Grayscale Investments launched its Solana Trust ETF on NYSE Arca on Tuesday, becoming the first of the firm’s staking products to uplist under new SEC-approved generic listing standards. The move intensifies competition in the nascent Solana ETF market, where Bitwise’s debut product already captured $69.5 million in first-day inflows.The launch expands Grayscale’s digital asset lineup beyond Bitcoin and Ethereum, offering investors exposure to Solana’s proof-of-stake blockchain through a familiar exchange-traded wrapper. GSOL now joins Bitwise’s BSOL and Rex-Osprey’s SSK as the third Solana ETF trading on U.S. exchanges.Grayscale Enters With Staking-Enabled StructureGSOL carries a 0.35% expense ratio and holds 525,387 SOL tokens, with 74.89% currently staked to generate network rewards. Grayscale intends to pass on 77% of all staking rewards to investors on a net basis, potentially adding 5-6% annual returns based on historical Solana staking yields of 6-8%. Introducing Grayscale Solana Trust ETF (Ticker: $GSOL), offering investors exposure to @Solana $SOL, one of the fastest-growing digital assets. $GSOL features: Convenient Solana exposure paired with staking benefits. Exposure to a high-speed, low-cost blockchain.… pic.twitter.com/TgVNlhqBPO— Grayscale (@Grayscale) October 29, 2025 The fund first launched as a private trust in 2021, was listed on OTCQX in 2023, and began staking in October 2025.Inkoo Kang, Senior Vice President of ETFs at Grayscale, framed the launch as evidence that digital assets belong in “modern portfolios” alongside traditional equities and bonds. Kristin Smith, President of Solana Policy Institute, also noted that staking ETPs allows investors “to help secure the network, accelerate innovation for developers, and earn rewards on one of the most dynamic assets in modern finance.”The product is not registered under the Investment Company Act of 1940, meaning it lacks the regulatory protections of traditional ETFs and mutual funds. Grayscale emphasized that GSOL represents indirect exposure to Solana and carries significant risks, including the potential loss of principal.Bitwise Dominates Early Solana ETF FlowsBitwise’s Solana ETF captured $69.5 million on its October 28 debut, nearly six times the $12 million raised by Rex-Osprey’s competing product. BSOL stakes 100% of its held SOL tokens in-house to deliver Solana’s full network yield to investors, charging a 0.20% management fee that has been waived for the first three months.Matt Hougan, Bitwise’s Chief Investment Officer, attributed institutional enthusiasm to Solana’s on-chain revenue leadership. “Institutional investors love ETFs, and they love revenue,” he said. Institutional investors love ETFs, and they love revenue. Solana has the most revenue of any blockchain. Therefore, institutional investors love Solana ETFs.I have a feeling the Bitwise Solana Staking ETF, $BSOL, is gonna be huge.This material must be accompanied by a…— Matt Hougan (@Matt_Hougan) October 28, 2025 Rex-Osprey’s SSK takes a different approach, holding 54% in direct Solana, 43.5% in a Swiss-listed CoinShares ETP, and the remainder in JitoSOL and cash, with monthly staking rewards classified as return of capital for tax purposes.Despite positive sentiment around ETFs, the market remains cautious about near-term price action. Traders on Polymarket give Solana just a 28% chance of reaching a new all-time high before 2026, with SOL trading at $200 today, up nearly 1% over 24 hours.Source: PolymarketSolana Challenges Ethereum’s Institutional DominanceSpeaking with Cryptonews, Maria Carola, CEO of StealthEX, views the Solana ETF launch as a defining moment in the battle for Layer 1 blockchain dominance. “The launch of a spot ETF on Solana is a signal that has broken out in the protracted battle for dominance in the Layer 1 blockchain space,” she said. “For the first time, institutional investors are being invited to consider Solana as a standalone macro asset.“Carola notes that projections of $3 billion in ETF inflows over the next 12-18 months depend on Solana maintaining its 2024 momentum in DeFi expansion and network stability. She acknowledges that while Solana offers technological advantages in speed and scalability, “it’s Ethereum’s fundamentals, such as stability, institutional reputation, and integration into the global financial system, that maintain its leadership.” Ethereum currently holds over $60 billion locked in DeFi with a mature staking ecosystem that continues to set the standard for institutional investors seeking predictability and reliability.However, Carola suggests a potential coexistence model where “Ethereum serves as the underlying trust and settlement layer in the on-chain economy, while Solana becomes its high-performance execution engine.” She adds that if ETF inflow projections are met by the end of 2025, “Solana could become the first blockchain since Ethereum to break the institutional glass ceiling.“Regulatory Momentum Builds Across Multiple BlockchainsThe Solana ETF wave follows Hong Kong’s October approval of China Asset Management’s SOL spot fund, which began trading on October 27 with a minimum investment of $100. The product carries a 0.99% management fee and a 1.99% total expense ratio, making Solana the third cryptocurrency, after Bitcoin and Ethereum, to receive spot ETF clearance in the territory. Multiple U.S. issuers, including VanEck, Canary Capital, Franklin Templeton, Fidelity, and CoinShares, have also received approval for Solana ETF proposals. SEC Poised to Approve HBAR ETF — Hedera’s Gregg Bell calls it a “new chapter” for regulated crypto access, marking the first time investors can gain ETF exposure to $HBAR#HBAR #ETFhttps://t.co/x1w10VfAvE— Cryptonews.com (@cryptonews) October 28, 2025 Recently, Bloomberg analyst Eric Balchunas also confirmed that the SEC is expected to approve the first Hedera and Litecoin ETFs, with listing notices for Canary’s HBAR and LTC products scheduled for October 28. The post Solana ETF Race Heats Up as Grayscale Joins Bitwise on Wall Street appeared first on Cryptonews.

More Headlines

Alibaba’s Qwen3-MAX AI With Explosive 3-Month Solana Price Prediction – Is SOL Going to Hit $320 By January 2026?

CryptoNews.com

Altcoin ETFs Slam $69M In Trading Volume As FOMC Set To Pump BTC USD Price

99bitcoins

[LIVE] Crypto News Today, October 29 – Bitcoin Price Hovers Around $113K, Ethereum at $4K, and ZCash Could Be Ready for Another Run? Next 1000x Crypto Ahead of FOMC?

99bitcoins

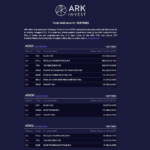

Cathie Woods Crypto Shopping Spree: Best Crypto to Buy Based on ARK Invest Bids

99bitcoins

Why Is Crypto Down Today? – October 29, 2025

CryptoNews.com

Is Bank of England Quietly Tapping HBAR Crypto For Stablecoin Push?

99bitcoins