The Pound Sterling (GBP) extended its downtrend and reached seven-month lows near 1.3000 against the US Dollar (USD), before GBP/USD buyers quickly jumped in and recovered some ground. Pound Sterling rebounded; not out of the woods yet Safe-haven flows returned with a bang and acted as a strong headwind to the risk-sensitive Pound Sterling while boosting the US Dollar to its highest in five months against its six major currency rivals. “Sell everything” theme gripped the market as traders witnessed a wave of exhaustion following the Artificial Intelligence (AI) driven record rally in global stocks. US tech stocks tumbled, drowning the major indices, with investors selling Gold to cover their losses in equity markets. Investors grew concerned over inflated technology stock valuations, particularly in the artificial intelligence (AI) space, fuelling the long-due correction in global indices. That being said, the USD also found fresh support from reduced expectations that the US Federal Reserve (Fed) will deliver another interest rate cut in December. The December Fed rate cut bets were slashed after strong US private sector employment and services activity data. Data published by the ADP showed that US private payrolls increased by 42,000 jobs in October, exceeding expectations of a 25,000 gain, while the ISM Services PMI increased more than expected to 52.4 last month due to a solid jump in New Orders. This broad USD strength smashed the GBP/USD pair to challenge the 1.3000 psychological level before it staged a decent comeback in the latter part of the week. Cable’s turnaround was mainly driven by a sharp pullback in the USD across the board and US Treasury bond yields, following Thursday’s private labor data and resurfacing concerns over a protracted government shutdown. The executive outplacement firm Challenger, Gray & Christmas said on Thursday that corporations announced a 183.1% monthly surge in layoffs, the worst October in over two decades, per Reuters. The latest jobs data refuelled concerns about the weakening US labor market conditions, slightly boosting the odds of the Fed rate cut next month to 69% versus a drop to 62% seen after the release of the US ADP Employment Change data. The recovery in GBP/USD was unfazed by the Bank of England’s (BoE) dovish hold decision. The members of the BoE Monetary Policy Committee (MPC) voted 5-4 to maintain the key Bank Rate at 4%, in a narrower than expected split. The BOE underscored that future rate cuts will depend on the evolution of the outlook for inflation. “If progress on disinflation continues, Bank Rate is likely to continue on a gradual downward path,” the Monetary Policy Statement (MPS) said. Heading into the weekend, the USD came under renewed selling pressure and helped GBP/USD stretch higher. The monthly report published by the University of Michigan (UoM) showed that the Consumer Sentiment Index dropped to 50.3 in November from 53.6 in October. Week ahead: High-impact UK data to hog the limelight Amid a holiday-shortened week, the data drought from the United States (US) will likely continue as no end in sight to the government shutdown. The longest shutdown in American history will put the focus back on some private-sector statistics and speeches from Fed officials. In case the government funding is restored, the delayed US Nonfarm Payrolls and Jobless Claims will be eagerly awaited. The US Consumer Price Index (CPI), Producer Price Index (PPI) and Retail Sales reports for October will also be in focus. From the United Kingdom’s (UK) economic calendar, the employment data on Tuesday will offer some incentives to Pound Sterling traders. On Wednesday, BoE Chief Economist Huw Pill is due to speak in a panel discussion titled “An assessment of the BoE’s reaction to Covid-19” at the Institute of International Monetary Research Conference hosted by the University of Buckingham. Thursday will feature the monthly and preliminary reading of the British third-quarter Gross Domestic Product (GDP) data alongside the industrial figures. GBP/USD: Technical outlook GBP/USD: Daily Chart As observed on the daily chart, GBP/USD is struggling at the previous strong support-turned-resistance at 1.3142 on the road to recovery. The 14-day Relative Strength Index (RSI) has turned lower while below the midline, currently near 36, suggesting that more downside remains on the cards. Adding credence to the bearish potential, the 21-day Simple Moving Average (SMA) is looking to close the week below the 200-day SMA, which will confirm a Bear Cross if that happens. These technical indicators point to more pain for the GBP/USD pair heading into a new week. If the abovementioned resistance is scaled decisively, powerful resistance will then align around the 1.3265 region, where the Aug 4 low, the 21-day and 200-day SMA close in. A sustained move above that zone will unleash additional recovery toward the 50-day SMA barrier at 1.3393. Conversely, if the downside regains momentum, a test of the multi-month troughs at 1.3010 will be inevitable. Selling pressure will intensify below the latter, opening the door toward the April 11 low of 1.2967. The last line of defense for Pound Sterling buyers is seen at the 1.2850 psychological level. The post GBP/USD Weekly Forecast: Pound Sterling Sellers Refuse to Give Up Yet appeared first on BeInCrypto.

More Headlines

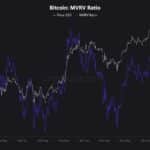

Bitcoin Miners Face Squeeze as Hash Price Nears Break-Even Levels

CryptoNews.com

Will Trump Give Out a 2k Stimulus Check? What You Need to Know

99bitcoins

Bitcoin Bear Market Is Fading as a Famous Short Closes Out: Why Bitcoin Hyper ($HYPER) Could Run Next

NewsBTC

Why Is The Crypto Market Up Today?

BeInCrypto

Rich Dad, Poor Dad Claims Bitcoin Price Still Going to $250K: Is Bitcoin Price Prediction Still Bullish?

99bitcoins

Bitcoin and Ethereum Forecast: Can BTC Rebound Toward $115K and Will ETH Clear Its Major Resistance Zone?

99bitcoins