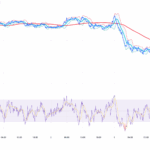

XRP investors may be facing a difficult period as their portfolios show little improvement in November. However, several data points reveal positive signals that contradict the token’s bearish price action. These divergences suggest that XRP remains one of the top choices among retail investors seeking to protect their portfolios amid the unpredictable volatility of late 2025. XRP Dominance Rises While Price Falls A divergence occurs when two related indicators move in opposite directions. It often reveals underlying dynamics that are not immediately visible. The first notable divergence appears between XRP’s price and its market dominance (XRP.D), which represents XRP’s share of the total crypto market capitalization. XRP Prive vs XRP Dominance. Source: TradingView TradingView data shows XRP’s price has been forming lower lows over the past month. Meanwhile, XRP.D has been trending upward during the same period. Currently, XRP.D stands at 4%, up from 3.8% last month. This rise suggests that investors may be shifting their focus to XRP as many altcoins lose momentum. A Q3 2025 report from Kaito Research ranked XRP alongside Ethereum (ETH), trailing only Bitcoin across six key metrics: Volume, Liquidity, Market Capitalization, Market Availability, Maturity, and Custody Availability. “Bitcoin achieves a perfect 100/100 score, and ranks as the only AAA-rated asset. ETH and XRP tied for second place with scores of 95,” investor Crypto Eri ~ Carpe Diem said. Exchange Withdrawing Addresses Surge The second divergence appears in on-chain data: XRP’s price continues to fall, but the number of withdrawing addresses has surged. According to CryptoQuant, since July, the price of XRP has dropped from above $3.50 to $2.20. Yet, the 30-day average number of withdrawing addresses has increased from under 1,000 to over 2,500. Instead of panicking and sending XRP to exchanges for selling, many investors are withdrawing their tokens from exchanges. This move signals long-term commitment and makes the circulating supply on exchanges more scarce. XRP Exchange Withdrawing Addresses (Binance). Source: CryptoQuant. A recent report from BeInCrypto revealed that 300 million XRP were withdrawn from Binance in the past month. In November, XRP reserves on Binance continued to hit new lows. Earlier in 2025, a similar rise in withdrawing addresses coincided with XRP’s upward price movement. This pattern suggests that the current fear-driven sentiment might be masking the token’s underlying strength. XRP Holders Increase The third divergence suggests that XRP’s price is decreasing while the number of holders is increasing. Data from CoinMarketCap reveals that over the past month, XRP’s price has dropped from above $3 to $ 2.20, but the number of holders has increased by over 8,000. XRP Holders. Source: CoinMarketCap. This trend suggests that many investors view the price decline as an opportunity to accumulate XRP at better valuations. Recent positive developments may have encouraged this sentiment. Both Franklin Templeton and Grayscale Investments submitted amended filings to the US Securities and Exchange Commission (SEC) for proposed XRP exchange-traded funds (ETFs). Additionally, the Madras High Court in India recognized XRP as a legal asset, granting it protection under criminal law. These diverging signals indicate that many XRP investors remain confident despite the broader market’s fearful mood. Confidence alone does not guarantee success, but what matters more is having a clear capital protection strategy when the market moves against expectations. The post 3 Diverging Signals Show XRP Investors Holding Firm Despite Market Fear appeared first on BeInCrypto.

More Headlines

Why Is Crypto Down Today? – November 5, 2025

CryptoNews.com

Morning Crypto Report: Bitcoin and Ethereum Lose $800 Million in One Day, Unique XRP ETF Secures Key Listing, $150,000 BTC Is Real in 2025: Bitwise

U.Today

Solana Just Booked Its Second-Biggest Week in History Despite Choppy Market

CryptoPotato

Now That The Chainlink Price is Dead, What’s Next For It?

99bitcoins

Bitcoin Dips Under $110,000 After Fed Cuts Rates

The Defiant

Crypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions

The Defiant