Bitcoin continues to dominate Binance’s futures market, commanding 27.17% of the platform’s total $2.002 trillion futures trading volume in October. This represents a significant increase from September’s $1.95 trillion, amidst a resurgence of both institutional and speculative interest in the derivatives sector despite last week’s market pullback. Bitcoin Futures Heat Up Specifically, Bitcoin futures trading volume surged to $543.33 billion in October, which, according to CryptoQuant, is up from $418 billion in September and slightly above August’s $542 billion. The steady trading activity above the $2 trillion threshold highlights an optimistic market environment characterized by robust liquidity and renewed confidence. Such consistent growth in trading volume often comes before heightened price movements, which indicates the potential for increased volatility in the near term. If this momentum aligns with rising funding rates and expanding open interest, it could set the stage for another bullish phase driven by deep-pocketed institutional participants and active speculators. These factors taken together position Bitcoin to challenge and break key resistance levels, further validating the broader recovery lately seen across the crypto market. As for its price trajectory, Bitcoin’s current market dynamics appear to be entering an accumulation stage, according to crypto analyst Axel Adler Jr. He noted that the Bitcoin Heat Macro Phase has pivoted into the Bottom/Accumulation zone, which is typically a signal of waning speculative pressure and potential groundwork for the next growth phase. Adler stressed that for a meaningful rally to unfold, volatility must stabilize, and external market shocks should remain absent for at least a week. Meanwhile, researcher 0xNobler stirred speculation by reporting that an insider with a “100% win rate” just opened $150 million in long positions ahead of Donald Trump’s scheduled speech. The trader’s impeccable track record in predicting Bitcoin and Ethereum swings could point to possible insider knowledge or coordinated market anticipation. All Eyes on CPI The long-delayed US Consumer Price Index (CPI) data for September is set to be released later today after a week-long postponement. Economists expect consumer prices to have risen for a second consecutive month due to higher costs in tariff-sensitive goods, while easing shelter prices may temper services inflation. Wells Fargo’s Sarah House said that goods inflation is likely to remain elevated despite some cooling in services. Bitfinex analysts added that a core CPI reading above 3.2% year-on-year could lift real yields and pressure Bitcoin, whereas a softer print below 2.8% could boost risk appetite and potentially benefit BTC. The post Bitcoin Dominates Binance Futures With $543B Volume – Institutions Are Back in the Game appeared first on CryptoPotato.

More Headlines

Bitcoin Liquidity Flush Meets Ethereum Recovery Push — Traders Await The Next Big Signal

NewsBTC

Nearly $360M In Crypto Shorts Squeezed As Bitcoin Recovers To $116,000

NewsBTC

SSR Oscillator Signals Liquidity Waiting To Enter Bitcoin – Details

BitCoinist

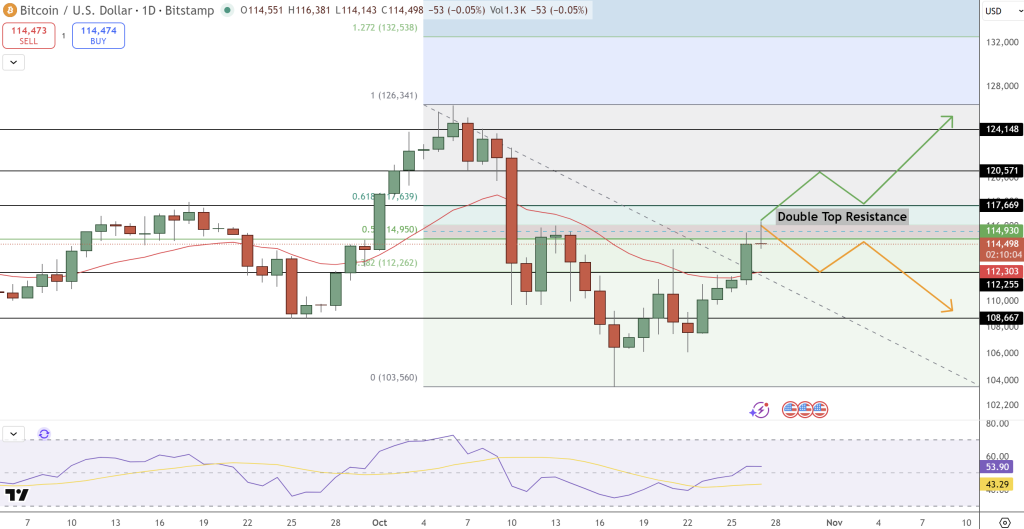

Bitcoin Price Prediction: BTC Targets $124K as Trade Optimism and Institutional Demand Fuel Rally

CryptoNews.com

Bitcoin Price Could See A New All-Time High Above $126,000 If It Breaks This Critical Level

NewsBTC

Digital Yen Goes Live: JPYC EX Integrates Traditional Finance With DeFi

NewsBTC