ChainlinkLive Feed

Chainlink breaking news and instant alerts. Crypto Feed's minimalist interface delivers verified headlines, price movements, and protocol updates the moment they happen. Fast, focused, no fluff.

- LIVE

Chainlink (LINK) Boosts Transparency for Gold-Backed Stablecoin GLDY with Streamex Partnership

Chainlink (LINK) Boosts Transparency for Gold-Backed Stablecoin GLDY with Streamex PartnershipStreamex Corp. partners with Chainlink to enhance transparency and cross-chain functionality for the gold-backed stablecoin GLDY, utilizing Chainlink’s Proof of Reserve and CCIP. (Read More)

- LIVE

Is MegaETH MEGA The Next 100X Crypto To Buy? Layer-2 Perfect For AI Agents And x402?

Is MegaETH MEGA The Next 100X Crypto To Buy? Layer-2 Perfect For AI Agents And x402?It is true that every crypto project Vitalik Buterin, the co-founder of Ethereum, endorses turns to gold. ETH crypto is already a huge success and may underpin the future of finance. At the moment, all eyes are on the MegaETH layer-2. MegaETH crypto is not your ordinary project. Already, not only is the MegaETH presale going viral, but the oversubscribed ICO makes it easy to see why it could be the next 100X crypto to buy now. (Source: Arkham) And MegaETH is not all about pomp and color. Whales are involved, and not only that, the MegaETH presale is bot-free. Those who bought MEGA crypto at the start of the presale are all verified humans. DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now The MegaETH Presale: Over $275M Raised In Hours Ahead of the MegaETH presale, it was clear that the community was eager to get in. Barely two hours after the MegaETH presale started, it raised over $285M. And not just that, according to Arkham Intelligence, the ICO was oversubscribed by more than 5X. $285 MILLION COMMITTED TO MEGAETH IN ONLY 2 HOURS The MegaETH public sale has been open for 2 hours so far – it is already oversubscribed by more than 5x. 819 addresses committed the max amount, sending $186,282 USDT to MegaETH’s sale address. pic.twitter.com/4KCcRhLDtH — Arkham (@arkham) October 27, 2025 Interestingly, onchain data shows that 819 addresses committed the maximum amount of 186,282 USDT. As 99Bitcoin reported, the MegaETH hard cap is roughly $50M, where 5% of the total supply has been allocated to the presale. Presale participants also had to get verified and buy MEGA tokens using only one address. DISCOVER: 20+ Next Crypto to Explode in 2025 Why is MegaETH Trending? Will MEGA 100X With AI Providing Tailwinds? MegaETH is building an Ethereum layer-2, not just any other off-chain platform. Their goal is to design and launch what they describe as the first “real-time” blockchain that will bridge the gap between Web2 and decentralized systems. The platform aims to deliver sub-millisecond transaction latency and high throughput exceeding 100,000 while being fully compatible with the Ethereum virtual machine. MegaETH will also embed Chainlink oracles directly on its sequencer for sub-second price feeds. Introducing Native, Real-Time Data Streams. Built in collaboration with @chainlink. A first-of-its kind integration combining the security of traditional onchain oracles with the immediacy of streaming data. pic.twitter.com/FZXAb4EMXv — MegaETH (@megaeth_labs) October 16, 2025 Their direct compatibility with the EVM means that any dapps built on the mainnet can port to MegaETH without losing Ethereum’s security or decentralization. What’s crucial here is the speed MegaETH promises, which makes it ideal for running dapps using the x402 standard. The blockchain-agnostic protocol allows any website, app, and, crucially, AI agents to demand and settle payments in a single HTTP call. There is no need for logins, KYC, or API keys, and there is no risk of chargebacks. Every transfer can be settled using any stablecoin, such as USDC, and processed autonomously. I’ve been seeing x402 everywhere lately, and I’m sure you have too. So I finally sat down to really understand what it’s all about… and damn it’s one of those things that makes you stop and go, “Oh wow, this actually changes everything.” Let me explain in a Eli5 way.… pic.twitter.com/5e473pDCoR — Hercules | DeFi (@Hercules_Defi) October 28, 2025 MegaETH will be the ultra-low-latency and near-zero-fee compute layer through which x402 can thrive, making stablecoin payments useful in real time. All transactions go through in milliseconds, not seconds, meaning that AI agents will act before price moves regardless of volatility. Ahead of its launch, MegaETH has launched its native stablecoin, USDm, developed on Ethena. This coin will help reduce sequencer fees and support dapps. Introducing MegaUSD (USDm), the native stablecoin of MegaETH. Built in collaboration with @ethena_labs.$USDM aligns incentives across stakeholders, letting users and apps enjoy the lowest fees possible while routing scalable value back to MegaETH. pic.twitter.com/xxwRy8Skk6 — MegaETH (@megaeth_labs) September 8, 2025 DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025 Is MegaETH MEGA The Next 100X Crypto To Buy? MegaETH presale oversubscribed by over 5X MegaETH ICO hard cap at $50M MegaETH is building an Ethereum layer-2 Will MegaETH rise on x402 adoption? The post Is MegaETH MEGA The Next 100X Crypto To Buy? Layer-2 Perfect For AI Agents And x402? appeared first on 99Bitcoins.

Chainlink partners with Streamex to power cross-chain gold-backed stablecoin GLDY

Chainlink partners with Streamex to power cross-chain gold-backed stablecoin GLDYStreamex Corp. has partnered with Chainlink to leverage its technology to provide institutional-grade transparency and cross-chain functionality for its gold-backed stablecoin, GLDY. Nasdaq-listed Streamex Corp., a regulated platform for commodity tokenization, has partnered with Chainlink (LINK) as its official oracle…

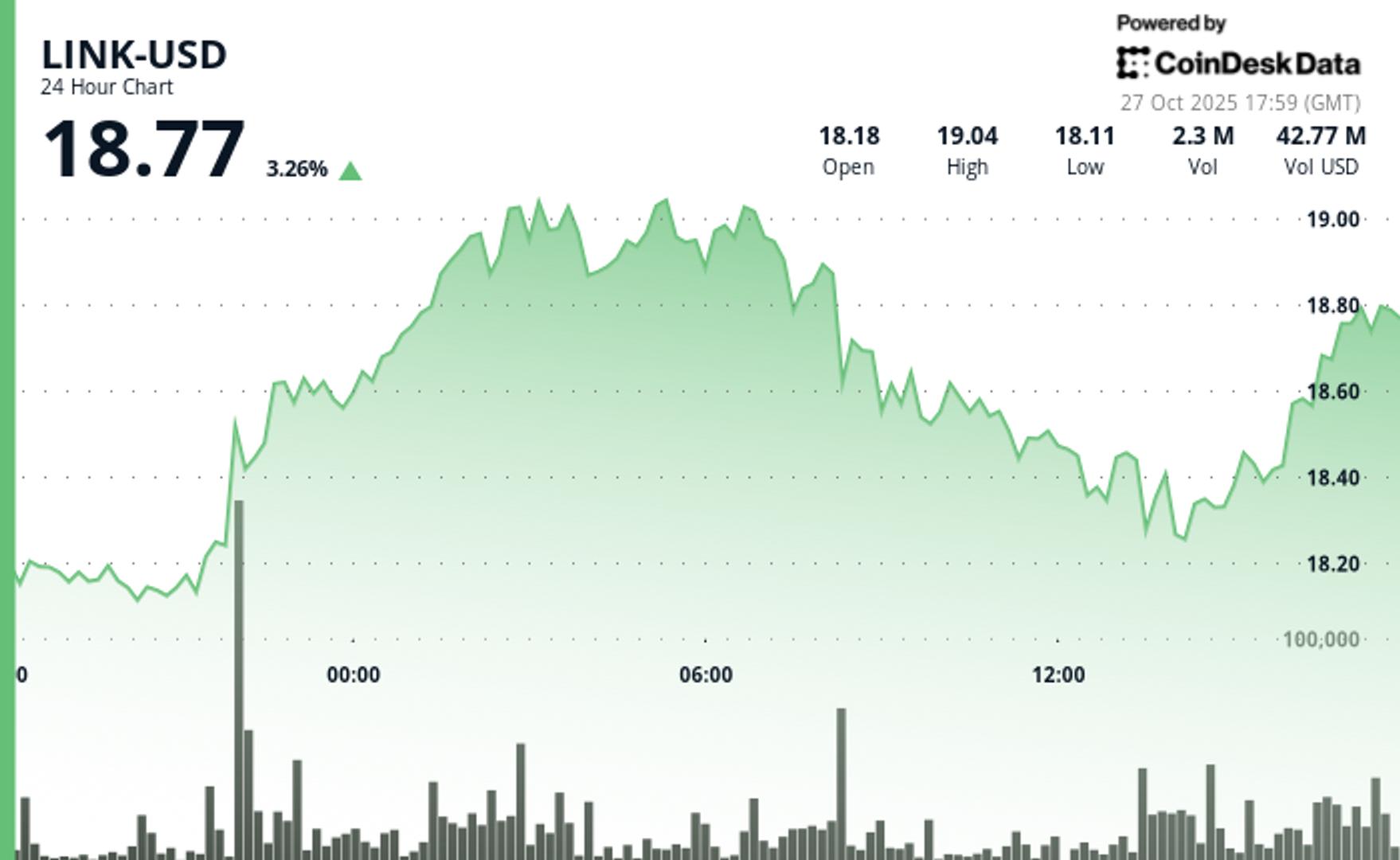

Chainlink whales drain $9M from Binance – Can LINK bulls break $20 wall?

Chainlink whales drain $9M from Binance – Can LINK bulls break $20 wall?LINK’s next breakout may already be loading… traders brace as whales stack $14M off Binance.

Chainlink whales drain $9M from Binance – Can LINK bulls break $20 wall?

Chainlink whales drain $9M from Binance – Can LINK bulls break $20 wall?LINK’s next breakout may already be loading… traders brace as whales stack $14M off Binance.

Ethereum Sees $169M in Outflows, But Traders Aren’t Backing Down on Leverage Bets

Ethereum Sees $169M in Outflows, But Traders Aren’t Backing Down on Leverage BetsEthereum-based investment products recorded their first weekly outflows in five weeks, with $169 million, following steady withdrawals seen each day. Despite this, demand for 2x leveraged Ethereum ETPs stayed strong, which indicated continued trader interest in high-risk exposure. This comes as overall digital asset investment products attracted $921 million in inflows after several “choppy” weeks. The partial US government shutdown has clouded the macroeconomic outlook, limiting access to crucial policy data and creating uncertainty about the Federal Reserve’s next moves. However, Friday’s softer-than-expected CPI report revived optimism that more rate cuts may still come this year. Meanwhile, global ETP trading activity remained high, with $39 billion in volume for the week. This figure is far above the year-to-date average of $28 billion. Bitcoin Pulls Ahead In its latest edition of ‘Digital Asset Fund Flows Weekly Report,’ CoinShares reported Bitcoin investment products drew in $931 million in inflows this week and lifted total inflows since the US Federal Reserve’s rate cuts began to $9.4 billion. Year-to-date (YTD) inflows now stand at $30.2 billion, still trailing the $41.6 billion recorded in 2024. Short Bitcoin products also saw positive sentiment as this cohort attracted $14.4 million in new capital. Enthusiasm for Solana and XRP has tapered off ahead of their anticipated US ETF launches, with inflows of $29.4 million and $84.3 million, respectively. Multi-asset funds followed with $33.2 million in inflows, while Litecoin and Chainlink logged smaller gains of $0.3 million and $0.1 million during the same period. Among assets facing outflows, Sui followed Ethereum’s suit and registered $8.5 million, and Cardano saw $0.3 million in outflows. Regional inflows were led by the US with $843 million, while Germany delivered one of its biggest weeks to date with $502 million. Brazil and Australia recorded smaller gains of $13.2 million and $0.9 million, respectively. On the other hand, Switzerland saw outflows of $359 million, though these were largely technical and were tied to asset transfers between providers. Sweden mirrored this trend with $49 million in outflows, and both Hong Kong and Canada registered modest declines of $11.2 million and $10 million each. Markets Brace for Trump-Xi Trade Talks According to QCP Capital, crypto markets are entering a critical crossroads this week as global and domestic catalysts converge. All eyes are on the upcoming Trump-Xi meeting as any progress on a US-China trade deal is expected to boost investor confidence and risk appetite, and lift Bitcoin and other assets out of their October stagnation. However, much hinges on the Federal Reserve’s decision regarding its quantitative tightening program. Additionally, the drawn-out US government shutdown and weak equity sentiment threaten to dampen momentum. With BTC trading flat and risk reversals turning neutral, markets appear to be cautiously positioned. Until Bitcoin reclaims the $116,000 level, the digital asset trading platform expects range-bound trading as crypto awaits its next macro-driven breakout. The post Ethereum Sees $169M in Outflows, But Traders Aren’t Backing Down on Leverage Bets appeared first on CryptoPotato.

Chainlink's LINK Gains as Whales Accumulate $188M After October Crypto Crash

Chainlink's LINK Gains as Whales Accumulate $188M After October Crypto CrashLarge tokens holders withdrew nearly 10 million tokens from Binance, one onchain analyst noted, signaling steady investor demand.

Chainlink-Analyse: Kann der LINK-Kurs jetzt ausbrechen?

Chainlink-Analyse: Kann der LINK-Kurs jetzt ausbrechen?In der Kursanalyse wirft Bastian (Bitbull) einen Blick auf Chainlink (LINK) und erklärt, welche Kursmarken jetzt wichtig sind. Source: BTC-ECHO BTC-ECHO

Whales Accumulate LINK: On-Chain Data Confirms Strong Buying Pressure

Whales Accumulate LINK: On-Chain Data Confirms Strong Buying PressureChainlink’s on-chain data shows a massive whale accumulation phase, with exchange balances plunging and nearly all holders turning net buyers. As technicals align and institutional adoption rises, LINK may be gearing up for a breakout toward $46. The post...

Chainlink price eyes $15 retest before 200% rally toward $46, analyst says

Chainlink price eyes $15 retest before 200% rally toward $46, analyst saysChainlink price is consolidating above $17 support, but technicals hint at a pullback toward the $15 zone — potentially setting the stage for the next major bullish leg toward $40–$46. Chainlink price technical analysis Chainlink (LINK) price is currently consolidating…

ETH LEADS MAJORS, CPI TODAY, AVAX DATS COMING

ETH LEADS MAJORS, CPI TODAY, AVAX DATS COMINGCrypto higher on lower PPI, ETH leads. BitMine buys $201m more ETH. Binance & Franklin Templeton to partner on RWAs. POP Culture Group & Robin Energy both buy BTC. XRP reserves on exchanges surge by 1.2b tokens. AVAX Foundation eyes $1b raise to setup DATs. Chainlink, UBS to automate tokenized fund ops. Hayes buys $1m ENA ahead of Hyperliquid vote. Kraken offers to list Paxos-issued USDH. SEC delays staking decisions on various ETFs. VanEck plans HYPE spot staking ETF. Gemini, Figure hike IPO price range. Scroll DAO appears close to being dissolved. Ledger rolls out enterprise mobile app. India continues to resist comprehensive crypto law. HK proposes capital rules for banks holding crypto. Russia may consider crypto bank to combat fraud.