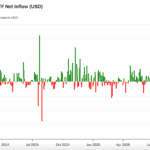

Crypto pundit Butcher has suggested that Binance and market maker Wintermute may be responsible for the Bitcoin and Ethereum price crashes. The pundit also alluded to the October 10 crypto market crash and how both firms contributed to the crash. Pundit Blames Binance and Wintermute For Bitcoin and Ethereum Price Crashes In an X post, Butcher alleged that Binance and Wintermute are responsible for the recent Bitcoin and Ethereum price crashes. He explained that in the past 30 days, these firms have traded $34.5 billion between themselves. The pundit further revealed that the crypto exchange sends BTC and ETH in chunks of $10 million to $100 million to Wintermute wallets hours before every major dump. Wintermute then sells these coins on the market, triggering a cascade of liquidations. Butcher stated that Binance and Wintermute used this playbook during the October 10 Bitcoin and Ethereum price crash, which contributed to the $19 billion liquidation event. He revealed that on that day, Wintermute received $700 million from Binance, and then spot sell walls appeared on every pair, followed by $19 billion in longs liquidated in 90 minutes. The pundit claimed that Wintermute bought back these coins at a 30% discount. He noted that Binance benefits by pocketing the funding rate fees while Wintermute pockets the spread. Butcher further alleged that both firms used a similar playbook during last week’s Bitcoin and Ethereum price crash, dumping $1.14 billion in BTC. This resulted in $1.16 billion in liquidations. The Bitcoin and Ethereum price have extended their decline this week, with BTC dropping below $100,000 yesterday for the first time since June. ETH also dropped to as low as $3,100 on the day, recording a 10% loss in the process. Butcher again claimed that Binance was responsible for the crash, stating that there was “total manipulation” from the crypto exchange. This came as he declared that retail investors weren’t responsible for the selling pressure. Market Still Expected To Bounce Back Market expert Raoul Pal suggested that the crypto market is still going to bounce back despite the Bitcoin and Ethereum price crashes. He expects the bull market to resume when the U.S. government shutdown ends, noting that the shutdown is currently causing a sharp tightening of liquidity. Pal noted that the global liquidity is still on the rise, suggesting that some of this liquidity could spark a bounce in the Bitcoin and Ethereum prices once the shutdown ends. The expert further remarked that the treasury could spend up to $350 billion in a couple of months once the shutdown ends and quantitative easing begins. The dollar is also expected to weaken once liquidity begins to flow, which is a positive for the crypto market.

More Headlines

Raoul Pal: Crypto Set to Soar as QT Ends and Global Stimulus Returns

CryptoPotato

[LIVE] Crypto News Today, November 5 – Bitcoin Price USD Retest $98K As Momentum (MMT) Surges +1500% After CEX Listings: Best New Crypto to Buy?

99bitcoins

Crypto Sale Moves From ETHZilla, Sequans Spark DAT Unwind Fears

The Defiant

BitMine Accumulates $800 Million of ETH Amid Market Weakness

The Defiant

ZCash Chat with: 0xMert_ ! Crypto Recovering? BTC back above $102K!

Decrypt

Will Bitcoin Bounce After US Shutdown? And What’s Next for Ethereum as L2 Scaling Accelerates?

99bitcoins