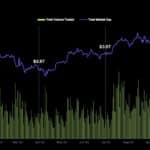

Chainlink (LINK) has lost almost 30% over the past month, including a fresh 8% drop in the last 24 hours alone. The latest data, however, suggests that the token might be quietly entering one of its strongest accumulation phases in recent memory. Strong Accumulation Signal Over just the past 30 days, CryptoQuant found that more than 15 million LINK have left centralized exchanges, and when zooming out to the start of the year, the pattern becomes way more meaningful. Interestingly, the exchange balances have dropped from over 180 million LINK to roughly 146 million today. That’s around 34 million tokens pulled into private custody, staking, or other non-exchange addresses. In practical terms, the share of LINK’s supply sitting on exchanges has fallen from about 18% to 15% this year. This is a surprisingly large shift in a relatively short time. Lower exchange balances normally translate into lower available sell-side liquidity. When holders move tokens off exchanges, it usually means they are not planning to sell immediately. Sharp inflows back into exchanges have very often lined up with local price tops, because traders move coins back to sell or take profit. The current trend is the opposite. LINK is experiencing pronounced outflows. It does not guarantee a rally, but it does signal a supply-squeeze type environment if demand stays steady. And with LINK’s growing role in cross-chain data flows and staking continuing to expand, this setup looks like a constructive mid-term structure, even if short-term volatility remains. Opportunity? Following a choppy October, LINK is currently trading near $16.1, but crypto analyst Ali Martinez stated that if the crypto asset does pull back to $15 in the short term, that dip could end up being a “golden buy zone” before a much bigger move higher. This area has historically acted as a strong support where large players accumulate. So if LINK dips there again, Martinez believes it could set the stage for a breakout later that pushes toward the $100 target he expects. Even Alphractal founder Joao Wedson had said that the current selling in LINK may actually be constructive. He recently argued this could be the last local reset before a larger move to the upside. Wedson explained that the Buy/Sell Pressure Delta sitting in negative territory typically reflects strong hands absorbing supply. Historically, the asset’s fall below major moving averages has been a solid entry zone rather than pointing to weakness. He added that a sharp upside move into year-end is still firmly on the table. The post Chainalink’s (LINK) Supply Shock Begins? 15 Million Tokens Vanish From Exchanges in 30 Days appeared first on CryptoPotato.

More Headlines

Cardano Founder Fires Back At Critics, Outlines 2026 Revival Plan

BitCoinist

CoinGecko Q3 Crypto Market Report: Key Trends for Bitcoin, Eth, & DeFi

99bitcoins

[LIVE] Crypto News Today, November 3 – Why Is Crypto Crashing Again? BTC Price USD Defends $107K as Balancer Is Being Exploited for Over $70M – Best Crypto to Buy

99bitcoins

Bitcoin May Be This Week’s Big Story As Saylor Teases Fresh Buy

NewsBTC

One Painful Dip Before Next Bitcoin Price Rally? Here’s What Charts Show

BeInCrypto

Macro Factors, Spot ETFs, and the New Bitcoin Price Roadmap

BeInCrypto