Bitwise Chief Investment Officer Matt Hougan is urging investors to look past Bitcoin’s sharp pullback, arguing that the cryptocurrency’s long-term value has little to do with its recent slide and everything to do with the service it provides. Key Takeaways: Bitwise CIO Matt Hougan says Bitcoin’s recent drop is “short-term noise” and doesn’t affect its long-term value. Hougan argues Bitcoin should be viewed as a digital wealth-storage service, not a traditional asset. He cites rising global debt and growing demand for non-sovereign value storage as drivers of future Bitcoin adoption. In a memo sent to clients late Tuesday, Hougan dismissed concerns about a deeper downturn, saying the current drop, roughly 27.5% from Bitcoin’s October all-time high, is “short-term noise.”Bitwise CIO Says Bitcoin’s Value Lies in Its Service, Not Its PriceBitcoin briefly dipped below $90,000 this week, prompting renewed questions from investors about what underpins its value.Hougan said he begins most advisor conversations with the same question: how can something that doesn’t generate profits or dividends be worth $2 trillion?The answer, he argued, lies in treating Bitcoin not as a physical asset but as a digital service.Hougan describes Bitcoin’s core function as a wealth-storage service, a way to hold value without relying on banks, governments, or intermediaries. Framing it this way, he said, removes the discomfort some feel toward an intangible asset.“The value of Microsoft’s stock is tied to how many people want its service,” Hougan wrote. Bitcoin follows the same logic. The more people who want its service, the more valuable it becomes. https://twitter.com/Matt_Hougan/status/1990821866068402656?s=20 Unlike software, however, Bitcoin can’t be rented or subscribed to. “The only way you get the service is to buy the asset,” he noted.That scarcity-based demand model, he said, explains Bitcoin’s roughly 28,000% appreciation over the past decade, a period during which major institutions, pension funds, sovereign wealth funds, prominent investors, and millions of individuals sought access to it.Hougan pointed to growing digital adoption and rising global debt as long-term tailwinds. As more people seek a self-custodied, non-sovereign store of value, Bitcoin’s relevance increases, he said.“In our increasingly digital age, with governments piling up more and more debt, I’m guessing a lot more people will want its service in the future,” Hougan concluded.Experts Split on Whether Bitcoin’s Sell-Off Signals a New Crypto WinterAs reported, despite the recent pullback, several analysts have told Cryptonews that the current downturn looks more like a macro-driven correction than the start of a prolonged freeze, pointing to institutional adoption, regulatory progress, and sector resilience as signs the foundation remains strong.Bitwise’s Danny Nelson and HashKey’s Tim Sun both argued that the market is far from a full-blown winter.They noted that, unlike previous collapses, the current cycle has not seen a catastrophic event like FTX, and that infrastructure improvements, from tokenization to stablecoin expansion, continue to strengthen the ecosystem.Other analysts highlighted that the absence of a euphoric peak and the impact of global liquidity make this downturn different from historical bear markets.Still, several experts warn that the coming weeks hinge on US monetary policy. If the Federal Reserve fails to ease borrowing conditions, liquidity could tighten further and deepen the market shock.However, if rate expectations soften, analysts say the market may stabilize, offering long-term investors an opportunity to accumulate ahead of a future rebound.The post Bitcoin’s Value Comes From Its Utility, Not Short-Term Price Drops: Bitwise CIO appeared first on Cryptonews.

More Headlines

ETH Leverage Soars While Price Stalls – A Major Risk Signal?

CryptoPotato

Aster’s 26% Breakout Revives Altcoin Hopes As Maxi Doge Eyes Next 1000x Crypto Status

BitCoinist

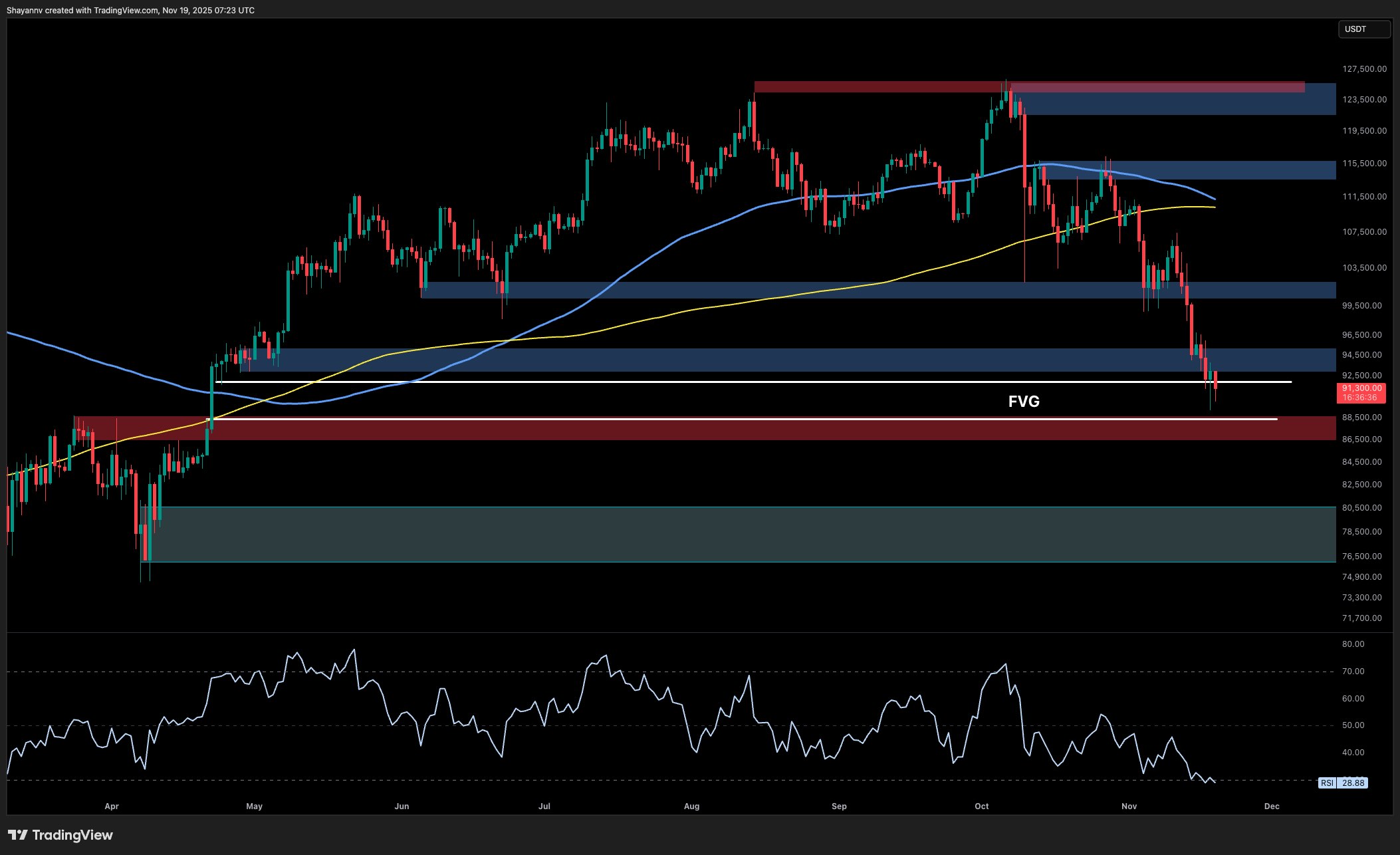

Bitcoin Price Analysis: Is BTC Heading Below $90K Again as Sellers Remain in Control?

CryptoPotato

Rebirth of Order: HTX DAO Highlights 2025 – From Deflation to a Web3 Model of Financial Autonomy

BeInCrypto

Bitcoin Price Prediction: Price Crashes, Death Cross Appears – But What Happens Next Might Shock Traders

CryptoNews.com

Analysts Reveal Key Support Levels for Bitcoin if Selling Pressure Doesn’t Ease in November

BeInCrypto