risky contracts. SNORT holders receive early bot access and discounted 0.85% trading fees. With its presale nearing completion, raising over $5.5 million, Snorter Bot plans to burn 50% of its token supply and expand to multiple chains post-launch. The presale remains open at $0.1083 per token, positioning SNORT as a leading contender among the best crypto presales of 2025. Visit SNORT Here 6 hours ago MetaMask Registers Domain for Token Claiming, Hinting at Upcoming Airdrop By Fatima MetaMask has registered the domain name “claim.metamask.io”, fueling speculation about an impending airdrop. This move suggests that MetaMask may be preparing to distribute its native token, possibly $MASK, to users. While details remain unconfirmed, the registration of this domain indicates that the project is taking steps toward a potential token launch. Only use official channels and never connect your wallet to unverified links. 7 hours ago Bo Hines Says, “US Bitcoiners Are Becoming Engaged At Local Level Because Financial System Failed So Many For So Long” By Fatima While Bitcoin was designed to be apolitical, it is now deeply entwined with political institutions. On 25 October 2025, Bo Hines, who is the former head of US President Donald Trump’s Council of Advisers on Digital Assets, acknowledged that previously governments viewed cryptocurrency and Bitcoin as almost a criminal asset that was used for nefarious activity. “They’ve realized that that’s not the case. People want freedom, and they want the freedom to move money how they please. And so the demand that people have created for this commodity has changed the course of history, and governments are forced to address it,” said Hines, while talking at the PlanB Forum in Lugano, Switzerland. I think that you’re going to start seeing Bitcoiners in the US become more engaged at a local level as well. And this, honestly, is a result of the fact that the financial system has failed so many people for so long. Hines, who is now the Strategic Advisor for Digital Assets and US Strategy at Tether, said, “So in the US, obviously, we’ve created the Strategic Bitcoin Reserve in which the Treasury is responsible for being a custodian over. But that’s a direct result of the power and persistence that the people created, and I think that’s an incredible thing to recognize. And I think that it will change the really change the course of history forever. Read The Full Article Here 10 hours ago How Much Did a Presidential Pardon Cost CZ? $700K if Binance Offers Any Clues By Fatima Over the weekend, Binance founder Changpeng “CZ” Zhao secured a Presidential pardon from Donald Trump following months of speculation and an extensive lobbying effort in Washington. The Binance-affiliated token, BNB, which is most commonly associated with CZ, has risen around 10% since the pardon was confirmed on October 23, increasing from $1,060 to $1,150 as it continues to solidify its position as the fourth-largest cryptocurrency by market capitalization, according to CoinGecko. This time last year, CZ had just finished serving a four-month prison sentence for violating US anti-money laundering laws and was supported by a campaign aimed at appealing to prominent figures within the Trump administration. Market Cap 24h 7d 30d 1y All Time Read The Full Article Here 10 hours ago BNB Completes 33rd Quarterly Burn Worth $1.66 Billion By Fatima The BNB Foundation has completed its 33rd quarterly BNB burn, permanently removing 1,441,281.413 BNB, worth approximately $1.66 billion, from circulation. This reduces the total supply to 137,738,379.26 BNB, moving closer to the long-term target of 100 million BNB. The burn was conducted through the BNB Auto-Burn mechanism, an independently auditable and transparent system designed to maintain predictability in supply reduction. The latest burn occurred directly on BNB Smart Chain (BSC) as part of the ongoing BNB Chain Fusion. All burned tokens were sent to the official “blackhole” address, ensuring they are permanently removed from circulation. 11 hours ago HYPE USD Prints A +40% Weekly Candle: Is Alt Season Here? By Fatima HYPE USD is back, baby! What a stunning week for the new altcoin with a +40% gain weekly candle! Investors are probably back in bullish land and eyeing even higher prices. This week we are going to have a lot of big economy news coming out, which will be significant and effect the financial markets. Will Hyperliquid sustain the momentum? Follow along for further insight. Market Cap 24h 7d 30d 1y All Time $HYPE v $ASTER insane comparison atm, they look inverse to one another$HYPE -raising $1B, massive buyback announcement, best performer of the last week in top 100, already back above liquidation candle level, only 20% from ATH$ASTER – poor buyback announcement, worst… pic.twitter.com/pJKyam1KkS — $trong (@StrongHedge) October 26, 2025 There was this rumour going around that ASTER was going to be a big competitor to Hyperliquid. This analysis by StrongHedge shows the correlation between both and where buyers’ interest was in for the past 10-15 days – in HYPE. Before reading further, please get acquainted with last week’s analysis. Read The Full Article Here The post [LIVE] Crypto News Today, October 27 – BTC Price USD Reclaims $115K Ahead of FOMC Meeting, BNB Flips Again XRP: Best Crypto Presale to Buy? appeared first on 99Bitcoins.

SharpLink Gaming loads up Ethereum treasury with $78m as price reclaims $4,200

SharpLink Gaming loads up Ethereum treasury with $78m as price reclaims $4,200SharpLink Gaming is back in focus as the company expands its Ethereum treasury amid renewed market optimism. SharpLink Gaming has added a significant amount of Ethereum to its holdings, purchasing 19,271 ETH worth $78.3 million, according to on-chain data reported…

Western Union pilots stablecoin settlement system to modernize remittances

Western Union pilots stablecoin settlement system to modernize remittancesRemittance giant Western Union is piloting a stablecoin-based settlement system to power its treasury operations and modernize how it moves money across borders. During a recent earnings call, Debin McGranahan, Wester Union’s CEO, revealed that the firm is “actively testing…

Australian crypto firms back draft laws, but ‘critical questions’ remain

Australian crypto firms back draft laws, but ‘critical questions’ remainAustralia’s crypto exchanges have been largely positive about the government’s proposed crypto laws, but have told the Treasury that further clarity is needed.

South Korea’s Bitplanet begins Bitcoin treasury plan with 93 BTC buy

South Korea’s Bitplanet begins Bitcoin treasury plan with 93 BTC buySouth Korea’s publicly listed Bitplanet has begun its daily Bitcoin accumulation program, purchasing 93 BTC on Oct. 26 as part of a long-term plan to build a 10,000 BTC treasury. The move marks the country’s first fully regulated Bitcoin purchase…

Korean Public Company Bitplanet Kicks Off Treasury Plan, Buys Bitcoin as Market Rebounds

Korean Public Company Bitplanet Kicks Off Treasury Plan, Buys Bitcoin as Market ReboundsBitplanet, a publicly-listed firm backed by Metaplanet’s Simon Gerovich and Sora Ventures, has begun its daily Bitcoin purchases.

XRP Reversal Sends Price Towards $1, DOGE Treasury to Go Public, Bitcoin Beats Gold, Binance’s CZ Pardoned — Top Weekly Crypto News

XRP Reversal Sends Price Towards $1, DOGE Treasury to Go Public, Bitcoin Beats Gold, Binance’s CZ Pardoned — Top Weekly Crypto NewsTop crypto news this week: XRP price slides back into bearish territory; SHIB community shares crucial scam alert; Binance's CZ finally pardoned.

XRP Crypto Reclaims #3 Spot, Overtakes BNB: Institutional XRP News on Verge of Going Parabolic

XRP Crypto Reclaims #3 Spot, Overtakes BNB: Institutional XRP News on Verge of Going ParabolicXRP crypto has roared back into the spotlight this weekend, surging past Binance Coin (BNB) to reclaim its position as the third-largest cryptocurrency by market capitalization, a ranking it hasn’t held consistently in years. (Source – CoinGecko) The token climbed to $2.63 with a market cap of approximately $158Bn, edging above BNB’s $156Bn as capital flows shifted sharply in XRP’s favor. The move caps a +12.8% weekly rally, outpacing every other top-five digital asset and reigniting debate over whether XRP is entering a long-awaited institutional cycle. Market Cap 24h 7d 30d 1y All Time BNB, despite modest gains of +0.55% on the day and +4.35% on the week, appears to be losing momentum after an October rebound driven largely by regulatory relief and new U.S. exchange support, highlighted by former president Donald Trump’s pardon of Changpeng Zhao and secondary market listings on Coinbase and Robinhood. Market Cap 24h 7d 30d 1y All Time But the drivers behind XRP’s surge run deeper than simple market rotation. Institutional XRP News Could Trigger Parabolic XRP Price Breakout The standout catalyst is the emergence of Evernorth, a digital asset treasury (DAT) initiative aiming to accumulate and deploy XRP at scale. Funded partly by Ripple co-founder Chris Larsen, who strategically liquidated a portion of his personal holdings to seed the venture, Evernorth is structured to tighten the circulating supply rather than flood it. Backed by Japan’s SBI Group, the project is preparing a $1B+ SPAC raise to establish an institutional-grade XRP reserve, with planned activities spanning liquidity provisioning, on-chain treasury management, and lending markets across the XRP Ledger. This supply-constraining dynamic emerges simultaneously as Ripple aggressively expands into enterprise payments, RLUSD stablecoin growth approaches $1Bn in on-ledger assets, and Ripple Prime launches as a brokerage-style institutional access hub. Meanwhile, the XRP ETF race is accelerating. Grayscale, Bitwise, CoinShares, Franklin, WisdomTree, 21Shares, and Canary all submitted coordinated amended S-1 filings a move analysts interpret as direct response to SEC feedback, signaling regulatory alignment and clearing a major bottleneck. (Source – CME Group) CME futures open interest has surged as well, hitting $9.9B, while spot XRP ETFs have quietly gathered over $100M in AUM within weeks of launch. Interestingly, sentiment among retail traders remains historically low, with small wallets selling into the rally, creating a classic contrarian setup as institutional accumulation deepens. EXPLORE: XRP Futures – Ripple Trading Guide XRP Price Analysis: Will Price Action Erupt to $2.9 After 20DMA Reclaim? As XRP price pushes into technical strength, XRP is currently trading at a market price of $2.61 (representing a 24-hour change of +0.74%) at press time. This comes as a bullish push to the upside saw XRP USD reclaim a foothold above the 20DMA support at $2.49 on Saturday, October 25, marking a pivotal moment as the price smashed a ceiling of resistance that had dominated the trend since October 7. Now consolidating its foothold, box trading clearly depicts an upside trajectory in the coming week for XRP (FOMC permitting), with immediate targets at $ 2.90 and $ 3.40. (Source – TradingView, XRP USDT) The RSI indicator, meanwhile, continues to bolster XRP price outlook, with a neutral reading at 51 highlighting that the move hasn’t over-extended momentum just yet – something that puts the +11% jump to $2.9 firmly on the cards. DISCOVER: 16+ New and Upcoming Binance Listings in 2025 The post XRP Crypto Reclaims #3 Spot, Overtakes BNB: Institutional XRP News on Verge of Going Parabolic appeared first on 99Bitcoins.

Ripple (XRP) News Today: October 26

Ripple (XRP) News Today: October 26Ripple finally closed the Hidden Road deal, which became big news at the end of the week as the prime broker now goes under a different name. This and more interesting news from the past week or so will be detailed in the following article. Hidden Road and Other Big Ripple Deals Although the Hidden Road purchase, worth $1.25 billion, was initially announced in April, the actual conclusion was highlighted on Friday. In a statement on X, the Brad Garlinghouse-led company noted that the brokerage platform will now be known as Ripple Prime. This means that the company is now the first in the crypto industry to “own and operate a global, multi-asset prime broker – bringing the promise of digital assets to institutional customers at scale.” Teuncrium’s CEO weighed in on the matter, indicating that Ripple is “building the new Wall Street with XRP and Hidden Road.” Garlinghouse took it to X to highlight the company’s five big moves since 2023. Despite the ongoing pressure from the SEC lawsuit at the time, Ripple made two significant purchases in 2023 and 2024: namely, the acquisitions of Metaco (a Swiss-based crypto custody provider) and Standard Custody & Trust Company, an enterprise-grade, regulated platform for cryptocurrencies. 2025 became an even more impactful year for Ripple as, aside from Hidden Road, it also announced deals to acquire Rail for $200 million and GTreasury for $1 billion. Additionally, Evennorth Holdings, a newly formed Nevada corporation, launched and entered a business combination agreement with Armada Acquisition Corp II to enable institutional adoption of Ripple’s XRP. XRP Back to 4th In line with the aforementioned announcements from Ripple, the project’s native token is about to close with a substantial 11.5% weekly surge that has driven its price to a multi-week peak of $2.65. This has helped its market cap soar to almost $159 billion, which makes XRP the fourth-largest cryptocurrency by surpassing BNB. What’s particularly interesting about this price surge is that it comes at a time when whales have been seemingly taking profits off the table with sizeable sell-offs. In contrast, the popular meme coin and futures trader going by the X handle James Wynn said he was joining the XRP Army with a significant investment. Wynn noted that he went “down the rabbit hole of XRP” and determined it could “revolutionize the banking systems.” Popular analyst Ali Martinez picked up today’s price move from XRP and outlined the next critical resistance on its way toward $3.00. He also brought up the first line of defense in case this rally is another fakeout. Two key levels for $XRP: – Support at $2.15 – Resistance at $2.80 pic.twitter.com/HbfNSNGZFs — Ali (@ali_charts) October 26, 2025 The post Ripple (XRP) News Today: October 26 appeared first on CryptoPotato.

Bitcoin Soars Above $113K as US Secretary Hints at China Trade Deal

Bitcoin Soars Above $113K as US Secretary Hints at China Trade DealBitcoin’s unexpected Sunday pump continues as the asset surged past $113,000 minutes ago for the first time since Tuesday. This comes following positive news from US Secretary Bessent, who noted that China is ready to make a deal that will remove the 100% tariff imposed by the POTUS. BREAKING: US Treasury Secretary Bessent says China is “ready” to make a trade deal with the US after 2 days of negotiations. Bessent says the agreement will remove President Trump’s 100% tariff set to go live November 1st. — The Kobeissi Letter (@KobeissiLetter) October 26, 2025 Recall that Donald Trump shocked the financial markets on October 10 when he claimed that China was deceitful in some sensitive economic areas and warned that the US would impose a 100% tariff against several products. Later, he confirmed the new taxation, which was supposed to become official on November 1. However, the leaders of the two superpowers have scheduled a meeting this week in Asia. In the meantime, both parties’ delegations have met on a couple of occasions to discuss the terms. According to a Reuters report from earlier today, the POTUS said he was confident of striking a deal with President Xi Jinping, after top economic officials reached a preliminary consensus in the trade talks. The Kobeissi Letter noted that this is the 10th and final step of Trump’s tariff plan, which includes announcing a new deal and a subsequent surge in the financial markets. Since most of them are closed on Sunday, the only beneficiary for now is the crypto industry. The leader, bitcoin, has rocketed to a multi-day peak of almost $113,500 after breaking past $112,000 and $113,000 earlier today. The asset plunged hard during the October 10 massacre, dropping to as low as $101,000 on some exchanges. BTCUSD. Source: TradingView The post Bitcoin Soars Above $113K as US Secretary Hints at China Trade Deal appeared first on CryptoPotato.

This Week In Crypto Asia: WazirX Resumes Operations, Asian Exchanges Push Back On BTC Hoarding, Cambodian Crypto Overlord Gets Sanctioned