LtcLive Feed

Ltc breaking news and instant alerts. Crypto Feed's minimalist interface delivers verified headlines, price movements, and protocol updates the moment they happen. Fast, focused, no fluff.

Ripple News: New Report Reveals XRP ETF Launch Timeline

Ripple News: New Report Reveals XRP ETF Launch TimelineThe post Ripple News: New Report Reveals XRP ETF Launch Timeline appeared first on Coinpedia Fintech News The first-ever spot ETFs for Solana (SOL), Litecoin (LTC), and Hedera (HBAR) began trading on Wall Street yesterday, marking a big moment...

Ripple News: New XRP Report Reveals ETF Launch Timeline

Ripple News: New XRP Report Reveals ETF Launch TimelineThe post Ripple News: New XRP Report Reveals ETF Launch Timeline appeared first on Coinpedia Fintech News The first-ever spot ETFs for Solana (SOL), Litecoin (LTC), and Hedera (HBAR) began trading on Wall Street yesterday, marking a big moment...

数据:美国 Hedera 现货 ETF 和 Litecoin 现货 ETF 上市,首日均无净流入流出

数据:美国 Hedera 现货 ETF 和 Litecoin 现货 ETF 上市,首日均无净流入流出ChainCatcher 消息,Canary HBAR ETF(股票代码HBR)、Canary Litecoin ETF(股票代码LTCC)在纳斯达克正式上市,均为该币种首只美国现货ETF。从上市第一天资产规模来看,远小于同日上市Solana现货ETF 2.9亿美元的资产规模,低于市场预期。 根据 SoSoValue 数据,HBR上市首日无净流入流出,交易额 863 万美元,总资产净值 109 万美元,HBAR净资产比率(市值较 HBAR 总市值占比)达 0.01%;LTCC上市首日无净流入流出,交易额 138 万美元,总资产净值 96.9 万美元,LTC净资产比率(市值较LTC总市值占比)达 0.01%。 Canary HBAR ETF 支持现金和实物申赎,不支持 HBAR 通过质押提供额外收益,管理费率 0.95%。Canary Litecoin ETF 仅支持现金申赎,管理费率0.95%。

ETF Launch Countdown: Solana, Litecoin, and Hedera Set to List Despite U.S. Government Shutdown

ETF Launch Countdown: Solana, Litecoin, and Hedera Set to List Despite U.S. Government ShutdownInstitutional investors are brimming with excitement as exchange-traded funds (ETFs) linked to Solana (SOL), Litecoin (LTC), and Hedera (HBAR) prepare to debut on U.S. exchanges this week, even as the U.S. Securities and Exchange Commission (SEC) remains partially shut down. Industry insiders confirm that fund issuers have filed the requisite documents and received listing notices, paving the way for a landmark expansion of crypto products into the traditional finance sphere. Altcoin ETF wave surges ahead The stalwart asset managers behind this push, Bitwise Asset Management, Canary Capital, and Grayscale Investments, have signalled that their funds will launch this week. According to Bloomberg analyst Eric Balchunas, exchange listing notices have been posted for Bitwise’s Solana ETF and Canary’s Litecoin and Hedera ETFs, with launches slated for Tuesday. Grayscale’s Solana fund conversion is expected on Wednesday. What’s key is how this is happening despite the U.S. government shutdown. Issuers are relying on regulatory mechanisms, notably Form 8-A filings and amended S-1 registration statements allowing automatic effectiveness after 20 days, to go live without requiring the SEC’s manual sign-off. This regulatory workaround, combined with the generic listing standards approved in September, has created a rare window for altcoin ETFs to break into the market. What the new ETFs mean for crypto markets For Solana, this ETF launch could prove transformative. As the sixth-largest blockchain by market cap, Solana already draws institutional interest for its high-speed ecosystem. The proposed product from Bitwise (ticker: BSOL) reportedly includes staking features, offering long-term holders a compelling “own crypto via a regulated fund” route. Meanwhile, Litecoin and Hedera, though smaller in market cap, gain legitimacy through this ETF channel. Canary Capital’s CEO confirmed the spot LTC and HBAR funds will trade on the Nasdaq starting Tuesday under the tickers “LTCC” and “HBR”. Institutional access is widening. Investors who previously needed to hold crypto wallets and navigate exchange custody can now access regulated funds via brokerage accounts. The market views this as a major step in bridging DeFi/crypto assets with mainstream finance. Bottom Line That said, timing matters. The surrounding conditions, regulatory innovation, shutdown-driven inertia at the SEC, and investor appetite for fresh crypto exposure, have aligned uniquely. Market watchers caution that while the launches are historic, they are not without risk, token prices, liquidity flows, and investor behaviour around product debut remain uncertain. In sum, the crypto industry stands at a tipping point. With Solana, Litecoin, and Hedera gaining regulated ETF wrappers, the era of altcoin funds may be officially underway, despite Washington being partially shut down. The countdown is on. Cover image from ChatGPT, SOLUSD chart from Tradingview

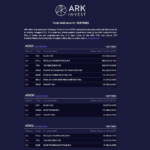

Cathie Woods Crypto Shopping Spree: Best Crypto to Buy Based on ARK Invest Bids

Cathie Woods Crypto Shopping Spree: Best Crypto to Buy Based on ARK Invest BidsCathie Wood is adding to her crypto-themed stock bets. This week, she put about $31 million into Jack Dorsey’s Block as demand for Bitcoin ETFs picked up again. According to an official announcement on X, ARK Invest bought $30.9 million in Block shares on Monday. The position was spread across three of its funds: ARKK, ARKW, and ARKF. Here's every move Cathie Wood and Ark Invest made in the stock market today 10/27 pic.twitter.com/4tKJozNK29 — Ark Invest Tracker (@ArkkDaily) October 28, 2025 The move fits ARK’s ongoing interest in companies linked to digital assets. It landed during a stretch of renewed inflows into US Bitcoin ETFs and the launch of new products focused on alternative tokens. (Source: X) Block remains a major public name in Bitcoin-related payments. Its Square business recently rolled out tools that allow US merchants to accept Bitcoin with no fees and automatically convert daily card sales into BTC. Bitcoin traded near $114,000 on Tuesday afternoon in the US market, while Ether stayed around $4,060. ARK Invest continued to build its crypto exposure, adding 385,585 shares of Block. The firm has been leaning not only on crypto-linked ETFs but also on companies involved in digital payments and on-chain services. Its buying streak has stretched into consumer platforms as well. Late last week, ARK purchased about $21.3 million worth of Robinhood shares across its funds. DISCOVER: Best New Cryptocurrencies to Invest in 2025 Here's every move Cathie Wood and Ark Invest made in the stock market today 10/22 pic.twitter.com/vk3O3vh5iD — Ark Invest Tracker (@ArkkDaily) October 23, 2025 The disclosure followed soon after and helped lift the stock during the session. The ARK 21Shares Bitcoin ETF (ARKB) recorded roughly $76.4 million in net inflows on Monday, the strongest single-day haul among BTC funds. US spot bitcoin ETFs have now posted gains for three straight days. (Source: Farside Investors) The market also saw new ETF options land on Tuesday. Spot products tied to Solana (SOL), Hedera (HBAR), and Litecoin (LTC) began trading, giving investors more regulated ways to access crypto beyond Bitcoin and Ether. DISCOVER: 20+ Next Crypto to Explode in 2025 What ARK’s bids imply about “best crypto to buy”? ARK is putting more money into Block. The move comes soon after its Square unit rolled out new Bitcoin payment and treasury tools for merchants. It shows ARK is still betting on Bitcoin’s real-world use. With steady inflows into ARKB, the message is clear: BTC remains the main focus. The recent Robinhood purchase highlights the importance of retail trading. Activity on the platform generally rises when altcoins get more liquidity. With expected ETFs tied to SOL, HBAR, and LTC, Solana now sits beside Bitcoin and Ethereum as one of the key assets to watch. ARK has moved in and out of Coinbase several times in 2025. This week, it leaned toward Block and Robinhood. The shift suggests ARK is focusing on payment networks and easier retail access, not only traditional exchange exposure. DISCOVER: 20+ Next Crypto to Explode in 2025 Join The 99Bitcoins News Discord Here For The Latest Market Updates The post Cathie Woods Crypto Shopping Spree: Best Crypto to Buy Based on ARK Invest Bids appeared first on 99Bitcoins.

SOL, HBAR, LTC ETFs Begin Trading in US, Marking New Era for Regulated Crypto Access

SOL, HBAR, LTC ETFs Begin Trading in US, Marking New Era for Regulated Crypto AccessCrypto just hit a new gear as three groundbreaking spot ETFs—focused on SOL, HBAR, and LTC—launched under the 1933 Act, unleashing regulated access to top digital assets and igniting a surge of institutional enthusiasm across markets. New Crypto Spot...

Litecoin (LTC) Price Prediction: LTC Breaks Out From Triangle Pattern, Targets $150 Rally Ahead

Litecoin (LTC) Price Prediction: LTC Breaks Out From Triangle Pattern, Targets $150 Rally AheadLitecoin (LTC) is showing strong signs of a potential breakout, positioning itself for a rally toward $150 or higher.

Bullish Signals: Top Crypto to Get Today, October 28 – HBAR, LTC, SOL

Bullish Signals: Top Crypto to Get Today, October 28 – HBAR, LTC, SOLThe US SEC approved several spot ETFs for top altcoins Hedera, Solana, and Litecoin, all of which have extremely bright potential. Today is the launch of Canary Capital’s HBAR and LTC ETFs, while Bitwise’s SOL ETF also begins trading today on the New York stock Exchange. Attention has now shifted to this week’s upcoming Federal Reserve FOMC meeting, where investors waiting for another interest rate cut. Despite a fairly severe recent crash that blighted most of October, traditionally the month of “Uptober. Many view the pullback as a healthy consolidation phase, one that clears out excess leverage and weak hands in preparation for the next major bull cycle.So, with substantial inflows expected in HBAR, LTC and SOL in the coming months, we take a look at just how high they can go. Hedera ($HBAR): Perhaps the Top Crypto is Not a Blockchain?Hedera (HBAR) is one of the most talked-about players in blockchain but it’s not actually a blockchain. Like every other blockchain, it is a distributed ledger system (DLS), however its unique Hashgraph technology offers a next-generation alternative to traditional blockchains with lightning-fast transactions, low fees, and rock-solid security. Additionally, the Hedera Council is a big lure for investors. Headed by a council of global giants like Google, IBM, and Boeing, HBAR carries institutional clout that’s rare to come by in crypto.News of Hedera’s approval in spot ETF investment products has caused the price to rally 17% in 24 hours. With a relative strength index (RSI) of 60, it appears there is more buying momentum right now, but there’s plenty of headroom left for further price appreciation before the week is out. There is sticky resistance at $0.35, but if US regulators manage to ignite a bull run, then $1 is conceivable. Litecoin ($LTC): The Silver to Bitcoin’s Gold Still Has Room to RunOften dubbed the “silver to Bitcoin’s gold,” Litecoin ($LTC) is an open-source, decentralized cryptocurrency created in 2011 by Charlie Lee as a streamlined fork of Bitcoin. While its Proof-of-Work (PoW) may seem outdated compared to modern Proof-of-Stake (PoS) systems like Ethereum and Cardano, Litecoin compensates with fast transaction speeds and low fees, making it a practical choice for everyday transactions.Using the Scrypt hashing algorithm, Litecoin allows easier mining than Bitcoin’s SHA-256. With a capped supply of 84 million coins and an active development team, it has retained its relevance through multiple market cycles.Compared to Hedera, Litecoin is lagging a little. It only rallied 3% in the last 24 hours, although it clocked a more considerable 10% rise in the last seven days.Litecoin has a neutral RSI of 52. Its support and resistance lines over the year may be resolving into a bullish descending triangle that often signals a breakout, in which case it could easily double from $100 to $200 in a monthSolana (SOL): Ethereum’s Top Rival Could Hit $1,000Solana ($SOL) continues to affirm its place as one of the fastest and most scalable blockchains in existence. With a market capitalization exceeding $109 billion and nearly $12 billion locked in DeFi applications, its ecosystem growth remains robust.Traders were closely watching potential developments around U.S.-based Solana spot ETFs. Today’s news could trigger a fresh wave of institutional investment similar to Bitcoin and Ethereum ETF inflows.Since bottoming near $100 in April, SOL has rebounded to around $199. Improved regulatory sentiment has bolstered confidence, while an RSI of 50 and a price now re-converged with its 30-day moving average, suggests today may be the start of a long Solana rallyKey support rests around $150, while major resistance stands at $250. ETFs could push SOL toward its previous peak of $293.31, or potentially even past $500, but $1,000 requires a sustained bull run.Maxi Doge (MAXI): One of the Year’s Top Crypto Presales is a Degen-Only Play with 100x PotentialMaxi Doge ($MAXI) is the latest meme coin sensation, currently in presale and already attracting over $3.8 million from investors eager to ride the next viral wave.Marketed as Dogecoin’s wilder, more chaotic cousin, Maxi Doge captures the playful and irreverent side of crypto’s degen culture through community memes, contests, and social media engagement.Built as an ERC-20 token on Ethereum, MAXI benefits from faster and more efficient transactions compared to Dogecoin’s legacy blockchain. Out of its 150.24 billion total token supply, 25% is allocated to the “Maxi Fund,” supporting marketing, partnerships, and ecosystem development.Staking is already available, offering up to 80% APY, though rates decrease as participation grows. The current presale price sits at $0.000265, increasing incrementally through each presale round.Purchase MAXI via MetaMask or Best Wallet.Stay updated through Maxi Doge’s official X and Telegram pages.Visit the Official Website HereThe post Bullish Signals: Top Crypto to Get Today, October 28 – HBAR, LTC, SOL appeared first on Cryptonews.

LTC Price Prediction: Litecoin Eyes $103-$106 Rebound as Technical Indicators Signal Bullish Momentum

LTC Price Prediction: Litecoin Eyes $103-$106 Rebound as Technical Indicators Signal Bullish MomentumLitecoin price prediction shows potential rebound to $103-$106 range within 1-2 weeks as MACD histogram turns bullish despite recent 3.28% decline. (Read More)

Big News: First Spot ETFs for Solana, Litecoin, and Hedera Go Live with $14.4M in First-Hour Volume

Big News: First Spot ETFs for Solana, Litecoin, and Hedera Go Live with $14.4M in First-Hour VolumeThe post Big News: First Spot ETFs for Solana, Litecoin, and Hedera Go Live with $14.4M in First-Hour Volume appeared first on Coinpedia Fintech News The first-ever spot exchange-traded funds (ETFs) for Solana (SOL), Litecoin (LTC), and Hedera (HBAR)...

Solana ETFs Could Draw Over $3B If Bitcoin, Ether ETF Trends Repeat

Solana ETFs Could Draw Over $3B If Bitcoin, Ether ETF Trends RepeatThree spot ETFs tracking SOL, HBAR and LTC went live under ’33 Act structure on Tuesday.

Litecoin Price Prediction: Is the LTC Price About to Explode Above $150 as First LTC ETF Lists Today?

Litecoin Price Prediction: Is the LTC Price About to Explode Above $150 as First LTC ETF Lists Today?Litecoin price prediction shows that the LTC token is about to explode above $150 following Canary Capital’s announcement today that it would launch an exchange-traded fund (ETF) tracking Litecoin (LTC) to be the first of such funds in the United States.According to an official statement, Issuer plans to launch the Canary Litecoin (LTCC) ETF on Nasdaq today following CERT approval with the U.S. Securities and Exchange Commission (SEC).Canary Capital CEO Steven McClurg stated that the Litecoin ETF will follow Ethereum as the next altcoin-based ETF to become effective, which has brought strong projections that LTC could soar 50% to $150. Canary Capital has just filed form 8-A with the SEC for the Canary Litecoin ETF to be listed on the @Nasdaq. Indicating that a launch is imminent and trading could soon commence. (NASDAQ:LTCC)Source: https://t.co/bvZW2tiROn pic.twitter.com/1yl8oM6G8l— Litecoin Foundation (@LTCFoundation) October 27, 2025 LTC Surges 9% As First U.S. Litecoin ETF Goes Live on NasdaqCurrently trading at $102.04 at press time, LTC is up 9% in the last 7 days and has a market cap of around $7.8 billion, putting it in the top 20 cryptocurrencies.Analysts have now revealed that LTC is showing strength on the weekly timeframe as the trend appears ready to flip upward, targeting $150 in the short term. Data also shows that most Litecoin bulls (holders with at least 100 LTC) are still holding their tokens for at least 4 years without selling, with precisely over 67% of all Litecoin in existence residing in these types of addresses.Source: X/LitecoinLitecoin price prediction: Ichimoku Breakout Points At $140- $300The LTC/USDT weekly chart displays a clear bullish breakout from a long-term ascending trendline that has supported price action since early 2024. After months of sideways movement between the $80-$120 range, the price has recently broken above a key resistance zone around $100-$103, suggesting renewed bullish momentum.The Ichimoku cloud indicator shows that the price has decisively broken above the cloud, which is a strong bullish signal indicating a potential trend reversal. Source: X/CryptoBull_360The cloud ahead extends into December, providing a projected path that could take Litecoin toward the $140 level in the near term.In the mid-term, the Litecoin price prediction suggests an ambitious target of approximately $300 by late 2025 or early 2026, representing a potential gain of over 100% from current levels.However, traders should be cautious of a potential retest of the breakout zone near $100 before the rally continues. The volume profile on the chart reveals that there was significant accumulation in the $60-$80 range during 2024, which often acts as strong support during pullbacks.AI Content Creation platform SUBBD Hits $1.3M Presale MilestoneWith Litecoin and other OG coins waking up to stage a typical Q4 rally, the DeFi and AI sectors have been seen leading market recovery, according to Wintermute’s latest market update. Investors are looking at solid early-stage projects at the intersection of AI and crypto.One with the hottest appeal right now is SUBBD, an AI agent creator platform that has already raised $1.3 million in its ongoing presale.The platform connects over 2,000 influencers with a combined audience exceeding 250 million fans who pay for premium content subscriptions. SUBBD generates revenue through these subscription fees, creating a sustainable business model.The presale currently offers access to acquire the SUBBD tokens at $0.0568 with 20% fixed staking returns for early participants. Investors can make purchases through the official SUBBD presale website using ETH, USDC, USDT, or BNB. There’s also an option to buy the SUBBD token using USD, GBP, AUD, and NZD via credit/debit cards or e-wallets such as Neteller and Skrill.The post Litecoin Price Prediction: Is the LTC Price About to Explode Above $150 as First LTC ETF Lists Today? appeared first on Cryptonews.

First U.S. Spot Solana and Litecoin ETFs Begin Trading

First U.S. Spot Solana and Litecoin ETFs Begin TradingThe first U.S. spot exchange-traded funds (ETFs) for Solana (SOL), Litecoin (LTC), and Hedera (HBAR) have officially begun trading.Visit Website

现货 SOL、LTC 和 HBAR ETF 已开始在华尔街交易

现货 SOL、LTC 和 HBAR ETF 已开始在华尔街交易ChainCatcher 消息,加密记者 Eleanor Terrett 在 X 平台发文表示,首批现货 SOL、LTC 和 HBAR ETF 已开始在华尔街交易。

HBAR, Litecoin post gains ahead of upcoming ETF launches

HBAR, Litecoin post gains ahead of upcoming ETF launchesAltcoins HBAR and LTC are experiencing price rallies as buzz surrounding their ETF launches draws market attention. At the time of writing, HBAR trades near $0.22, up 18.1% in the last 24 hours and about 1.57% higher over the past…

First Spot ETFs for Solana, Litecoin, and HBAR Set to Debut Amid SEC Clarity

First Spot ETFs for Solana, Litecoin, and HBAR Set to Debut Amid SEC ClarityThe U.S. market is about to welcome its first spot exchange-traded funds (ETFs) for Solana (SOL), Litecoin (LTC), and Hedera (HBAR). The funds, issued by Bitwise, Canary Capital, and Grayscale, are set to start trading today and tomorrow on Nasdaq and the NYSE, according to filings and industry sources. Legal Loophole and Market Reaction Journalist Eleanor Terrett shared in an October 27 post on X that the final regulatory step was completed when exchanges like the Nasdaq certified Form 8-A filings for the new funds. This form officially registers the ETF shares for public trading. The Canary HBAR ETF (HBR) and Canary Litecoin ETF (LTCC) are scheduled to start trading on October 28, as confirmed by Canary Capital CEO Steven McClurg. Similarly, the Bitwise Solana Staking ETF (BSOL) will launch on the same day, with Grayscale’s Solana Trust (GSOL) converting to a spot ETF on October 29. The launches are taking place even as parts of the U.S. government remain shut down. The issuers reportedly made use of a legal provision that lets registration statements go into effect automatically after 20 days without SEC intervention, therefore removing the need for a manual sign-off. Bloomberg’s James Seyffart added that the SEC’s Division of Corporate Finance had earlier published guidance clarifying this rule, which ETF lawyers used to push through the filings. Eric Balchunas, another Bloomberg analyst, confirmed that all exchange listing notices had been posted, calling it the “final step before shares can start trading.” Meanwhile, some traders on X debated the speed of the process, with one user cautioning that “there are still steps to take after submitting the 8-A form,” while others celebrated the milestone as “a win for crypto clarity.” Bitwise described its Solana Staking ETF as the first U.S. fund offering 100% direct exposure to SOL, targeting a 7% average staking reward with zero management fees for a limited time. Canary Capital’s HBAR ETF will hold real HBAR tokens in custody with BitGo and Coinbase Custody, while pricing data will be supplied by CoinDesk Indices. Broader Context and What Comes Next The new ETFs come after months of speculation that altcoin funds could soon follow Bitcoin and Ethereum’s lead. Back in June, Seyffart had raised the odds of approval for Solana and Litecoin ETFs to 90%, with HBAR close behind at 75%. His predictions now appear on target. This launch also fits into a broader pattern of growing demand for digital asset funds. As of October 22, there were 155 active ETF filings across 35 cryptocurrencies, according to Bloomberg data. Solana and Bitcoin led with 23 filings each, followed by XRP and Ethereum. Analysts say this flood of new products could soon reshape how traditional investors gain crypto exposure, though many may prefer diversified index-style funds over single-token ETFs. The post First Spot ETFs for Solana, Litecoin, and HBAR Set to Debut Amid SEC Clarity appeared first on CryptoPotato.

Solana, Litecoin, Hedera ETFs Ready? Experts Expect Tuesday Launch Despite Goverment Shutdown

Solana, Litecoin, Hedera ETFs Ready? Experts Expect Tuesday Launch Despite Goverment ShutdownMultiple crypto exchange-traded funds (ETFs) are set to launch this week despite the government shutdown, with investment products based on Solana (SOL), Litecoin (LTC), and Hedera (HBAR) seemingly ready to start trading as soon as Tuesday. Related Reading: Crypto...

HBAR steps onto Wall Street: Canary’s Hedera ETF Going Live on Nasdaq Imminently

HBAR steps onto Wall Street: Canary’s Hedera ETF Going Live on Nasdaq ImminentlyHedera’s native token, HBAR, will receive its first US exchange-traded wrapper on Tuesday, with Canary Capital’s HBAR ETF slated to begin trading on Nasdaq alongside the firm’s Litecoin product. These two first-of-their-kind listings will arrive in a week already marked by a number of crypto fund debuts. Canary’s chief executive, Steven McClurg, confirmed the launches after the firm filed the required Form 8-A registrations on Monday and finalized its S-1 under the SEC’s shutdown playbook, which allows registrations to go effective 20 days after filing when the delaying amendment is removed. Time for an HBAR ETF? pic.twitter.com/FHxRqHGXBI — Hedera Foundation (@HederaFndn) October 27, 2025 No Accident: HBAR ETF Launch Plays on US Shutdown Guidance The timing is not accidental. In mid-September, the SEC approved generic listing standards that allow exchanges to list spot commodity ETPs meeting preset criteria, thereby compressing approval timelines that previously required bespoke staff reviews. That plumbing, combined with the shutdown guidance from CorpFin, explains how multiple crypto ETFs, Solana from Bitwise on NYSE and Canary’s HBAR and LTC on Nasdaq are able to launch in the same 24-hour window despite constrained regulator staffing. For Hedera, an exchange-traded vehicle listed on a national market is more than a marketing milestone; it formalizes brokerage-account access to HBAR for RIAs and institutions that can’t, or won’t, manage direct custody. Early flows into the fund will serve as a live test of pent-up demand for enterprise-oriented L1 exposure in public markets, as well as a gauge of how much capital rotates from offshore ETPs or centralized exchange balances into US wrappers under the new standards. The CANARY $HBAR ETF — a Milestone for Hedera & Institutional Adoption What Happened?• Financial firm Canary Capital (via subsidiaries) has filed with the U.S. SEC to launch a Spot ETF directly tracking the price of @hedera $HBAR.• At the same time, Nasdaq filed a rule… pic.twitter.com/88wjDDxodV — Marco Ħ (@MarcoSalzmann80) October 27, 2025 Market watchers had flagged Canary’s filings as “at the goal line” in recent weeks; on Monday evening, ETF analysts pointed to listing notices and effectiveness updates as the last boxes checked before the bell. DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now HBAR ETF Marks Major Milestone: This Isn’t Just Another ETF HBAR’s setup differs from Bitcoin and Ether precedents in two ways that investors will care about. First, creation/redemption mechanics under the generic standards should reinforce tighter NAV discipline than earlier-era crypto products, particularly if authorized participants lean into in-kind activity. Second, Hedera’s Hashgraph consensus and enterprise governance pitch create a non-EVM diversification leg within alt exposure, which matters to allocators who see smart-contract beta as increasingly concentrated in EVM chains. If Canary’s product sees day-one liquidity and spreads stabilize quickly, expect rival issuers to accelerate HBAR filings under the same ruleset, just as Solana’s ETF lineup filled out within weeks. Market Cap 24h 7d 30d 1y All Time Macro context also amplifies the launch in a unique way. This ETF window lands ahead of mega-cap tech earnings and the FOMC decision, a pairing that can whipsaw risk budgets. Whether HBAR’s new wrapper functions as a flow magnet or a volatility amplifier will depend on the balance of primary-market creations versus secondary-market churn in the first sessions.# DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025 The post HBAR steps onto Wall Street: Canary’s Hedera ETF Going Live on Nasdaq Imminently appeared first on 99Bitcoins.

CRYPTO ALL GREEN, PPI TODAY, PUMP & IP LEAD ALTS

CRYPTO ALL GREEN, PPI TODAY, PUMP & IP LEAD ALTSCrypto mixed ahead of PPI, SOL outperforms. ETH ETFs get inflows after 6-day outflow streak. Metaplanet upsizes discounted $1.4b raise. KindlyMD commits $30m in Metaplanet equity raise. Sharplink buys back 1m shares. Ethena joins race for HYPE stablecoin. Native Markets favourite to win HYPE stablecoin race. CBOE plans perp style futures with BTC, ETH. Dems want seats at SEC, CFTC to support crypto bill. CFTC exploring recognising foreign crypto platforms. Gemini to IPO this week. Robinhood to embrace copy trading. Grayscale files for HBAR, LTC, BCH vehicles. Binance, SGB to offer direct USD transfers for retail. Vietnam approves 5 year crypto trading market pilot.