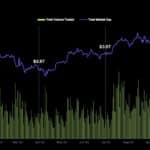

Bitcoin slipped below $100,000 for the first time since June 2025 and officially entered bear market territory with a 20% decline from its October 6 record high as crypto markets wiped out over $1 trillion in total market capitalization. The sharp downturn, driven primarily by unprecedented leverage levels rather than weakening fundamentals, has left 300,000 traders liquidated daily on average while crypto adoption, deregulation, and technological advancement continue at a record pace.The massive selloff can be traced back to heightened leverage amplifying market swings, particularly the $20 billion liquidation event on October 10.“Leverage is a wild ‘drug,'” noted The Kobessi Letter, describing how the market has evolved into its most reactive form in history amid Trump posts and breaking headlines. The million dollar question:What is happening crypto right now?Crypto markets have now officially erased over -$1 TRILLION of market cap since October 6th.But why?The answer to this question seems to be more technical than fundamental.That is, crypto adoption is still…— The Kobeissi Letter (@KobeissiLetter) November 4, 2025 Technical Breakdown and Support Levels—What’s Next for BTC?Bitcoin lost key support at the 85th percentile cost basis of around $109,000 and now hovers near $103,500, according to Glassnode data.The next key level sits at the 75th percentile cost basis near $99,000, which has historically provided support during pullbacks. CryptoQuant reported that short-term holders intensified loss-selling pressure, stating, “today alone, we’re seeing roughly 30,300 BTC being deposited while underwater, reflecting a growing wave of capitulation among recent buyers.”Source: CryptoQuantThe pressure continues as the STH-SOPR hovers around 1, typically indicating stress and fragile confidence.“Each time price attempts to recover and reaches the STH realized price (currently around $112,500), we see immediate profit-taking or break-even exits,” CryptoQuant noted. “These reactions create overhead resistance and make it harder for price to break higher.“Why Institutions Keep Buying Despite the BloodbathEarlier today, Binance data reveals that Bitcoin is trading below its moving average of $112,245, with unrealized losses at just 0.06%.Source: CryptoQuantCryptoQuant analysts observed that this means “only a small percentage of traders on Binance are currently holding their coins at a loss, indicating that most positions were opened at or below the current price.”“In other words, the market has not yet entered a phase of widespread losses or a significant sell-off,” the analyst added.Despite October’s correction, market sentiment remains cautiously optimistic as we enter November. Bitcoin ETFs recorded inflows of nearly 50,000 BTC over the past 30 days, indicating continued institutional accumulation.“Accumulation of coins by major market participants, the trade agreement between Washington and Beijing, and moderately positive stock market performance are paving the way for a possible recovery in November,” said Shawn Young, Chief Analyst at MEXC Research, when speaking with Cryptonews.Young added that November is historically strong for cryptocurrencies. “This seasonal factor, combined with growing inflows into Bitcoin ETFs (almost 50,000 BTC over the past 30 days), indicates continued institutional position accumulation.” Key resistance now sits between $111,000 and $113,000. “A break of this level could trigger upward momentum and pave the way to $117,000, and with favorable macroeconomic news, a retest of the all-time high of $126,000,” Young explained.Bear Case vs. Bull Case OutlookAnalyst Plan C maintains his base case for continued bull market conditions, expecting recovery after briefly dipping below the 50-week moving averages. However, he addressed growing fears directly. He said that “a lot of the fear right now comes from people having PTSD from previous Bitcoin events like the FTX/Luna collapses, or from the recent mass liquidation events if they were holding altcoins.“ My Bitcoin Market Synopsis:You’re going to want to bookmark this.*Not Investment Advice*My base case remains that we are still in a bull market: we’ll recover from this dip over the coming week or two after briefly dipping below the 50-week SMA/EMA, then closing back above…— PlanC (@TheRealPlanC) November 4, 2025 Plan C emphasized how institutional adoption has fundamentally changed market dynamics.“With the institutional bid and the market cap now comfortably over $1 trillion, Bitcoin is not the same asset. The ‘it could go to zero’ discount that existed in all previous bear markets has been completely removed.”“Bitcoin is now on the radar of essentially ALL the big money players in the world,” he added.He projected that even in a bear scenario, “the odds of dropping below $70,000 (-45%) are extremely small, and a move to $80,000–$90,000 is much more likely if — and it’s a big if — the bull market is truly over, which I still don’t think it is.“The post Bitcoin Falls Below $100K, Wipes Out $1 Trillion from the Crypto Market – Here’s What’s Really Happening appeared first on Cryptonews.

More Headlines

CoinGecko Q3 Crypto Market Report: Key Trends for Bitcoin, Eth, & DeFi

99bitcoins

Panic Hits Crypto: OG Whales Dump $41B in Bitcoin — Is $70K Next?

BeInCrypto

Why Is The Crypto Market Down Today?

BeInCrypto

Bitcoin Price Prediction: BlackRock ETF Launch, AI Trading Wins, and Tom Lee’s $200K BTC Forecast Fuel Market Optimism

CryptoNews.com

Bitcoin Price Outlook vs XRP Tundra: Which Could Offer Better 2025 Returns?

CryptoPotato

Cango Inc. Announces October 2025 Bitcoin Production and Mining Operations Update

TheBitCoinNews