AptLive Feed

Apt breaking news and instant alerts. Crypto Feed's minimalist interface delivers verified headlines, price movements, and protocol updates the moment they happen. Fast, focused, no fluff.

Bitcoin Price Plunges Toward $100K as Analysts Call the Start of a Bear Market

Bitcoin Price Plunges Toward $100K as Analysts Call the Start of a Bear MarketBitcoin cannot catch a break on Tuesday as its adverse price movements continue to dig new lows, with the latest being at just under $101,000. With the asset now on the brink of its first price dump below $100,000 since June, whales and treasury companies have begun to offload, while some analysts believe this is the official start of a bear market. Sequans Communications, one of the numerous BTC treasury firms, announced today that it had redeemed 50% of convertible debt issued to purchase bitcoin by selling off 970 units of the cryptocurrency. Thus, it reduced its total outstanding debt from $189 million to $94.5 million. Its BTC stash has dropped to 2,264 from 3,234. In another bearish development, which intensified the immediate selling pressure on the asset, whales had offloaded $272 million worth of the asset, as reported by popular analyst Ali Martinez. These moves have only added to the overall negative landscape in the crypto industry for the past week. Recall that BTC challenged the $116,000 resistance last Tuesday only to be rejected and driven south hard. The beginning of the current business week has been particularly painful. Bitcoin was stopped at $111,000 on Sunday and has dumped by $10,000 since then to just under $101,000 hours ago. Moreover, the cryptocurrency has retraced by roughly 20% since its all-time high marked less than a month ago. As such, the Kobeissi Letter categorized it as the beginning of the bear market. BREAKING: Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history. pic.twitter.com/EHoyb8xsZK — The Kobeissi Letter (@KobeissiLetter) November 4, 2025 The altcoins have been in an even worse state over the past day. TAO leads the adverse trend with a massive 18% decline, followed by IP, APT, KAS, OKB, TON, SOL, and many others. The larger caps have suffered badly as well, with ETH dumping by 7%, XRP by 6%, BNB by 8%, and SOL by 8.5%. The post Bitcoin Price Plunges Toward $100K as Analysts Call the Start of a Bear Market appeared first on CryptoPotato.

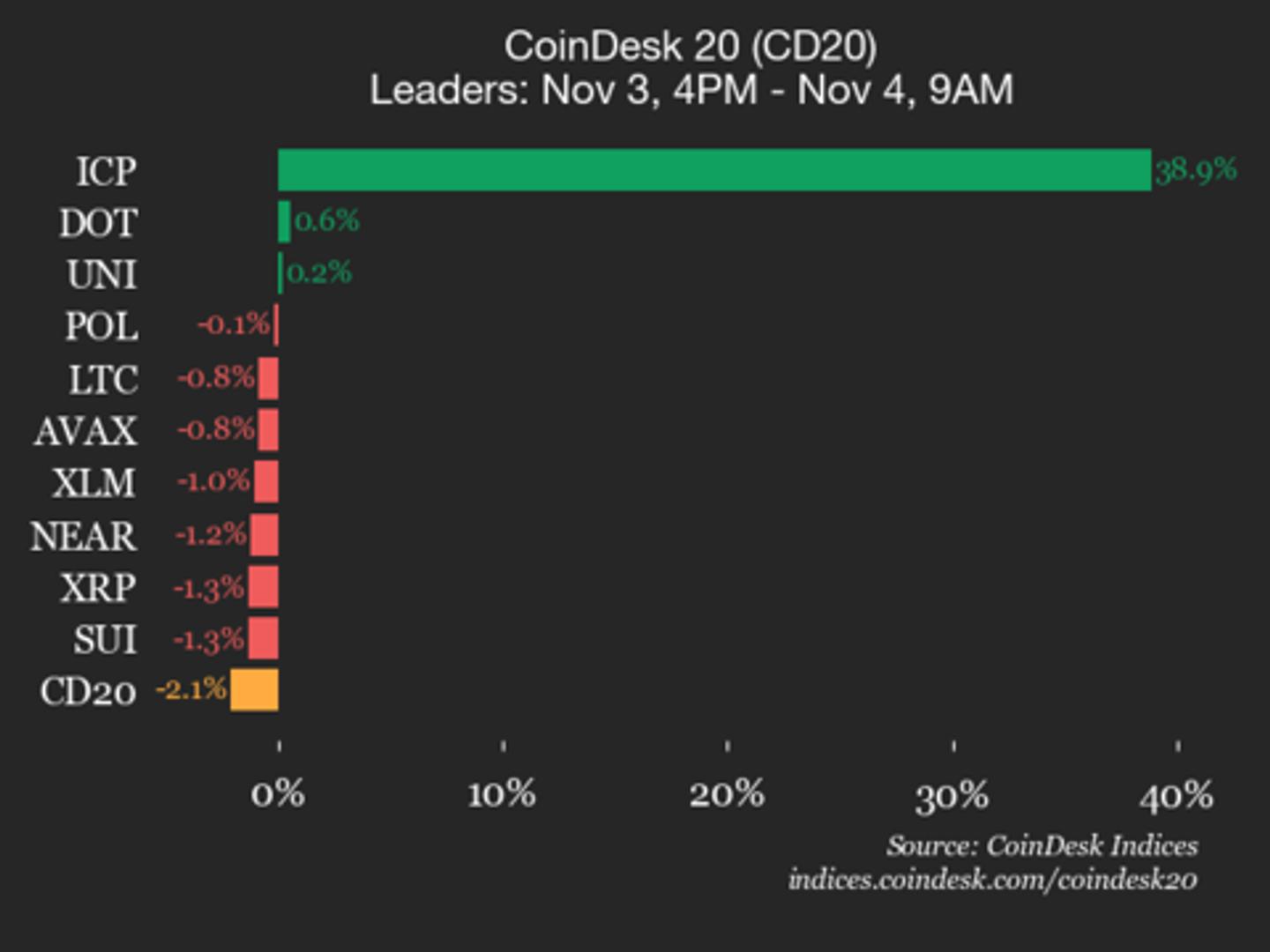

CoinDesk 20 Performance Update: Internet Computer (ICP) Leaps 38.9% as Index Declines

CoinDesk 20 Performance Update: Internet Computer (ICP) Leaps 38.9% as Index DeclinesCronos (CRO) fell 3.6% and Aptos (APT) dropped 3.4%.

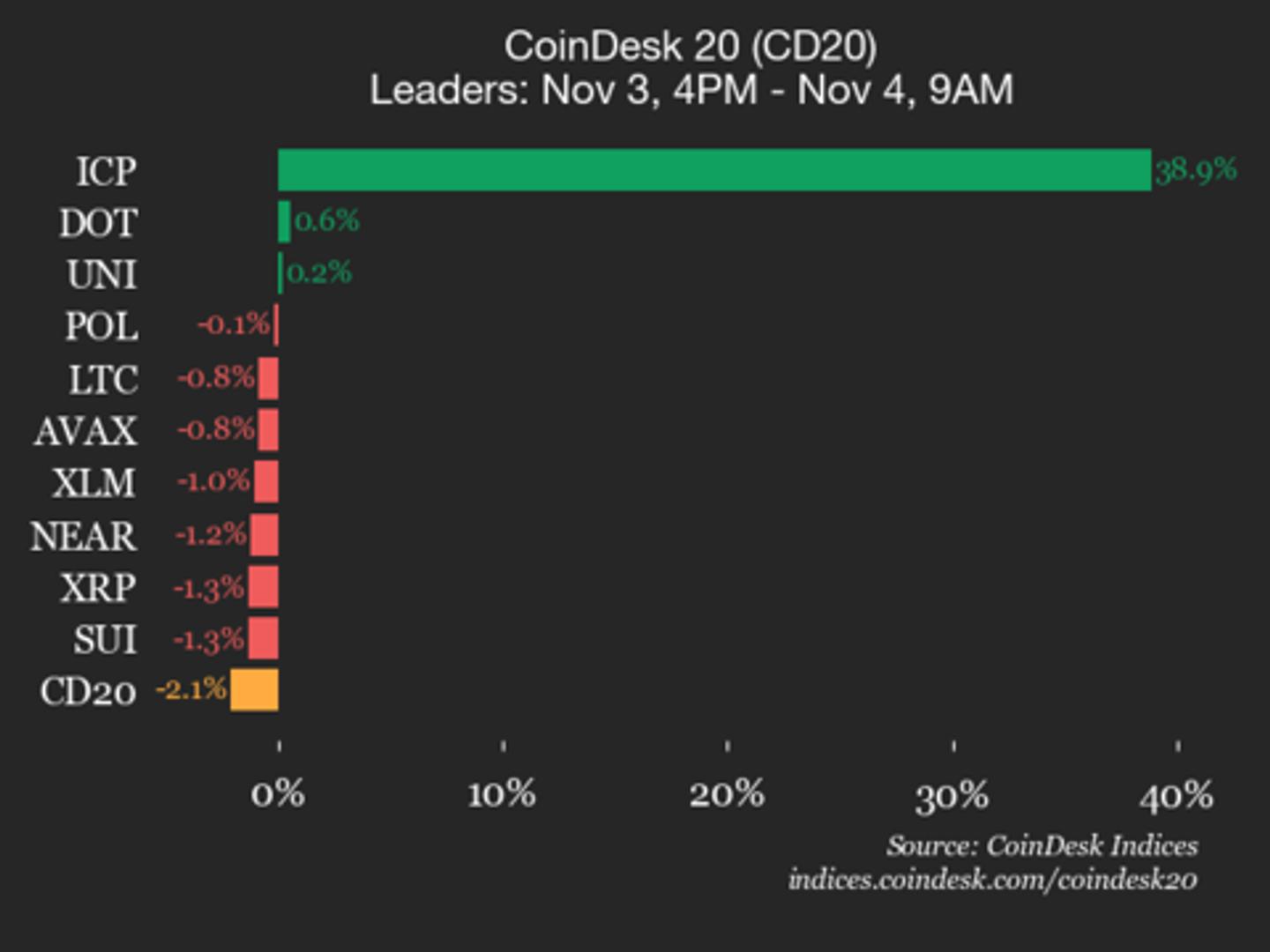

CoinDesk 20 Performance Update: Internet Computer (ICP) Leaps 38.9% as Index Declines

CoinDesk 20 Performance Update: Internet Computer (ICP) Leaps 38.9% as Index DeclinesCronos (CRO) fell 3.6% and Aptos (APT) dropped 3.4%.

Bitcoin, Altcoins Take Another Beating: Privacy Coins Buck the Trend (Market Watch)

Bitcoin, Altcoins Take Another Beating: Privacy Coins Buck the Trend (Market Watch)Bitcoin’s early-November slump continues in full force as the asset plunged below $104,000 to mark a multi-month low (on most exchanges). The altcoins have been battered even more, aside from a few privacy coins, which have registered impressive gains. BTC Dives Below $104K It was a week ago when the primary cryptocurrency tested the $116,000 resistance on a couple of occasions, but to no avail. The rejection following the second attempt was particularly painful as the asset slumped to $112,000 a day later. Then came the US Fed’s decision to lower the interest rates, which is typically regarded as a bullish development for risk-on assets. However, BTC dropped once again, this time to under $110,000. After a brief and unsuccessful recovery attempt, the cryptocurrency initiated another leg down and dipped to $106,000 at the end of the business week. It recovered some ground during the weekend and jumped to $111,000 on Sunday. However, the bears reemerged on Monday and drove bitcoin south to under $106,000. The pain continued in the past 12 hours or so as BTC dumped to just over $103,500 – the lowest level since late June (excluding the flash crash on Binance on October 17 to $101,000). This means that bitcoin’s market cap has plummeted to $2.070 trillion on CG, while its dominance over the alts is up to 58.5%. BTCUSD. Source: TradingView Privacy Coins Defy the Trend As expected, most altcoins have posted even more painful declines than BTC over the past day. APT leads this negative trend with a massive 12% drop, followed by WLFI, TON, ATOM, CRO, KAS, BGB, ASTER, and many others. The larger caps are in no better shape. Ethereum has slumped below $3,500, BNB plunged to $950, and XRP is down to $2.26. ADA, LINK, SOL, HYPE, TRX, DOGE, BCH, and SUI are deep in the red as well. In contrast, DASH has skyrocketed by more than 70%, followed by ICP’s 35% surge, and ZEC’s 23% pump. The total crypto market cap has lost another $150 billion in a day and is down to $3.530 trillion on CG. Cryptocurrency Market Overview. Source: QuantifyCrypto The post Bitcoin, Altcoins Take Another Beating: Privacy Coins Buck the Trend (Market Watch) appeared first on CryptoPotato.

Crypto Carnage Continues: BTC, ETH, XRP Plunge Further as Liquidations Top $1.1B

Crypto Carnage Continues: BTC, ETH, XRP Plunge Further as Liquidations Top $1.1BBitcoin’s nosedive that started earlier this morning continued in the past hour or so as the asset plunged to a two-week low of just over $105,000. The altcoins were obliterated once again, with BNB slumping below $1,000, ETH dropping by over 6%, and SOL plunging by over 8% daily. BTCUSD. Source: TradingView CryptoPotato reported the first wave of BTC declines that transpired earlier today when the cryptocurrency was rejected at $111,000 and slumped by roughly four grand to $107,000. It managed to stabilize there at first and even tapped $108,000 before the bears initiated another leg down an hour ago, pushing the asset south to $105,300 (on Bitstamp). This multi-week low harmed over-leveraged traders, as the total longs liquidated for BTC alone are worth over $300 million on a daily scale. Even whales with impeccable records up to this point were wrecked. Lookonchain reported that Machi Big Brother has been fully liquidated, marking a total loss of over $15 million. Another trader – 0xc2a3 – that had a 100% win streak until today has “surrendered,” closing BTC, ETH, and SOL longs at a loss. Their total P&L went from over $33 million to -$17.6 million. The 100% win streak is over — trader 0xc2a3 has surrendered. He closed all his $BTC longs and part of his $ETH and $SOL longs at a loss. His total P&L has flipped from +$33M to –$17.6M.https://t.co/2I4Jrb3MUA pic.twitter.com/3bSIXFG9JV — Lookonchain (@lookonchain) November 3, 2025 Most altcoins have suffered even more in the past 24 hours, led by double-digit declines by ASTER (-20%), WLFI (-12%), APT (-12%), PEPE (-11.3%), WLD (-11%), ARB (-11%), and several others. Even the larger caps were not spared. Ethereum slipped below $3,600 earlier today, BNB trades below $1,000 as of press time, XRP has lost the $2.40 support, while SOL has dumped below $170 after an 8% drop. The total value of wrecked positions has skyrocketed to more than $1.1 billion, according to CoinGlass data. In total, more than 300,000 traders have been liquidated, with the single-largest position taking place on HTX, which was worth almost $34 million. Liquidation Data on CoinGlass The post Crypto Carnage Continues: BTC, ETH, XRP Plunge Further as Liquidations Top $1.1B appeared first on CryptoPotato.