MergeLive Feed

Merge breaking news and instant alerts. Crypto Feed's minimalist interface delivers verified headlines, price movements, and protocol updates the moment they happen. Fast, focused, no fluff.

- LIVEWhy Is The Crypto Market Down Today?

The total crypto market cap (TOTAL) and Bitcoin (BTC) took a break over the last 24 hours following consistent rise over the last couple of days.MYX Finance (MYX) took a hit as well, falling by 12% over the past day, but still holding above its crucial support. In the news today:- Bitwise and Canary Capital confirmed their Solana and HBAR ETFs will begin trading tomorrow, signaling growing acceptance of altcoin-based funds. Despite the bullish development, both tokens have yet to show a price rally amid broader market uncertainty and regulatory caution. The US sanctioned the Cambodia-based Huione Group as a transnational crime organization linked to money laundering through South Korean crypto exchanges. South Korea’s FSS revealed Huione Guarantee moved roughly 15.9 billion KRW ($12 million) in Tether transactions over the past three years. The Crypto Market Stabilizes The total crypto market cap dropped by $7 billion in the last 24 hours, signaling a minor but notable cooling in momentum. Although modest, this decline follows a steep pullback from an intraday high of $3.89 trillion, highlighting traders’ caution amid fluctuating sentiment across the broader cryptocurrency market. Despite the decline, TOTAL holding above the $3.81 trillion support is a positive sign. This stability suggests the market may be finding its footing, which is essential to sustain the recent rally. However, losing this key level could invite selling pressure, potentially pushing TOTAL down toward $3.73 trillion. Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. Total Crypto Market Cap Analysis. Source: TradingView If the total market cap manages to rebound from the $3.81 trillion support, further upside could follow. A bounce from this area would indicate renewed buying interest and healthy consolidation. In that case, TOTAL could revisit $3.89 trillion in the near term, marking steady recovery and renewed investor confidence. Bitcoin Faces a Barrier Bitcoin’s price has hovered just below the $115,000 resistance level for the past 24 hours, showing limited upward momentum. Currently trading at $114,416, the crypto king is struggling to break through this key psychological barrier. Bitcoin may again face difficulty crossing this resistance, as it has multiple times in recent sessions. Failure to do so could trigger a pullback toward $112,500 or potentially slide to $110,000. Such a retracement would reflect profit-taking among traders and renewed caution amid prevailing macroeconomic uncertainty. Bitcoin Price Analysis. Source: TradingView However, Bitcoin’s Relative Strength Index (RSI) currently sits in positive territory, suggesting rising bullish momentum. If buying pressure strengthens, BTC could breach $115,000 and aim for $117,261 in the near term. MYX Finance Holds Above Critical Support MYX price has dropped nearly 12% in the past 24 hours but continues to hold above the key $2.64 support level. The altcoin has repeatedly tested this threshold, showing resilience despite heightened volatility. If selling pressure intensifies, MYX could break below the $2.64 support, signaling a potential continuation of the downtrend. A decisive move lower might push the altcoin toward $1.98, where stronger support could emerge. MYX Price Analysis. Source: TradingView However, the Parabolic SAR indicator still points to an active uptrend, suggesting underlying bullish potential. If MYX rebounds from $2.64, the altcoin could rally toward $3.73 in the coming days. Sustained buying momentum at this level could invalidate the bearish outlook. The post Why Is The Crypto Market Down Today? appeared first on BeInCrypto.

Bitcoin Liquidity Flush Meets Ethereum Recovery Push — Traders Await The Next Big Signal

Bitcoin Liquidity Flush Meets Ethereum Recovery Push — Traders Await The Next Big SignalBitcoin’s recent liquidity flush has stirred volatility across the market, leaving traders cautious as Ethereum shows signs of a potential recovery. While BTC struggles to stabilize after clearing key liquidity levels, ETH is attempting to reclaim crucial resistance, setting the stage for what could be the next major directional move in the crypto market. Market Weakness Persists After $116,000 Liquidity Sweep Can Özsüer, in his latest BTC 1H Current Chart update shared on X, highlighted that the hourly chart of Bitcoin shows little to no bullish reflection at the moment. He pointed out that market sentiment has weakened, particularly after the $116,000 liquidity zone was cleared, which further dampened the outlook across the broader crypto market. According to Özsüer, the overall setup remains fragile, and taking scalp long positions in such conditions could be risky until a clearer reversal structure begins to form. Özsüer identified the $111,000 level as a potential zone for an initial reaction buy, suggesting that some short-term support could emerge around this point. However, he cautioned that if this level fails to hold, Bitcoin could experience a sharper decline toward the trendline support near $109,000. He further advised that traders should construct their strategies carefully, focusing on the zones within what he referred to as “box number 1.” This area could provide a technical framework for identifying potential entry points and managing risk effectively. To conclude, Özsüer noted that the cleanest and safest approach would be to align trading plans around optimal price levels while ensuring that positions remain protected above the defined support structure. Bullish Momentum Builds If $4,200 Is Reclaimed While Bitcoin faces a potential drawdown, crypto analyst Ted Pillows revealed that ETH is currently engaged in a critical fight to reclaim the $4,200 resistance zone. The success of this immediate technical battle is crucial, as it will determine the asset’s trajectory in the days to come. Ted pillows outlined the condition for a continuation of the rally; if Ethereum is able to decisively reclaim and hold the $4,200 level, traders should “expect more bullish continuation.” Conquering this resistance would likely signal a clear path to the next higher price targets. Conversely, should ETH fail to secure the $4,200 zone, the price will likely retreat. The analyst predicts that this failure would trigger a necessary retest of the $4,000 level before the market can attempt any further upward moves, indicating that $4,000 acts as the crucial defense line against a deeper correction.

- Is the Dollar Losing Its Crown? How AI and Crypto Are Rewiring Global Finance

The dollar’s dominance has long defined global finance. Yet as central banks trial crypto and AI reshape cross-border settlement, the system faces its first true structural test in decades. This shift could redefine how global liquidity and trust are priced. IMF COFER data place the dollar’s share of global reserves at 56.32% in early 2025 — the lowest since the euro’s birth. Meanwhile, 94% of monetary authorities are testing central-bank digital currencies. That signals diversification and digitalization of state money. AI’s arrival in financial infrastructure accelerates this shift. The Bank for International Settlements warns that autonomous trading and liquidity algorithms could magnify systemic risk. At the same time, new digital rails promise cheaper and faster transfers. Legacy networks built on the greenback are quietly eroding. Indicators of a Permanent Shift in Dollar Dominance BeInCrypto spoke with Dr. Alicia García-Herrero, Chief Economist for Asia-Pacific at Natixis and former IMF economist. Drawing on two decades of macro research, she explains how CBDCs, AI, and stablecoins may redraw global monetary power. She also outlines which metrics will reveal that pivot first. The dollar still anchors reserves, yet erosion has begun. COFER data show a steady slide since 2000. The question is no longer whether alternatives arise, but when the shift becomes measurable — a timeline investors can now watch in real time. Source: IMF COFER, Q2 2025 “From my IMF days analyzing COFER data, we tracked USD’s share of global FX reserves — now 56.32% in Q2 2025 — alongside RMB and EUR gains plus CBDC pilots where 94% of central banks are engaged. Crypto’s volatility could amplify AI-driven risks, as BIS warns. But CBDCs offer controlled shifts. I’d expect measurable erosion if USD dips below 55% by 2027, with $1B+ annual CBDC settlements signaling permanence. Stablecoins buttress dollar stability without wild swings.” Her threshold — a drop below 55% by 2027 plus billion-dollar CBDC flows — would mark a turning point for reserve structures. It shows when diversification stops being theory and becomes policy. Stablecoin Market Share and Emerging Bloc Risks Stablecoins remain an extension of dollar liquidity. Around 99% of circulation is USD-pegged, with USDT and USDC dominant. Non-dollar or commodity-backed tokens could spark bloc-based competition — a clear sign that liquidity may fragment along political lines. Source: Messari “USD-linked stablecoins like USDT and USDC command over 99% of the $300 billion market as of October 2025. A yuan-backed stablecoin hitting 10–15% share could ignite bloc tensions. Conflict only arises if it surpasses 20%, fracturing global liquidity.” García-Herrero argues that a rival stablecoin must capture over 20% of global settlements to trigger true bloc fragmentation. That marks the point where digital currencies start redrawing geopolitics, not just payments. On-chain settlement now tops $35 trillion annually — twice Visa’s throughput. Stablecore CEO Alex Treece calls it “a modern Eurodollar network” serving global USD demand beyond banks. It shows that digital rails still strengthen the dollar’s reach. IMF data show these tokens already handle about 8% of GDP-scale flows in Latin America and Africa. That proves stablecoins now act as informal policy instruments. “Stablecoins satisfy existing dollar demand. It’s market-driven, not state-driven. In the short term they reinforce dominance. In the long term, it depends on US policy and confidence.” Treece compares this digital-dollar system to the 1960s Eurodollar market, when offshore investors tapped US liquidity through parallel networks. Private innovation extended the dollar’s reach instead of replacing it. Stablecoins in High-Inflation Economies In inflation-hit economies like Argentina and Turkey, stablecoins serve as informal dollar rails. They act as a digital hedge against currency collapse and offer a parallel financial lifeline showing crypto’s real-world role. “In Argentina, stablecoins shield 5 million users and make up over 60% of crypto transactions. They become destabilizing at 20–25% of retail payments or 15% of FX turnover. In Turkey, similar adoption ranks it high globally. Overall, their stabilizing role outweighs risks at current levels.” Her rule of thumb: moderate use stabilizes. But when stablecoins exceed a quarter of payments, they threaten monetary sovereignty — the point where relief turns into risk. Tokenization and Sovereign Debt Tokenization has become a key theme in finance, though sovereign uptake lags. While BIS pilots move slowly, private firms advance faster. Franklin Templeton expects early adoption in treasuries and ETFs in Hong Kong, Japan, and Singapore. These pilots show where regulation and innovation already meet. “Institutions want vehicles that manage volatility and enhance liquidity. It starts with retail, but institutional flows follow once secondary markets mature.” — Max Gokhman, Franklin Templeton CoinGecko data show tokenized treasuries above $5.5 billion and stablecoins over $220 billion. The concept is shifting from pilot to practice as traditional assets quietly migrate on-chain. “RWA tokenization’s trillions-by-2030 projections feel ambitious, but tokenized bonds have already hit $8 billion by mid-2025. I foresee 5% of new sovereign issuance by 2028, led by Asia and Europe, while USD resilience will persist.” Her projection — 5% of sovereign issuance tokenized by 2028 — signals gradual reform led by Asia and Europe. It complements rather than replaces the dollar system. Digital finance often evolves through compliance, not rebellion. Both public and private efforts are converging. García-Herrero expects regulator-led uptake, while Franklin Templeton bets on market pull. Either way, traditional assets are migrating to blockchain rails — one bond and one fund at a time. China’s e-CNY and State-Led Crypto China’s e-CNY continues to expand under tight central control. By mid-2025 it had handled 7 trillion yuan in transactions. This shows Beijing’s ability to digitize money without private crypto and how centralized ecosystems can scale quickly. Study Times, the Central Party School’s journal, frames crypto and CBDCs as tools of “financial mobilization.” Beijing’s digital yuan and blockchain networks serve as strategic assets for liquidity control and sanction resilience — a “digital logistics front” merging finance and security. “China’s e-CNY exemplifies disciplined digital finance. It processed 7 trillion RMB by June 2025. A fully state-led model emerges when private blockchain FDI falls below 10% of fintech inflows. By late 2026, we’ll see clear dominance.” She defines state-led dominance as private blockchain investment under 10% of fintech inflows. That level may arrive by late 2026, when digital sovereignty becomes measurable, not rhetorical. Russia–China Trade and the “State-Led Web3 Bloc” Facing sanctions, Russia and China now settle most trade outside the dollar system. Their digital-asset experiments raise the question of when coordination becomes a formal bloc — a turning point that could reshape settlement geography. “Russia’s 2025 legalization of crypto for foreign trade, with non-USD/EUR flows now over 90% in yuan and ruble, shows how a ‘state-led Web3 bloc’ could emerge if 50% of trade shifts to digital assets. CBDC bridges might mitigate risk, and ironically, USD-pegged stablecoins could stabilize such flows.” Her 50% benchmark defines the threshold for a new clearing sphere. It could stabilize sanctioned trade yet deepen global fragmentation. Europe has already reacted. The EU’s recent ban on a ruble-backed stablecoin, A7A5, marked its first direct crypto sanction. It showed how digital assets have become both weapon and target in financial conflict. Proof of Personhood and Financial Inclusion Proof-of-Personhood systems like Worldcoin’s biometric model are reframing debates on identity and inclusion. Their economic value remains unproven, yet scalability could shape how fast AI-age trust frameworks evolve. “Proof-of-Personhood pilots like Worldcoin, with 200 million identities verified by mid-2025, could cut borrowing costs by 50–100 basis points or lift capital access by 20–30%. If achieved by 2027, it would validate PoP beyond hype.” The debate mirrors the wider digital-identity race. TFH’s Adrian Ludwig sees proof-of-human systems as a trust layer for an AI age. García-Herrero says only measurable impact will prove their worth. AI and Crypto Cross-Border Trade Dominance AI-driven finance now shapes liquidity, compliance, and settlement. The BIS says machine-learning copilots already automate AML reviews. Project Pine smart contracts let central banks adjust collateral in real time, signaling programmable compliance’s rise. BIS frames this as a programmable yet regulated financial core. Speculative outlooks like AI 2027 imagine AI systems directing liquidity, R&D, markets, and security policy. BIS calls for integrity-by-design before such systems fully emerge. “AI’s cross-border edge will surge, with 75% of payments becoming instant by 2027. China seems poised for over 30% share through state-backed sandboxes and nearly $100 billion in investments. Stablecoins could complement AI agents, curbing volatility.” Investments nearing $100 billion by 2027 favor that model. Stablecoins may serve as compliant, tokenized layers linking automated liquidity to programmable money — the next battleground for regulators. Sovereign Bitcoin Reserves and Resource Bottlenecks Bitcoin’s share in sovereign reserves remains small yet symbolic. Its link to risk assets and reliance on energy and chips may create new geopolitical choke points. Digital reserves could soon tie to physical supply chains. “Sovereign Bitcoin reserves remain under 1% of total FX. Hitting 5% by 2030 would spark a volatile ‘digital gold race.’ Energy and semiconductor supply could become choke points, while stablecoins offer a steadier reserve alternative.” Meanwhile, digital-asset treasury (DAT) firms manage over $100 billion in crypto, revealing how fragile balance sheets can mirror sovereign risk. Bitcoin-focused treasuries with strict liquidity buffers appear most resilient — a preview of challenges nations may face as adoption rises. Transparency of Crypto and Governance Advantage Public blockchains are entering government registries and procurement systems. For democracies, transparent ledgers offer accountability that directly strengthens fiscal credibility. “Blockchain procurement pilots boost transparency in democracies like Estonia, with government adoption markets jumping from $22.5 billion in 2024 to nearly $800 billion by 2030. At 15–20% of national spend on-chain, democracies gain a structural edge.” Her 15–20% benchmark marks the point when blockchain adoption becomes structural. It raises transparency scores and gives open societies a governance advantage. Conclusion Across ten domains — CBDCs, AI, stablecoins, tokenization, and blockchain — García-Herrero’s framework suggests evolution, not revolution. The dollar’s reach is diffusing, not disappearing, as digital money turns monetary power into a shared, data-driven system. Her analysis grounds speculation in measurable data: reserve ratios, settlement flows, and adoption thresholds. The future monetary order will hinge less on disruption than on governance — how transparency, trust, and control align in the digital age. The post Is the Dollar Losing Its Crown? How AI and Crypto Are Rewiring Global Finance appeared first on BeInCrypto.

Bitcoin Price Prediction: BTC Targets $124K as Trade Optimism and Institutional Demand Fuel Rally

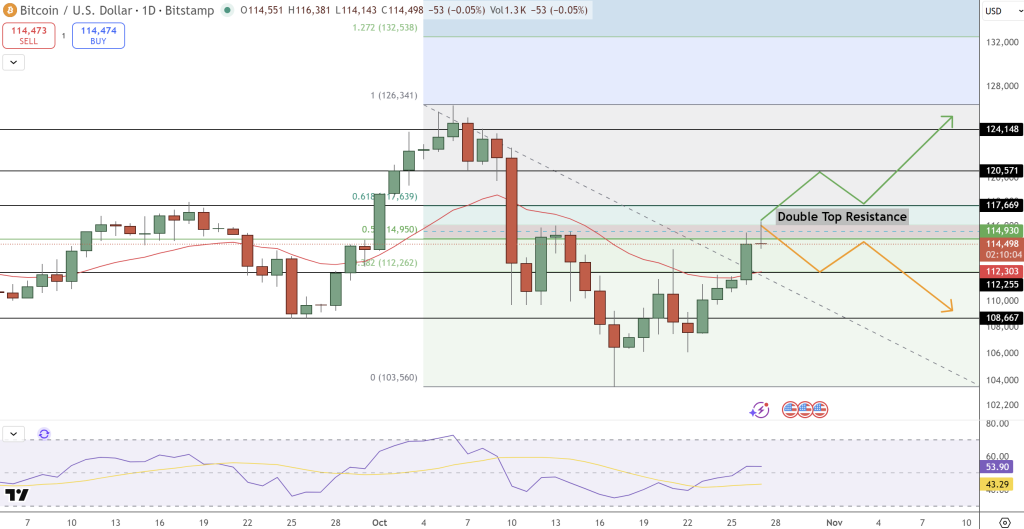

Bitcoin Price Prediction: BTC Targets $124K as Trade Optimism and Institutional Demand Fuel RallyBitcoin’s bullish momentum continues to reshape global markets. Crypto lender Ledn has surpassed $1 billion in Bitcoin-backed loans, the US dollar has weakened on renewed trade optimism, and American BTC, a Trump-linked firm, has expanded its holdings to $445 million. Together, these moves highlight deepening institutional confidence as investors increasingly use BTC for liquidity, leverage, and long-term value preservation.Ledn Surpasses $1B in Bitcoin-Backed Loans as Demand SoarsCrypto lender Ledn has issued over $1 billion in Bitcoin-backed loans this year, marking a sharp rise in crypto credit demand as investors choose to borrow rather than sell during the bull market. Since its inception, the firm has disbursed $2.8 billion in BTC loans, including $392 million in Q3, and now operates in over 100 countries, generating about $100 million annually.With BTC trading above $115,500, more holders are unlocking liquidity without selling, underscoring Bitcoin’s expanding role as both financial collateral and long-term store of value. With a Ledn loan, you can have your bitcoin and spend it tooSince 2018, @hodlwithLedn has issued over $10B in bitcoin-backed loans across 100+ countries. A Ledn loan allows you to borrow cash while keeping your bitcoin, with no credit check.https://t.co/Ih2nYgv67p— Bitcoin.com News (@BTCTN) October 27, 2025 The milestone highlights Bitcoin’s expanding role as financial collateral, reinforcing its position as both a store of value and credit asset in the evolving digital economy.US Dollar Falls as Trade Deal Hopes Lift Global MarketsThe US dollar weakened on Monday against major currencies, including the euro, yuan, and Australian dollar, as optimism over a potential US-China trade agreement boosted global market sentiment. President Donald Trump said both sides are close to finalizing a deal and will meet later this week in South Korea, fueling investor confidence and easing demand for the greenback as a safe-haven asset. Market Sentiment is IN • BEARISH: US Dollar, New Zealand Dollar• BULLISH: Swiss Franc, Euro• NEUTRAL: AUD, GBP, CAD, JPYWhere are you placing your focus this week?Full breakdown & insights:https://t.co/pArWjmvZE3 pic.twitter.com/VPv41nn2fs— City Traders Imperium (@CTI_Funding) October 27, 2025 The Chinese yuan climbed to its highest level in over a month after the People’s Bank of China set a stronger midpoint rate, while the Australian dollar gained following hawkish comments from the country’s central bank governor. US dollar slips as trade optimism boosts risk appetite – https://t.co/I3RAt1feo7 via @Reuters— Dan Popescu (@PopescuCo) October 27, 2025 As risk appetite improves and global equities rally, traders are watching whether trade progress and stronger Asian currencies will extend the dollar’s decline this week.Trump-Linked American BTC Boosts Treasury to $445M With New BTC PurchaseAmerican Bitcoin, co-founded by Eric Trump and Donald Trump Jr., has expanded its BTC treasury to 3,865 BTC worth $445 million after acquiring an additional 1,414 BTC valued at $163 million. Eric Trump reaffirmed the company’s long-term confidence in BTC, emphasizing its mission to increase the “Bitcoin-per-share” ratio over time. Exciting news! Trump-linked American Bitcoin just added $163M in BTC, boosting its treasury to over $445M! This move signals strong confidence in the crypto market and its future potential. What does this mean for the landscape? Let’s discuss! … https://t.co/EH3Avmmq1Q— Fight for Democracy (@breakingwtfnews) October 27, 2025 The company went public on the Nasdaq under the ticker “ABTC” in September after merging with Gryphon Digital Mining. Its debut sparked strong market interest, with shares surging over 80% on the first trading day.The latest purchase deepens the link between Bitcoin adoption and U.S. politics, highlighting the Trump family’s growing involvement in the crypto sector. Following the announcement, Bitcoin prices climbed above $115,540, as investors viewed the move as a major vote of confidence in the cryptocurrency’s future.Bitcoin (BTC) Price Forecast: Bulls Eye $124K as Breakout LoomsBitcoin (BTC/USD) is trading around $114,572, consolidating after rebounding from the $108,600 support zone. The daily chart shows a potential double-top pattern forming near $117,600, aligning with the 61.8% Fibonacci retracement, a key resistance level where sellers could reappear.Bitcoin Price Chart – Source: TradingviewThe short-term outlook remains positive as Bitcoin trades within a rising channel, supported by a bullish EMA crossover between the 20-day and 50-day averages near $112,300. The RSI at 54 signals neutral momentum, leaving room for further gains before entering overbought territory.Recent Doji and spinning top candles indicate short-term indecision as bulls test the ceiling. A breakout above $117,600 could trigger an advance toward $120,500 and $124,100, while failure to hold may lead to a retest of $112,250.If buyers maintain control and global sentiment strengthens, Bitcoin could extend its rally toward the $130K region in the coming weeks.Bitcoin Hyper: The Next Evolution of BTC on Solana?Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $24.7 million, with tokens priced at just $0.013165 before the next increase.As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.Click Here to Participate in the PresaleThe post Bitcoin Price Prediction: BTC Targets $124K as Trade Optimism and Institutional Demand Fuel Rally appeared first on Cryptonews.

MetaMask Airdrop Finally Happening? Mysterious Claim Site Reignites MASK Token Speculation

MetaMask Airdrop Finally Happening? Mysterious Claim Site Reignites MASK Token SpeculationA newly discovered domain linked to MetaMask has reignited speculation that the long-rumored MASK token airdrop could be imminent. The emergence of a password-protected claim portal at claim(.)metamask(.)io has fueled widespread belief that Consensys’ popular Ethereum wallet is preparing to roll out its long-awaited token distribution. INTEL: MetaMask has registered a domain for claiming MetaMask tokens, suggesting the airdrop may be near— Solid Intel (@solidintel_x) October 27, 2025 How Soon Is the MetaMask Airdrop? The Countdown to MASK BeginsThe domain, first spotted earlier this week, features a login page that requests user authentication but provides no additional information. While MetaMask has not officially confirmed any connection to the site, blockchain analysts and community members say its design and domain structure align with MetaMask’s official ecosystem. The discovery coincides with the rollout of MetaMask Rewards, a new point-based loyalty program announced earlier this month, intensifying speculation that the claim page may soon go live.In early October, MetaMask unveiled a $30 million rewards initiative designed to incentivize users for on-chain activity.Source: MetaMaskThe program allows participants to earn points for swapping tokens, bridging assets, and other DeFi interactions, particularly those carried out on Linea, Consensys’ Ethereum Layer-2 network.Industry observers believe these reward points could later serve as eligibility criteria for claiming MASK tokens in a potential airdrop.Consensys CEO Joe Lubin previously confirmed that a MetaMask token would arrive “sooner than you would expect,” calling it a step toward decentralization.Lubin described the reward system as “a bridge between the wallet’s DeFi utility and its next stage of decentralization,” further strengthening expectations that the MASK token is nearing release.Source: PolymarketThe odds of a MetaMask token launch this year have also surged in prediction markets. On Polymarket, traders now estimate a 19% chance of a MASK airdrop before year-end, a sharp rise from earlier forecasts.Still, not everyone is convinced the new claim page signals an immediate launch. MetaMask’s Director of Product, Christian Montoya, said that the company is “launching a new loyalty program” as part of its initial rewards phase, but cautioned users to remain alert to phishing attempts.“You will not have to find some account on social media that you’ve never heard of giving you a link,” Montoya said. “It will be in the wallet. It’ll be on our main website.”MetaMask Evolves Into All-in-One DeFi Platform as Token Rumors GrowRumors of a MetaMask token have persisted since 2021, when developers first floated the idea of community ownership through a governance token. Every 6 months @MetaMask teases about an airdrop, drives volume to their swaps/bridges and when they have farmed a few million they go silent.Been hearing an airdrop since 2021, and now they come out with a point system, nice way to farm more and not care about OGs/supporters.…— 0000.eth (@Epicvillages) October 4, 2025 However, until now, MetaMask has avoided confirming any concrete distribution plans despite multiple ecosystem expansions, from token swaps and bridges to its latest integration of on-chain derivatives trading.On October 8, the wallet introduced MetaMask Perps, a new feature allowing users to trade perpetual futures directly within the app. MetaMask Unleashes “CEX Killer” With New In-Wallet Perps TradingMetaMask has entered the on-chain derivatives market with the launch of perpetual futures trading directly inside its mobile app, a move seen as a challenge to centralized exchanges.https://t.co/TZvpKKxLZO pic.twitter.com/Aouwt2guFJ— Cryptonews.com (@cryptonews) October 8, 2025 The launch marks MetaMask’s most important step toward becoming an all-in-one trading platform, placing it in direct competition with centralized exchanges such as Binance and OKX.In parallel, in August, governance discussions revealed plans to launch a native stablecoin, MetaMask USD (mUSD), developed in partnership with Stripe. The proposed token would operate on the M⁰ network for decentralized issuance and settlement, offering a fiat-backed alternative to existing stablecoins like USDC and USDT. Although the proposal was later removed, sources close to the matter confirmed that the project remains under development. MetaMask adds Google and Apple login to simplify wallet access, eliminating the need for complex seed phrase management.#MetaMask #Wallethttps://t.co/jjy80DdR9e— Cryptonews.com (@cryptonews) August 27, 2025 Earlier that same month, MetaMask also rolled out social login functionality, allowing users to create or recover wallets using Google or Apple credentials, part of a broader effort to simplify onboarding while maintaining self-custody principles.The wallet’s recent hint follows a backdrop of growing airdrop speculation across the crypto sector. Airdrop Season Returns: Linea’s Token Launch Sparks Wave of New DistributionsFollowing Consensys’ Linea token launch in September, which distributed over 9 billion tokens to eligible users, other major Web3 projects have followed suit. Linea has promised to launch its token soon. Can it revive the struggling L2 market after failures like Scroll?#Linea #L2 #Airdrophttps://t.co/1L8mznI06P— Cryptonews.com (@cryptonews) February 10, 2025 Polymarket, the decentralized prediction market, confirmed plans last week to release its POLY token through a retroactive airdrop.Chief Marketing Officer Matthew Modabber said the team aims to design a token “with true utility and longevity.” @Polymarket has confirmed a native token launch and an airdrop are planned after launching its U.S. app. #Crypto #Polymarket #POLY https://t.co/h4ENyRsbuS— Cryptonews.com (@cryptonews) October 24, 2025 Elsewhere, speculation continues around Base, the Coinbase-backed Layer-2 network, which recently hinted that it may explore a token after previously ruling it out. The shift follows Linea’s successful distribution and has added to the growing belief that a new wave of “airdrop season” could be underway. Base has explored launching a network token, reversing Coinbase’s earlier stance. @jessepollak and @brian_armstrong confirmed discussions. #Coinbase #Base https://t.co/5vMMa9mHQ3— Cryptonews.com (@cryptonews) September 15, 2025 Still, MetaMask remains the most anticipated project among them. The wallet boasts over 30 million monthly active users, making any potential MASK airdrop one of the largest events in DeFi history if confirmed. However, the company has repeatedly stressed that its reward system is designed for sustainable engagement, not one-time token farming.Developers said the program’s structure seeks to track consistent user behavior across DeFi activities rather than encourage short-term trading spikes.The post MetaMask Airdrop Finally Happening? Mysterious Claim Site Reignites MASK Token Speculation appeared first on Cryptonews.

Canary Capital’s CEO Confirms Spot Hedera And Litecoin ETFs Will Begin Trading Tomorrow

Canary Capital’s CEO Confirms Spot Hedera And Litecoin ETFs Will Begin Trading TomorrowAfter months of growing uncertainty and anticipation, the debut of exchange-traded funds (ETFs) for Hedera (HBAR) and Litecoin (LTC) is set to commence tomorrow, as confirmed by Canary Capital’s CEO Steven McClurg on Monday. Hedera And Litecoin ETF Launches Imminent Crypto reporter Eleanor Terret shared the news on X (formerly Twitter), revealing that the ETF launches for Litecoin and Hedera are imminent, with a statement from McClurg underscoring the excitement for the upcoming launch. Notably, the New York Stock Exchange (NYSE) has also made significant moves in the ETF sector by certifying 8-A filings and issuing listing notices for Bitwise Invest’s spot Solana (SOL) ETF launch tomorrow and Grayscale’s GSOL conversion slated for Wednesday. Despite the ongoing government shutdown, these ETF debuts are proceeding smoothly, Terret confirmed. The legal processes behind ETF launches, including the crucial 8-A filings, have been completed successfully, paving the way for the launch of these investment vehicles. ETF Listings Confirmed Addressing concerns about Securities and Exchange Commission (SEC) approval during the shutdown, a key detail emerged: the issuers strategically included provisions in their amended S-1 filings, enabling automatic effectiveness 20 days post-filing. This ensures a seamless transition to trading without manual SEC approval. Bloomberg’s ETF expert, Eric Balchunas, further corroborated this development on social media, confirming the listing notices for Bitwise, Canary, to launch imminently, with grayscale Solana’s conversion scheduled shortly after. Balchunas stated, “Assuming there’s not some last min SEC intervention, looks like this is happening.” The news has sparked a recovery in HBAR and LTC prices. Litecoin has regained the key $100 mark with a 2% surge in the 24-hour time frame, while Hedera has seen similar gains of 2.1% during the same period. Featured image from DALL-E, chart from TradingView.com

Whales Double Down on Chainlink: $188M Moved Off Binance Post-Crash

Whales Double Down on Chainlink: $188M Moved Off Binance Post-CrashChainlink (LINK) has remained one of the most closely watched altcoins since the October 10 market crash, as investors and analysts position for the next major market phase. Despite the broader crypto downturn, Chainlink’s network strength and growing on-chain activity have kept it in focus as a potential leader of the next bullish wave. Recent on-chain data shows a clear accumulation trend among whales, signaling renewed confidence in the project’s long-term value. Large holders have been steadily adding to their LINK positions since the crash, suggesting that institutional and high-net-worth investors view current levels as an opportunity rather than a risk. Analysts argue that once market volatility subsides and Bitcoin confirms its next direction, LINK could experience an outsized recovery driven by strong fundamentals and increased adoption of Chainlink’s oracle infrastructure. The project’s expanding presence across DeFi, tokenization, and real-world data integration continues to position it as one of the most strategically important assets in the Web3 ecosystem. For now, all eyes are on Chainlink’s resilience — as the market searches for stability, LINK’s accumulation behavior may be laying the groundwork for one of the most compelling rebounds in the next bullish phase. Whales Withdraw Nearly $190M in LINK — A Strong Signal of Accumulation According to Lookonchain, a total of 39 new wallets have withdrawn 9.94 million LINK — worth approximately $188 million — from Binance since the October 10 market crash. This large-scale movement of funds suggests that whales are accumulating Chainlink, potentially in anticipation of a market rebound. Withdrawals of this magnitude are often interpreted as a bullish signal, as investors typically move assets off exchanges when they intend to hold them long-term rather than sell. It reflects growing confidence among large holders, who may view current prices as a strategic entry point. The timing also coincides with a broader phase of market uncertainty, reinforcing the idea that sophisticated investors are quietly positioning ahead of the next major move. The significance of this pattern goes beyond price speculation. Whales accumulating LINK may also indicate long-term belief in Chainlink’s fundamental role within decentralized finance (DeFi) and real-world asset tokenization. As the leading oracle network, Chainlink secures data feeds and enables interoperability between blockchains — making it an essential layer in the Web3 infrastructure stack. If accumulation continues and market sentiment stabilizes, LINK could emerge as one of the key outperformers in the next crypto upcycle. Historically, similar accumulation phases have preceded major rallies in Chainlink’s price, particularly when exchange reserves decline and on-chain activity rises. In short, this $188 million withdrawal wave signals that large investors are accumulating with conviction, reducing selling pressure on exchanges and tightening supply — a setup that could pave the way for significant upside once broader market conditions turn favorable. Chainlink Holds Above Key Support As Whales Accumulate The weekly chart shows Chainlink (LINK) trading around $18.58, holding relatively stable after weeks of volatility following the October 10 crash. Despite the broader market uncertainty, LINK has managed to defend its key support zone near $16, which aligns with the 200-week moving average — a crucial long-term level watched by traders. Price action indicates consolidation above this support, with the 50-week moving average flattening and beginning to converge with the 100-week. This setup often signals the early stages of a structural base before a potential breakout, provided that buying momentum increases. The fact that whales have withdrawn nearly $188 million worth of LINK from exchanges reinforces this narrative, as such accumulation tends to tighten available supply and reduce selling pressure. Volume has also stabilized after a spike during the crash, suggesting that panic selling has cooled off. For a confirmed bullish shift, LINK needs to reclaim the $20–$22 resistance zone, which previously acted as both support and rejection during mid-year rallies. The chart reflects a period of healthy consolidation backed by on-chain accumulation. If Bitcoin stabilizes and macro conditions improve, LINK could be among the first altcoins to recover strongly, extending its long-term uptrend. Featured image from ChatGPT, chart from TradingView.com

White House Officially Taps Mike Selig As CFTC Chair – Inside the Shake-Up After Quintenz

White House Officially Taps Mike Selig As CFTC Chair – Inside the Shake-Up After QuintenzU.S. President Donald Trump has tapped the Securities and Exchange Commission’s (SEC) Mike Selig to lead the Commodity Futures Trading Commission, the latter confirmed on Saturday.Mike Selig Speaks Amid CFTC Chair NewsSelig, who most recently led the SEC’s Crypto Task Force as chief counsel, took to X on October 25 to say he was “honored” to spearhead the CFTC. I am honored to be nominated by President Trump to serve as the 16th Chairman of the U.S. Commodity Futures Trading Commission. With the President’s leadership, a Great Golden Age for America’s Financial Markets and a Wealth of New Opportunities stand before us. I pledge to work… https://t.co/cO2vLBAv0z— Mike Selig (@MikeSeligEsq) October 25, 2025 “With the President’s leadership, a Great Golden Age for America’s Financial Markets and a Wealth of New Opportunities stand before us,” Selig said.“I pledge to work tirelessly to facilitate Well-Functioning Commodity Markets, promote Freedom, Competition and Innovation, and help the President make the United States the Crypto Capital of the World,” he added.Brian Quintenz Nomination Withdrawn After Winklevoss ConcernsSelig’s nomination comes after the nomination process for Trump’s initial pick for CFTC chair, a16z policy head Brian Quintenz, stalled earlier this year.In July, reports emerged that Gemini co-founders Cameron and Tyler allegedly voiced concerns over whether Quintenz was aligned with the Trump administration’s plans for crypto.In September, Quintenz shared a series of messages between him and Tyler Winklevoss on X before his nomination was rescinded later that month. I’ve never been inclined to release private messages. But in light of my support for the President and belief that he might have been misled, I’ve posted here the messages that include the questions Tyler Winklevoss asked me pertaining to their prior litigation with the CFTC. I… pic.twitter.com/MN75M1XUpT— Brian Quintenz (@BrianQuintenz) September 10, 2025 Trump, who largely campaigned with support from the blockchain sector, has received both praise and scrutiny for his affiliation with the digital asset industry.Shortly before his inauguration, Trump selected Yammer founder David Sacks to serve as the newly established White House A.I. and Crypto Czar.Following news of Selig’s nomination, Sacks praised him as “deeply knowledgeable about financial markets” and “passionate about modernizing our regulatory approach in order to maintain America’s competitiveness in the digital asset era.”“On behalf of the President’s Working Group on Digital Assets, @patrickjwitt and I look forward to continuing our work with Mike to deliver on President Trump’s promise to make the U.S. the crypto capital of the planet,” he continued.The post White House Officially Taps Mike Selig As CFTC Chair – Inside the Shake-Up After Quintenz appeared first on Cryptonews.

Digital Yen Goes Live: JPYC EX Integrates Traditional Finance With DeFi

Digital Yen Goes Live: JPYC EX Integrates Traditional Finance With DeFiJapan has officially stepped into the regulated stablecoin era with the launch of JPYC EX, the country’s first fully licensed digital yen under the revised Payment Services Act. This milestone marks a pivotal moment for Japan’s financial sector, bridging traditional banking infrastructure with the Web3 ecosystem. Building on earlier versions of JPYC, the new JPYC EX is designed to serve as a compliant, yen-backed stablecoin connecting the nation’s banking system to blockchain-based commerce, DeFi applications, and cross-border payments. With full legal authorization and asset backing, it positions the yen as a future cornerstone in global digital finance. According to CryptoQuant, the total stablecoin market capitalization has now surpassed $150 billion, forming the backbone of liquidity for crypto markets, DeFi protocols, and global payments. Analysts from Citi and Bloomberg project that this figure could expand to between $1.6 and $4 trillion by 2030. Within that rapid growth, JPYC is forecasted to capture roughly 2% of the market, reaching a valuation of around $70 billion. A Fully Regulated Digital Yen Bridging Japan’s Finance and Web3 What distinguishes JPYC EX from other stablecoins is its combination of regulatory clarity, asset backing, and technical versatility. Domestic bank deposits and Japanese government bonds fully collateralize each token, ensuring complete transparency and stability. This structure makes JPYC EX one of the world’s most legally robust stablecoins. A benchmark for compliance-driven innovation in digital finance. Built on Ethereum, Polygon, and Avalanche, JPYC EX provides instant yen transfers with near-zero fees. Making it a practical tool for businesses and individuals alike. It supports commerce, payroll, peer-to-peer payments, and DeFi applications, offering the efficiency of blockchain without sacrificing legal or operational safeguards. JPYC EX also aligns closely with Japan’s digital transformation strategy, which aims to merge traditional finance with emerging Web3 systems. By serving as a settlement layer for e-commerce platforms, NFT marketplaces, and cross-border transactions, the stablecoin enables instant yen transfers across Asia, lowering costs and increasing accessibility for international trade. Looking ahead, analysts forecast JPYC’s market capitalization could reach $70 billion by 2030. It represents roughly 2% of the global stablecoin market. This growth potential underscores Japan’s ambition to establish the digital yen as a key pillar of the decentralized global economy. With its blend of regulatory trust, technological precision, and global reach, JPYC EX may redefine how national currencies operate in the Web3 era. Stablecoin Dominance Shows a Cooling Phase After Recent Surge The chart shows that stablecoin market dominance currently sits around 8.31%, following a sharp rise earlier in October that pushed the ratio above 9%. This level often signals heightened demand for liquidity and safety, as traders move capital into stable assets amid market uncertainty. Over the past few months, dominance has steadily climbed from the 7.3%–7.5% range, reflecting a cautious sentiment as Bitcoin and major altcoins face selling pressure. However, the recent pullback suggests that some funds are beginning to rotate back into risk assets, a potential early sign of market stabilization. Technically, the dominance remains above both the 50-day and 200-day moving averages, indicating a broader uptrend in liquidity positioning. If this level holds, it may serve as a buffer during continued volatility. Conversely, a sustained drop below 8% could signal that traders are redeploying capital into crypto assets, possibly fueling short-term rallies. Stablecoin dominance remains elevated — a sign that market participants still prefer holding dry powder. Until dominance begins a more decisive decline, this cautious stance will likely persist, underscoring the market’s fragile balance between risk-off sentiment and the readiness for re-entry into volatile assets. Featured image from ChatGPT, chart from TradingView.com

3 Meme Coins To Watch In The Final Week Of October

3 Meme Coins To Watch In The Final Week Of October3 Meme Coins To Watch In The Final Week Of October Ape and Pepe (APEPE) APEPE has emerged as one of the week’s top-performing meme coins, soaring 128% to reach $0.467. The strong price action reflects renewed retail enthusiasm...

- 3 Meme Coins To Watch In The Final Week Of October

The meme coins have seen considerable interest these past couple of weeks, result of the skepticism in the macro financial market. Smaller cap coins such as Ape and Pepe (APEPE) have taken the lead with considerable growth in the last few days. BeInCrypto has analysed three such meme coins that are showing signs of potential growth going forward. Ape and Pepe (APEPE) APEPE has emerged as one of the week’s top-performing meme coins, soaring 128% to reach $0.467. The strong price action reflects renewed retail enthusiasm and growing market liquidity. If investors hold their positions instead of taking profits, APEPE could maintain its uptrend. Sustained demand may push the token past $0.515 resistance and toward $0.650. Strong buying pressure and consistent inflows will be crucial to extend the rally. Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. APEPE Price Analysis. Source: TradingView However, profit-taking could spark a pullback, driving APEPE down to its $0.354 support level. A drop below this mark would signal weakening confidence and invalidate the bullish outlook. BurnedFi (BURN) BURN has mirrored APEPE’s strong momentum, surging 97% over the past week to reach $4.68. The steady rise highlights growing investor confidence and sustained market interest. The Chaikin Money Flow (CMF) indicator supports this bullish outlook, showing values above the zero line. This signals healthy capital inflows from BURN’s 85,000-plus holders. If momentum continues, the altcoin could break through the $5.00 resistance and target $5.50. BURN Price Analysis. Source: TradingView However, if selling pressure emerges, BURN may struggle to sustain its gains. A breakdown below $4.00 could trigger a sharper decline toward $3.34. Such a move would signal fading demand and invalidate the bullish thesis. Uranus (URANUS) Another one of the meme coins to watch is URANUS, which has emerged as another strong meme coin performer, surging 58.6% over the past week to $0.000002133. The rally highlights growing investor enthusiasm for high-risk, high-reward assets. The Parabolic SAR indicates that URANUS remains in an active uptrend. Continued momentum could push the price above $0.000002200 and toward $0.000002500. If this trajectory holds, the meme coin may attract more inflows from investors seeking short-term profits. URANUS Price Analysis. Source: TradingView However, if selling pressure increases, URANUS could face a sharp pullback. A decline below $0.000001872 might extend losses to $0.000001762. Such a drop would suggest fading investor confidence and invalidate the bullish outlook. The post 3 Meme Coins To Watch In The Final Week Of October appeared first on BeInCrypto.

Q3 2025: Bitcoin Surged to ATH But With ‘Notable Laggard’ as Ethereum Led the Quarter

Q3 2025: Bitcoin Surged to ATH But With ‘Notable Laggard’ as Ethereum Led the QuarterThe third quarter of 2025 was a significant one, posting substantial achievements, according to the latest crypto industry report by crypto data aggregator CoinGecko. Yet, despite Bitcoin (BTC)’s surge to a fresh ATH, major altcoins – particularly Ethereum (ETH) – strongly outperformed.The crypto market recorded its third consecutive rallying quarter in Q3 this year. This is also the second consecutive quarter of “significant capital appreciation,” the report noted.Moreover, it was the market’s second leg of recovery, powered by liquidity, a sharp recovery of trading activity, and renewed institutional inflows.The total market capitalization increased by 16.4% with $563.6 billion, hitting the $4 trillion mark. Notably, this is the highest level since late 2021.Source: CoinGeckoMoreover, the average daily trading volume saw “a decisive reversal” in Q3, suggesting higher market participation. It went up nearly 44% from Q2 to $155 billion, following two consecutive quarters (Q1 and Q2) of diminishing spot activity.At the same time, Bitcoin dominance noted a significant shift, dropping to 56.9%. This signaled “a material rotation into ETH and other large-cap altcoins” and “a material shift from the ‘flight to quality’ trend seen earlier in the year,” CoinGecko noted.The main beneficiary was Ethereum, as will be discussed below. Its market share rose to 12.5%, showing a renewed interest and capital inflows into ETH.Other major altcoins benefited as well, including XRP (+0.5 percentage points), BNB (+0.7 p.p.), and SOL (+0.4 p.p.). You may also like: Q1 2025: Bitcoin Boosts Dominance as Market Cap and Investor Activity Plunge The scheduled release date of Sean ‘Diddy’ Combs has been unveiled as the former Sam Bankman-Fried (SBF) jailmate plans to appeal his 2025 conviction, per information on the Federal Bureau of Prisons’ website. Release Date Set For Sean 'Diddy' Combs According to the Federal Bureau of Prisons, Combs is scheduled to be released on May 8, 2028. Combs was found guilty on two prostitution-related charges back in July of this year following a highly publicized trial that saw the... Altcoins In Focus, Bitcoin LaggingAltcoins strongly outperformed in Q3 this year, CoinGecko highlighted. BTC was “the notable laggard” in the top 5 coins category, with a 6.4% appreciation.At the same time, ETH led the list with a 66.6% rise, outperforming major altcoins and even hitting a new all-time high of nearly $5,000.Source: CoinGeckoNotably, there was a clear renewed interest in ETH, fueled by strong net inflows into US Spot ETH exchange-traded funds (ETFs) and institutional buy pressure from treasury companies such as Tom Lee’s Bitmine Immersion and Joe Lubin’s SharpLink.At the same time, BNB went up 53.6%, SOL 34.7%, and XRP 27%. BNB exploded in Q3, also hitting an ATH, powered by closer integration with Binance via Binance Alpha and the perp DEX Aster success, says the report.Also, SOL reached a quarterly high of $248 with an influx of treasury companies. However, it lost momentum amidst a late-September market pullback and ETF approval delay. You may also like: Sharplink Gaming Adds $80M in Ethereum to Strategic Reserve After Month-Long Lull Sharplink Gaming added 19,271 Ether worth about $80.37m to its strategic reserve on Monday, ending a month of quiet accumulation and signaling renewed conviction in the asset. The purchase lifts the company’s holdings to 859,400 Ether valued at roughly $3.6b, placing it second among disclosed corporate treasuries behind BitMine, which holds about 3.24m Ether worth $13.5b. ACY Securities said that the fresh buy fits Sharplink’s prior accumulation pattern and looks like positioning ahead... Speaking of ETFs…CoinGecko highlighted that BTC’s early surge followed continuous retail and institutional accumulation, particularly through Bitcoin ETFs.However, analysts also noted a reversal of the inflow trend at the end of September. US spot BTC ETFs recorded outflows amidst a general market decline.US Spot BTC ETFs net inflows decreased from $12.8 billion in Q2 to $8.8 billion in Q3. Total AUM grew by 16% from $143.4 billion to $166.3 billion.At the same time, US spot ETH ETFs noted $9.6 billion in net inflows. This was “by far the largest quarter and the first time it has surpassed BTC ETFs,” the report says. Total AUM reached $28.6 billion, marking a 177.4% jump quarter-on-quarter.Moreover, crypto digital asset treasury companies (DATCos) spent at least $22.6 billion in new crypto acquisitions in Q3. This was “by far the largest quarterly amount thus far.” Of this, altcoin DATCos accounted for $10.8 billion (47.8%).Overall, DATCos held some $138.2 billion worth of crypto by the end of Q3.Strategy dominated with >50% share, while two ETH DATCos made the top 5 list (Bitmine Immersion and Sharplink).Stablecoin Market Cap Hits New ATHIn the previous quarter, the top 20 stablecoin market cap surged by over 18%, with $44.5 billion, reaching a new ATH of $287.6 billion.Top gainers are: Ethena’s USDe: jumped by 177.8% or $9.4 billion in market cap, with the market share growing from 2% to 5%, overtaking USDS as the third-largest stablecoin. Tether’s USDT: saw the largest absolute increase, adding $17 billion to its market cap, while its market share fell from 65% to 61% due to the accelerated growth of other stablecoins. The market cap has continued to climb in early Q4, surpassing $300 billion. At the time of writing in late October, it stands at $312 billion, per CoinGecko. You may also like: Japan Breaks New Ground with Launch of First Yen-Denominated Stablecoin Japan will debut the world’s first stablecoin pegged to the yen on Monday, a small but significant step in a market still dominated by cash and card payments. The move aims to pull blockchain into everyday finance and test demand for a digital yen proxy. JPYC, a Tokyo startup, said it will issue a fully convertible yen stablecoin backed by domestic bank deposits and Japanese government bonds (JGBs). The company plans to waive transaction fees at launch to spur usage, and instead earn... DeFi SurgesDeFi Total Value Locked (TVL) was up 40.2% from $115 billion at the start of July to $161 billion at the end of September. ETH’s “outsized appreciation and the ongoing stablecoin narrative” fueled this surge, CoinGecko says.Moreover, the DeFi sector’s market cap climbed to $133 billion shortly after ETH hit $3,000 in mid-July. In late September, it hit the Q3 peak of $181 billion following a price jump of newly launched tokens from perpetual DEXes such as Avantis (AVNT) and Aster (ASTER).DeFi’s market share increased from 3.3% in Q2 to 4% in Q3 2025.CEX and DEXIn Q3, the top centralized exchanges (CEXes) recorded $5.1 trillion in spot trading volume. This is a nearly 32% increase from Q2’s $3.9 trillion. Upbit was the largest gainer, rising +40.5%, climbing to #9. Bybit rose by 38.4%, moving from #6 to #3. Its monthly average volume moved above $120 billion, the level last seen in February before the hack. Binance’s trading volume grew 40 QoQ for a cumulative $2.06 billion. Its market share increased slightly to 40%. Coinbase ranked #10 globally. Its volume rose by 23.4% but was still “outpaced by its rivals.” Meanwhile, the trading volume of the top 10 perpetual decentralized exchanges grew by +87% from $964.5 billion in Q2 to $1.81 trillion in Q3.Aster, Lighter, and edgeX are challenging Hyperliquid for the position of the largest Perp DEX. The latter had a 54.6% market share in Q3.“From an OI perspective, Hyperliquid still retains a sizeable lead amongst perp DEXes, with 75% share of OI as at October 1. No other competitor had You may also like: Upbit Corners 72% of S Korean Crypto Market as Smaller Exchanges ‘Face Extinction’ South Korean industry officials are once again voicing concerns that the crypto exchange Upbit may be a de facto monopoly, with smaller competitors’ market presence becoming “insignificant.” The South Korean newspaper Seoul Kyungjae reported that, per data from the regulatory Financial Supervisory Service (FSS), Upbit’s share of total domestic crypto trading volumes was 71.6% in the first six months of 2025. The platform’s operator, Dunamu, is on the verge of a merger with Naver, the... The post Q3 2025: Bitcoin Surged to ATH But With ‘Notable Laggard’ as Ethereum Led the Quarter appeared first on Cryptonews.

How Trump’s Words Moved Bitcoin: From Panic to Confidence in Just 2 Weeks

How Trump’s Words Moved Bitcoin: From Panic to Confidence in Just 2 WeeksOctober’s anticipated “Uptober” momentum and seasonal bullish expectations appear to have taken a backseat. Instead, US President Donald Trump’s aggressive tariff threats and trade remarks toward China took center stage, and dictated Bitcoin’s sharp price swings and investor emotions throughout the month. BTC Market’s Emotional Rollercoaster Trump’s China-related rhetoric in October 2025 reverberated through Bitcoin’s (BTC) price action and on-chain sentiment, as the asset continues to be sensitive to geopolitical risk. The Net Unrealized Profit/Loss (NUPL) indicator, which measures aggregate market psychology through unrealized gains and losses, reflected investors’ shifting emotions throughout the month. On October 10, when Trump threatened 100% tariffs on Chinese imports, Bitcoin tumbled by 8.4% to around $104,800. NUPL simultaneously dipped below 0.50, a level historically associated with rising fear and profit-taking. A few days later, as Trump adopted a softer tone on China, Bitcoin recovered toward the mid-$110,000 range while NUPL reflected cautious optimism. However, renewed tensions on October 14, which saw new export controls and port fees, ended up triggering another sell-off, which pushed both BTC price and NUPL lower again. Sentiment began to stabilize only after October 24, when news of Trump’s upcoming summit with his Chinese counterpart, Xi Jinping. Bitcoin climbed above $115,000, and NUPL started to recover. By October 26, reports emerged that Trump might cancel the tariff plan, which further boosted confidence, and NUPL approached 0.52, indicating growing market strength. Pointing to this market volatility and sentiment swings, CryptoQuant stated that geopolitical shocks like Trump’s trade threats don’t just shake prices; they also “reshape market sentiment.” BTC Shorts Liquidated As Bitcoin rebounded, over-leveraged short traders got liquidated. The asset now hovers above the $114,000 support zone, a level that recently acted as a strong area of buyer defense. According to crypto analyst Ted Pillows, the next key step for it is to reclaim the $118,000 zone, which has repeatedly served as short-term resistance throughout October’s choppy trading. A move above this threshold, he suggested, could pave the way for a new all-time high within the next one to two weeks. Not everyone shares the growing optimism. Another market expert, Ali Martinez, for one, warned that the asset could soon face profit-taking pressure, as the TD Sequential indicator has flashed a sell signal on the daily chart – a tool often used to identify potential trend exhaustion. The post How Trump’s Words Moved Bitcoin: From Panic to Confidence in Just 2 Weeks appeared first on CryptoPotato.

Bitcoin price breaks out of triangle at $115K, bullish momentum or bear trap ahead?

Bitcoin price breaks out of triangle at $115K, bullish momentum or bear trap ahead?Bitcoin price breaks out of a local triangle pattern and rallies toward $115,000, but the move faces major resistance at the channel high where a potential bull trap could emerge. Bitcoin (BTC) price has successfully broken out of a local triangle…

Mt. Gox Delays Creditor Repayments Again, Pushes Deadline to 2026

Mt. Gox Delays Creditor Repayments Again, Pushes Deadline to 2026Mt. Gox has extended its repayment deadline by another year to October 31, 2026, marking yet another delay for creditors awaiting restitution from the 2014 collapse. Rehabilitation trustee Nobuaki Kobayashi announced the extension on Monday, citing incomplete procedures and unresolved issues affecting numerous creditors who have not yet received their distributions.The decision comes despite the trustee having largely completed base, early lump-sum, and intermediate repayments for creditors who cleared the necessary verification steps. Many claimants remain without compensation due to procedural delays and complications during the payment process, prompting the court-approved extension to facilitate distributions “to the extent reasonably practicable.”Previous Bitcoin Movements Heighten ExpectationMt. Gox-linked wallets executed a major transaction back on March 6, transferring 11,833.64 BTC worth over $1 billion, according to blockchain analytics firm Arkham Intelligence. The movement saw 166.5 BTC sent to a known cold wallet while the remaining 11,834 BTC moved to an unidentified address.Exchange-related entities still control approximately 36,080 BTC valued at $3.26 billion, down from holdings that once topped 850,000 BTC before the catastrophic 2014 hack. The transaction occurred back then during heightened crypto market volatility triggered by US President Donald Trump’s trade tariffs implemented on March 4, which rattled high-risk assets, including Bitcoin. Mt. Gox moves over $1b to an unmarked wallet, the first major transfer in a month, fueling renewed speculation on creditor repayments. #MtGox #Arkham https://t.co/3mEUCf3lVN— Cryptonews.com (@cryptonews) March 6, 2025 Previous movements in December saw Mt. Gox shuffle about 1,620 BTC through unknown wallets, weeks after transferring over 24,000 BTC under similar circumstances. These sporadic yet substantial transfers have fueled speculation about whether the exchange is preparing for creditor distributions or restructuring its holdings for reasons known to them.Strive’s Billion-Dollar Play for Discounted ClaimsVivek Ramaswamy’s Strive Asset Management disclosed in May plans to acquire 75,000 Bitcoin through Mt. Gox bankruptcy claims, valued at approximately $8 billion. The strategy, requiring shareholder approval, aims to purchase Bitcoin at discounted prices to enhance per-share value and outperform Bitcoin’s long-term trajectory.However, Strive has evolved beyond just pursuing Mt. Gox claims and has aggressively expanded its Bitcoin treasury by other means. The company recently announced a $1.34 billion all-stock merger with Semler Scientific, which will add nearly 5,816 BTC to its holdings. Strive (Nasdaq: $ASST) just filed our Form S-4 registration for the pending acquisition of @SemlerSci (Nasdaq: $SMLR).This is a major milestone toward scaling our Bitcoin holdings, advancing our capital formation strategy, and strengthening our mission to outperform Bitcoin…— Strive (@strive) October 10, 2025 In addition, Strive has raised approximately $750 million in funding dedicated to Bitcoin purchases, and it continues to grow its treasury through mergers, acquisitions, and direct Bitcoin acquisitions.Back then, Strive partnered with 117 Castell Advisory Group to source and evaluate claims that had received definitive legal judgments pending distribution. The firm intends to file Form S-4 registration with the Securities and Exchange Commission, after which shareholders will vote on the acquisition through a proxy statement.Consequently, Strive seems to have moved past relying solely on Mt. Gox claims and is actively building a diversified Bitcoin treasury through new acquisitions and capital raises.FTX Creditors’ Hanging FateBankrupt exchange FTX announced in July that September 30 would be the start date for its next cash distribution round, with August 15 set as the record date for eligible claimants. The distribution was said to cover Class 5 Customer Entitlement Claims, Class 6 General Unsecured Claims, and approved Convenience Claims through partners BitGo, Kraken, and Payoneer.FTX secured court approval to reduce its disputed claims reserve by $1.9 billion from $6.5 billion to $4.3 billion, freeing additional capital for creditor payouts. FTX’s fallout is moving into a new phase, with unresolved claims under legal review and high-profile figures entering settlements.#ftx #cryptohttps://t.co/BB1Jg4qmoA— Cryptonews.com (@cryptonews) July 7, 2025 The exchange has returned approximately $6.2 billion to date following its November 2022 collapse, which resulted in founder Sam Bankman-Fried receiving a 25-year prison sentence for defrauding customers and investors of over $11 billion.Federal records confirm that Bankman-Fried is projected to be released on December 14, 2044, serving less than 21 years of his 25-year sentence due to good-behavior credits. The early release timeline has erupted speculation about a potential presidential pardon following President Trump’s recent clemency for Binance founder Changpeng Zhao, with SBF pardon odds jumping 6% on Polymaket immediately after CZ’s announcement.The post Mt. Gox Delays Creditor Repayments Again, Pushes Deadline to 2026 appeared first on Cryptonews.

Bitcoin Price Prediction: Bitcoin Shines With Weekend Pump On China Trade Deal Expectations – Is BTC About to Hit $130K This Week?

Bitcoin Price Prediction: Bitcoin Shines With Weekend Pump On China Trade Deal Expectations – Is BTC About to Hit $130K This Week?Bitcoin is trading with a bullish bias, having surged to $115,185, rising nearly 1.40% in 24 hours. Most of the optimism is driven amid renewed US-China trade talks which is supporting broader risk sentiment. With a market cap of around $2.29 trillion and daily trading volume of above $56.6 billion, Bitcoin remains the top-ranked cryptocurrency globally, supported by its limited circulating supply of 19.94 million BTC.US-China Trade Talks Ease Market TensionsThe positive sentiment follows reports that Washington and Beijing reached a trade “framework” during weekend talks in Kuala Lumpur, easing concerns of an escalating tariff war. The potential deal, expected to be formalized during Thursday’s APEC Summit in South Korea, could prevent the US from imposing a 100% tariff on Chinese goods and delay China’s planned rare-earth export controls.According to US Treasury Secretary Scott Bessent, Beijing has agreed to boost agricultural imports, including soybeans, which could support US farmers. China’s Vice Premier He Lifeng echoed similar optimism, stating that both sides achieved “a basic consensus” and would finalize details soon.Asian equities and commodities rose on Monday, extending gains, as markets priced in a potential easing of geopolitical risks that have clouded growth forecasts for much of 2025.Trade Tensions and Market OutlookThis week’s Trump-Xi meeting is crucial as the market participants are expecting progress toward de-escalating tariffs and technology restrictions, especially after Beijing’s recent announcement requiring export licenses for certain semiconductor materials and rare-earth elements, minerals essential for manufacturing electric vehicles and defense systems. China Foreign Minister says President Xi Jinping & President Trump respect each other. pic.twitter.com/fBVl3IlU0S— Mayank Dudeja || SPYONGEMS (@imcryptofreak) October 27, 2025 Trump’s retaliatory tariff threats had spooked markets earlier this month. However, recent updates suggest a more measured tone; therefore, easing trade tensions could revive global risk appetite. This may indirectly benefit cryptocurrencies such as Bitcoin, which often move in tandem with macroeconomic sentiment. Rare-earth restrictions could disrupt global supply chains if talks fail. Agricultural deals may stabilize US-China relations short term. Investor sentiment remains fragile ahead of the APEC summit outcome. Bitcoin Technical Analysis: Resistance AheadOn the technical front, the BTC/USD rebound from $108,600 has gained traction, but the price now faces a key hurdle around $117,600. A double-top resistance zone is extending this particular level. This level aligns with the 61.8% Fibonacci retracement, a historically strong reversal point.Recent candlestick patterns show small bodies with upper wicks, reflecting short-term hesitation. Meanwhile, the 20-day and 50-day EMAs around $112,400 have crossed bullishly, confirming underlying strength. The RSI at 55 shows room for further upside before entering overbought conditions.Bitcoin Price Chart – Source: TradingviewA sustained breakout above $117,600 could propel BTC toward $120,500 and potentially $124,100, while a failure to clear the resistance could trigger a pullback to $112,200 or $108,600.Trade Setup: Bullish: Enter on breakout above $117,600, targeting $120,500–$124,100 with stops near $112,200. Bearish: Short below $117,600, targeting $112,200 with stops above $118,000. Bitcoin’s structure remains cautiously bullish, supported by higher lows and strong volume. However, traders should watch closely as market momentum begins to slow near this critical resistance area.Bitcoin Hyper: The Next Evolution of BTC on Solana?Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $24.7 million, with tokens priced at just $0.013165 before the next increase.As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.Click Here to Participate in the PresaleThe post Bitcoin Price Prediction: Bitcoin Shines With Weekend Pump On China Trade Deal Expectations – Is BTC About to Hit $130K This Week? appeared first on Cryptonews.

Bitcoin Eyes $136,000 Target Following October Recovery as Technical Pattern Emerges

Bitcoin Eyes $136,000 Target Following October Recovery as Technical Pattern EmergesAccording to the said commentator, the premier digital currency’s graph is showing noteworthy signs of a major price breakout that will propel it to new heights.

Bitcoin Eyes $136,000 Target Following October Recovery as Technical Pattern Emerges

Bitcoin Eyes $136,000 Target Following October Recovery as Technical Pattern EmergesAccording to the said commentator, the premier digital currency’s graph is showing noteworthy signs of a major price breakout that will propel it to new heights.

Ethereum up 6% as Bull Flag Pattern Emerges, $5,000 Next?

Ethereum up 6% as Bull Flag Pattern Emerges, $5,000 Next?Ethereum, the second-most-popular cryptocurrency, has outperformed with a 6% increase, driven by momentum, with analysts highlighting a bull flag formation on its charts.

Crypto Market Sees Significant Gains: EVAA, CLANKER, AT, H, and CLASH Lead the Week

Crypto Market Sees Significant Gains: EVAA, CLANKER, AT, H, and CLASH Lead the WeekDuring a volatile week in the cryptocurrency market, EVAA, CLANKER, AT, H, and CLASH emerged as the top gainers, showcasing impressive growth and market activity. (Read More)

Western Union Initiates Stablecoin Transfers as Fed Targets Payment-Only Breakthrough

Western Union Initiates Stablecoin Transfers as Fed Targets Payment-Only BreakthroughWestern Union facilitates the movement of billions of dollars every year. As of October 27, the payment and remittance processor had a market cap of over $2.9Bn, generating over $1Bn in adjusted revenue in Q3 2025. And now that market share could be shifting onchain, The problem is that, though many users still rely on traditional finance rails to move funds across the world, alternatives are quickly catching up and gnawing market share. A significant threat to Western Union is the emergence and expansion of stablecoin issuers like Tether and Circle. Presently, the stablecoin market stands at over $312Bn. The largest stablecoin issuer, Tether, has minted over $183Bn of USDT, which tracks the greenback. Circle, the issuer of USDC, is fast rising up the market cap ranks, issuing over $76.2Bn of stablecoins. (Source: Coingecko) DISCOVER: 10+ Next Crypto to 100X In 2025 Western Union Initiates Stablecoin Transfers: What’s the Impact? Unsurprisingly, Western Union is jumping on the stablecoin bandwagon to avoid being left behind and perhaps even rendered obsolete. Since the enactment of the GENIUS Act in July 2025, many more firms have been experimenting with and integrating stablecoins. On Thursday last week, during Western Union’s Q3 2025 earnings call, CEO Deven McGranahan said the financial services company had launched a pilot that leverages stablecoins for value transfer. The CEO notes that the trial program will specifically focus on leveraging the blockchain and stablecoins to “reduce dependency on legacy correspondent banking systems.” In turn, this will shorten settlement times and, most importantly, improve capital efficiency. By leveraging stablecoins and instead of entirely depending on traditional rails, Western Union has a chance to move money cheaply and with “greater transparency.” Unlike fiat, which operates in opaque networks where the amount, source, and recipients are often obscured, crypto and stablecoin transfers are easier to track. If Western Union uses a public chain like Ethereum, every transfer will be easily monitored onchain, introducing higher transparency and trust. Still, it remains to be seen how Western Union will handle fluctuating gas fees, especially on Ethereum, which is a choice public chain for many finance companies. Ethereum continues to scale via layer-2s like Base, but fees on the mainnet can change drastically, sometimes spiking to over $50, depending on the network’s activity. (Source: Etherscan) DISCOVER: Best Meme Coin ICOs to Invest in 2025 Is The Proposal For a Payment-Only Fed Account A Breakthrough? If the Western Union pilot is successful, many more payments and finance companies will likely adopt the stablecoin approach, integrating this new technology or even becoming stablecoin issuers, such as PayPal. PayPal, which also facilitates the transfer of value and processing of transactions, is one of the largest stablecoin issuers. Through a partnership with Paxo, over $2.7bn of PYUSD stablecoin has been minted and distributed, earning an attractive yield across DeFi. As 99Bitcoins reported, Governor Waller recently proposed the creation of “skinny” Fed master accounts for Fintech companies, including stablecoin issuers. These payment-only Fed accounts will have balance caps and will likely boost crypto and DeFi by enabling direct Fed connectivity to eligible entities. Here, stablecoin issuers will benefit from cheap and instant settlement via Fedwire without the need for intermediaries. Big Crypto news from the Fed Federal Reserve Governor Christopher Waller just proposed "payment accounts" (aka "skinny master accounts") that could give crypto and fintech companies limited direct access to the Fed's payment systems like FedNow. This means faster , cheaper… pic.twitter.com/8DPgcmHKKx — Daniela (@chicablockchain) October 22, 2025 As a result, if this proposal passes, not only will crypto and DeFi be stable, but stablecoin issuance will also be smooth, allowing the dominance of USD-backed stablecoins across the globe. DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025 U.S. and China seek to resolve trade frictions Rare earth metal export controls might be delayed by a year China to import more soybeans from U.S. Bitcoin news: Will BTC USDT fly to over $126,000? The post Western Union Initiates Stablecoin Transfers as Fed Targets Payment-Only Breakthrough appeared first on 99Bitcoins.

Fed Interest Rate Decision and a Potential Merger: Crypto Week Ahead

Fed Interest Rate Decision and a Potential Merger: Crypto Week AheadYour look at what's coming in the week starting Oct. 27.

Alibaba Affiliate Ant Group Files ‘AntCoin’ Trademark in Hong Kong, Hinting at Crypto Ambitions

Alibaba Affiliate Ant Group Files ‘AntCoin’ Trademark in Hong Kong, Hinting at Crypto AmbitionsWhile the filing doesn’t confirm a token launch, it shows Ant Group laying legal groundwork to merge its Alipay ecosystem with regulated Web3 and stablecoin infrastructure.

100% Of Bitcoin Bull Market Peak Indicators Remain Untouched, Is There Still Room To Run?

100% Of Bitcoin Bull Market Peak Indicators Remain Untouched, Is There Still Room To Run?Over the years, a number of indicators have emerged that have often helped to pinpoint the Bitcoin bull market peak. These indicators have been triggered in previous cycles, and their triggers have often been a signal that it was...

Astros Launches and Joins the $1 Trillion Perp DEX Horse Race

Astros Launches and Joins the $1 Trillion Perp DEX Horse RaceThe new decentralized exchange (DEX) is built on top of the Sui blockchain which recently topped $2.6 billion in total value locked (TVL). A New Contender Emerges in the $1 Trillion Perpetual DEX Race Perpetual DEXs topped $1 trillion...

BIP-444: The Soft Fork Proposal Aiming to Restrict Arbitrary Data Sparks Fierce Debate in Bitcoin Community